If one is considering an investment in precious metals, it is essential to understand the offerings of Colorado Gold.

This article provides an overview of the diverse selection of products available, which includes gold, silver, platinum, and palladium coins, as well as bars and numismatic items.

Furthermore, we will assess Colorado Gold’s reliability as a coin dealer by examining its reputation, customer reviews, and safety measures.

We will evaluate the pros and cons of purchasing from Colorado Gold and propose alternative options.

By engaging with this content, readers can acquire the necessary information to make an informed investment decision.

What Products Does Colorado Gold Offer?

Colorado Gold provides a comprehensive array of products designed for both novice and seasoned investors in precious metals. Their inventory features a diverse selection of gold and silver coins, as well as platinum and palladium coins, along with gold and silver bars, accommodating a variety of investment strategies and preferences.

Additionally, collectors can explore a range of numismatic coins, each possessing distinct historical significance and market value. As a reputable gold dealer, Colorado Gold guarantees that its products adhere to industry standards for authenticity and certification, establishing itself as a trusted choice for individuals seeking to enhance their investment portfolios with precious metals.

1. Gold Coins

Gold coins serve as a fundamental component of precious metal investment, recognized for their intrinsic value and portability. At Colorado Gold, investors have the opportunity to select from a diverse range of gold bullion coins, all of which are distinguished by their quality and market liquidity. The pricing of these gold coins is closely tied to prevailing market trends, rendering them a suitable option for both short-term and long-term investment strategies.

These coins are available in various forms, including American Eagles, Canadian Maple Leafs, and South African Krugerrands, each possessing distinct characteristics and historical significance. Investors value these gold coins not only for their aesthetic appeal but also for their capacity to serve as a hedge against inflation.

As demand fluctuates, the pricing of these coin types presents substantial potential for investment returns, reflecting broader market movements and trends within global economies. A comprehensive understanding of the different types of gold coins enables investors to make informed decisions, thereby maximizing both the security and profitability of their investment portfolios.

2. Silver Coins

Silver coins represent an accessible entry point for investors seeking to diversify their portfolios with precious metals. Colorado Gold offers a comprehensive selection of silver coins, including popular silver bullion coins that are renowned for their affordability and potential for market appreciation. Investing in silver coins not only acts as a hedge against inflation but also reflects current market demand and trade-in value.

These coins are available in various denominations and designs, appealing to both collectors and investors. Notable examples include the American Silver Eagle and the Canadian Silver Maple Leaf, which are sought after due to their iconic status and intrinsic value.

The strong market demand for silver coins enhances their attractiveness as investments, especially during periods of economic uncertainty. As trade-in values fluctuate with market conditions, investors have the opportunity to leverage their assets effectively, making silver coins a prudent addition to any investment strategy.

3. Platinum Coins

Platinum coins present a distinctive opportunity for investors seeking to diversify their holdings within the precious metals market. Colorado Gold offers platinum coins that adhere to industry standards for quality and authenticity, attracting those interested in alternative investments beyond traditional gold and silver. The market value of platinum coins is subject to fluctuations, making them a compelling option for strategic investing.

Unlike more conventional assets, such as stocks or bonds, platinum coins can enhance an investment portfolio by providing a hedge against inflation and economic uncertainty. Their rarity compared to gold and silver contributes to their potential for appreciation, as supply constraints may lead to increased demand.

Additionally, the industrial applications of platinum—ranging from automotive catalysts to electronics—further solidify its intrinsic value in the global market. Investors who consider this precious metal can anticipate not only a safeguard against market volatility but also the opportunity for considerable long-term growth.

4. Palladium Coins

Palladium coins are gaining increasing recognition within the investment community due to their rarity and inherent value. As part of Colorado Gold’s offerings, these coins present an opportunity to incorporate a rare precious metal into an investment portfolio, aligning with current market trends and the rising demand for palladium. Their reliability as an asset further enhances their appeal for investors seeking to explore alternative precious metal investments.

Palladium coins possess unique properties that offer a striking aesthetic, attracting both collectors and investors. Unlike more commonly traded metals, palladium is not only utilized in jewelry but also serves a significant role in industrial applications, particularly in catalytic converters for automobiles.

As environmental regulations become more stringent and the automotive sector transitions toward greener technologies, the demand for palladium in these applications is expected to increase. This heightened recognition of palladium’s versatility, coupled with its limited supply, positions these coins as a strategic option for diversifying an investment portfolio, enabling investors to hedge against economic uncertainty while potentially achieving substantial long-term rewards.

5. Gold and Silver Bars

Gold and silver bars are preferred options for investors seeking substantial holdings in bullion form due to their ease of storage and potential market liquidity. Colorado Gold provides a diverse range of gold and silver bars that are competitively priced and aligned with current market values, making them appealing choices for both novice and experienced investors. The availability of convenient delivery options ensures a secure and efficient transaction process.

These precious metals act as a hedge against inflation and economic uncertainty, offering a tangible asset that can effectively diversify investment portfolios. By opting to invest in bars, individuals benefit from lower premiums over spot prices compared to coins, thereby enhancing their overall return on investment. The compact nature of bullion facilitates easier storage and security, whether at home or in a safe deposit box.

As the demand for physical gold and silver continues to increase, possessing these bars can also enhance liquidity during times of need, providing both peace of mind and financial advantages.

6. Numismatic Coins

Numismatic coins are esteemed for their historical significance and their appeal within the collector community, offering both aesthetic appreciation and investment potential. Colorado Gold presents a carefully curated selection of numismatic coins, including rare specimens that may appreciate substantially in value over time. The uniqueness and collectible nature of these coins necessitate proper appraisal to ensure authenticity and equitable pricing.

The appeal of numismatic coins extends beyond their visual allure, as their historical contexts often engage both collectors and investors. Each coin narrates a story, reflecting the economic conditions and cultural values of its time.

As enthusiasts explore the intricacies of numismatic coins, they discover opportunities for personal enjoyment as well as profitable investment. Trends within the numismatic market can significantly enhance the value of certain coins, highlighting the necessity for expert appraisal and well-considered choices for individuals seeking to secure their financial future through strategic acquisitions.

Participating in this vibrant community enables individuals to exchange knowledge, establish connections, and appreciate the intricate artistry of these tangible pieces of history.

Is Colorado Gold a Reliable Coin Dealer?

