In the world of precious metals investment, I find Schiff Gold to be a notable player, offering a variety of services that help investors like me navigate this lucrative market.

This article dives into the company’s history and the different precious metals investment options available to customers. I also take a look at insights from customer reviews, showcasing both the positive experiences people have had and some areas where they think improvements could be made.

I compare Schiff Gold with its competitors and examine the safety measures they have in place to protect investments. By the end, I’ll share my final thoughts and recommendations to give you a clearer picture of whether Schiff Gold is the right choice for your investment needs.

Company Overview and History

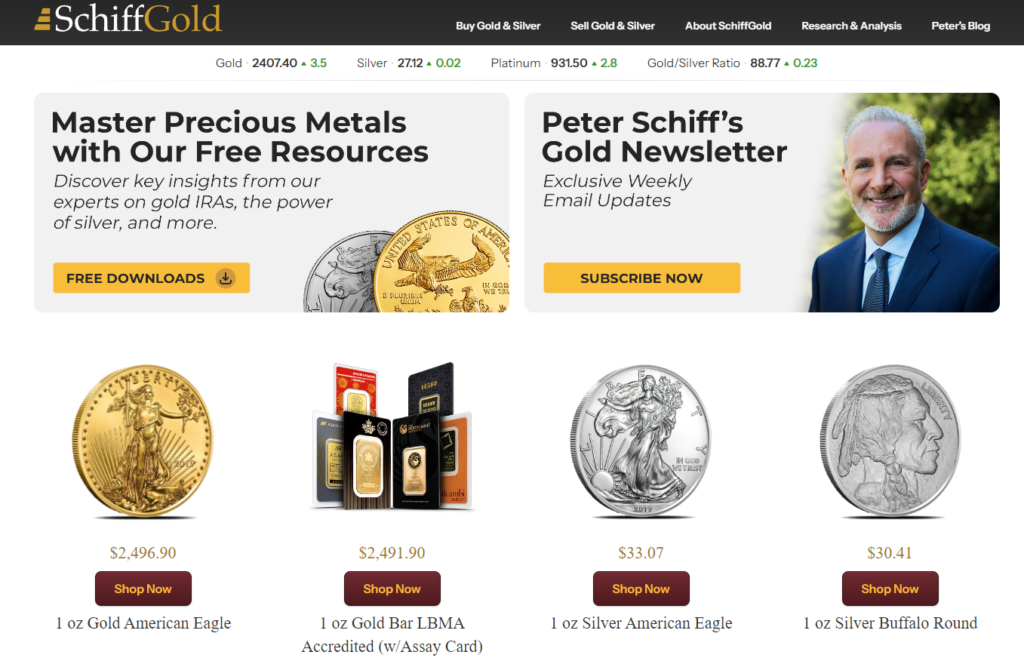

I’ve seen Schiff Gold become a major player in the precious metals market, especially when it comes to gold investments. The company started with a clear mission: to educate investors about the perks of owning physical gold and other precious metals. They’ve really kept up with the ever-changing market, and their dedication to transparency and great customer service has earned them a solid reputation. People often turn to them when looking to invest in gold bullion or explore different gold investment options to shield their wealth from inflation and market swings.

Since it kicked off, Schiff Gold has hit some impressive milestones, like launching a bunch of user-friendly online tools and resources that make buying gold a whole lot easier. Their mission isn’t just about selling precious metals; they’re all about enableing investors by offering deep insights into gold market trends and historical performance.

For example, when gold prices shot up above $2,000 per ounce in 2020, Schiff Gold adapted its strategies to highlight gold’s role as a hedge against economic uncertainty and currency devaluation. As more and more people look for gold investment strategies—reflecting a trend of wanting tangible assets for security—Schiff Gold is right there, helping clients navigate the complexities of this ever-evolving investment landscape.

Services Offered by Schiff Gold

I love how Schiff Gold offers a wide range of services for anyone looking to diversify their investment portfolios with precious metals. They provide everything from gold IRAs, which are fantastic for tax-advantaged retirement savings, to helping me purchase gold bullion and coins.

What’s great is that they tailor their options to fit my specific investment needs. Their service model includes personalized investment advice, so I really get to understand my choices and the benefits of owning gold, especially when it comes to financial security and capital preservation during those ups and downs in gold prices.

Precious Metals Investment Options

When I think about investing in precious metals, I really appreciate the variety of options available through Schiff Gold. They offer everything from gold coins and gold ETFs to physical gold bullion, catering to different investor preferences. Each of these options brings its own perks—like the tangible security of holding gold coins, which feels pretty reassuring, and the flexibility and liquidity of ETFs that can help with portfolio diversification.

As someone who’s been in the investing game for a while, I know how important it is to find the right mix of these assets for long-term wealth preservation and protection against inflation, especially in today’s rollercoaster market.

Investing in gold coins not only gives me that foundational security, but it also has a neat bonus: many of these coins hold numismatic value beyond just their metal content, so they’re appealing to both collectors and investors.

On the flip side, gold ETFs make entering the market super easy. I can get exposure to precious metals without having to worry about physical storage or security issues.

By diversifying among these options—maybe putting some funds into physical bullion for that security and some into ETFs for liquidity—I feel like I’m better equipped to navigate economic uncertainty while taking advantage of the stability that precious metals naturally provide.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

Customer Reviews of Schiff Gold

Customer reviews of Schiff Gold are super important for me when it comes to understanding the overall service quality and investment experience the company offers. I often find myself checking out online reviews and testimonials to get a sense of their credibility and reputation.

I like to look at aspects like customer service, investment strategies, and how satisfied other customers are. A lot of people seem to appreciate the helpful guidance Schiff Gold provides, which really assists them in making informed decisions about their gold purchases and long-term investment plans.

Positive Experiences and Testimonials

I’ve heard so many great things from customers about Schiff Gold. People often rave about their exceptional customer service and deep knowledge of gold investments. It seems like everyone appreciates how committed the company is to educating clients about the ins and outs of the gold market. This really enables them to make informed choices that fit their financial goals.

From smooth transactions to quick support, it’s clear that Schiff Gold really works hard to enhance the customer experience, which shows in their high satisfaction ratings.

One customer shared how diving into the market with Schiff Gold’s extensive resources made a huge difference when it came to a crucial investment decision, leading to significant growth in their portfolio. Another person talked about how a friendly and helpful representative guided them through the purchasing process, making it feel easy and even enjoyable.

These experiences not only build loyalty but also showcase the company’s ongoing dedication to quality service, ensuring clients feel valued every step of the way. By focusing on clear communication and personalized support, Schiff Gold keeps nurturing those lasting relationships with their clients.

Negative Reviews and Complaints

I’ve noticed that while lots of customers have shared positive experiences with Schiff Gold, there are also some negative reviews and complaints that point out areas where improvements can be made. A lot of the feedback I’ve come across tends to focus on concerns about gold investment risks and some gaps in communication. It’s really important for potential investors to grasp these issues since they offer a fuller picture of how the company performs and its reliability.

I’ve seen some specific trends in customer dissatisfaction, like complaints about delayed response times and confusion about the fees tied to their investments. Some folks are also frustrated with the educational resources available, wishing for more guidance to help them make informed decisions.

On the bright side, Schiff Gold recognizes these concerns and is actively working on improving their customer service and enhancing their educational offerings. By tackling these issues, they aim to create a more transparent and supportive environment for both current and future investors, helping everyone better understand the risks involved in gold investments.

Comparison with Other Gold Investment Companies

Comparing Schiff Gold with other gold investment companies really gives me some valuable insights into where it stands in the market and what makes it unique.

When I’m looking for a reputable dealer to buy precious metals, knowing how Schiff Gold measures up against the competition is key to making informed decisions. I pay attention to factors like fees, service quality, and product offerings, as these can really sway my choice, especially when I’m considering long-term investment diversification and strategies for protecting my assets.

Pros and Cons of Schiff Gold

When I’m evaluating Schiff Gold, I find it really important to weigh the pros and cons to see if it fits my precious metals investment needs. I often hear about the advantages, like their wide range of gold investment options and the positive feedback from customers about their expertise and customer service.

A lot of customers really appreciate the personalized guidance they get during the purchasing process, which is super helpful whether you’re a newbie or a seasoned investor. However, I keep a close eye on the transparency of fees because that can really impact overall returns.

Some reviewers have mentioned that while the company’s reputation in the industry is solid, there’s always that market volatility lurking around, which can affect the value of gold investments. Keeping a balanced perspective on these factors helps me make informed decisions that align with my financial strategies.

Competitor Analysis

Doing a thorough competitor analysis is a game-changer for me when it comes to finding alternatives to Schiff Gold and figuring out their viability in the gold market. By diving into the different gold suppliers and what they offer, I can get a better sense of market volatility and pick the best options for my investment portfolio. Each competitor has its own unique features that might catch the eye of different kinds of investors, so it’s really important to look at everything from all angles.

For example, some companies might focus on bullion sales, highlighting low premiums and handy storage options, while others offer a full suite of services like wealth management and personalized investment strategies. I need to weigh these factors against my own investment goals, especially considering global economic trends and how gold prices fluctuate.

Checking out customer reviews and fee structures can also give me more clarity on the strengths and weaknesses of each gold investment company, helping me make informed decisions that align with my financial objectives and risk tolerance.

Safety and Security Measures at Schiff Gold

In terms of investing in precious metals, I know that safety and security are top priorities, and Schiff Gold really gets this. They offer secure gold storage solutions to keep my investment protected, which is super important in today’s unpredictable economic climate.

Their focus on safe handling and storage is all part of their bigger plan to give me peace of mind as an investor choosing to buy gold for the long haul.

Protecting Your Investment

Protecting my investment in gold is super important, and I’ve found that Schiff Gold has some solid strategies to keep my assets safe from market ups and downs. They really focus on gold performance and give me great insights into market trends, which helps me make informed decisions and maximize my returns on gold investments. Understanding how to protect my assets can really enhance my overall investment strategy.

On top of all that market analysis, Schiff Gold also emphasizes individualized investor education. This way, I can really dive into the nuances of trading precious metals. It’s a tailored approach that not only boosts my confidence but also helps me spot potential opportunities in the gold market that could lead to great returns.

With their commitment to secure storage solutions and smart risk management techniques, Schiff Gold has created a solid framework for dealing with volatility. These proactive measures are crucial for anyone like me who wants to navigate the complexities of precious metals investing, ensuring my portfolio stays strong no matter what the economy throws my way.

Final Thoughts and Recommendations

Investing with Schiff Gold seems like a smart move for anyone looking to boost their financial planning and mix things up by adding some precious metals to their portfolio. I really appreciate their focus on educating customers, being transparent with communication, and offering a variety of investment options. It’s definitely worth checking out their insights for personalized investment advice that aligns with your financial goals.

By looking into different strategies like buying gold bullion, investing in gold ETFs, or even exploring gold IRA options, I’ve found that individuals can effectively reduce risk and protect themselves against inflation. Staying updated on market trends and getting tailored advice can really help investors make choices that fit their unique situations.

In the end, a balanced approach with careful planning and a solid understanding of the gold market can lead to smarter financial decisions. This way, I can maximize the potential of gold as a valuable asset in my investment strategy.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What are Schiff Gold Reviews?

Schiff Gold Reviews are feedback and opinions from customers who have purchased and used products from Schiff Gold, a gold and precious metals dealer.

Why should I read Schiff Gold Reviews?

Reading Schiff Gold Reviews can help you make an informed decision about whether or not to do business with Schiff Gold. They offer insights into the company’s products, services, and customer satisfaction.

Where can I find Schiff Gold Reviews?

Schiff Gold Reviews can be found on various online platforms such as Trustpilot, Google Reviews, and the company’s official website.

How can I trust Schiff Gold Reviews?

Schiff Gold takes pride in offering transparent and honest services. The company has strict policies in place to ensure that all reviews are genuine and from verified customers.

Are all Schiff Gold Reviews positive?

No, not all Schiff Gold Reviews are positive. The company values honest feedback and publishes both positive and negative reviews to provide a balanced view of their products and services.

Can I leave my own Schiff Gold Review?

Yes, if you have purchased products from Schiff Gold, you can leave your own review on their official website or on third-party review platforms. Your feedback is valuable to the company and future customers.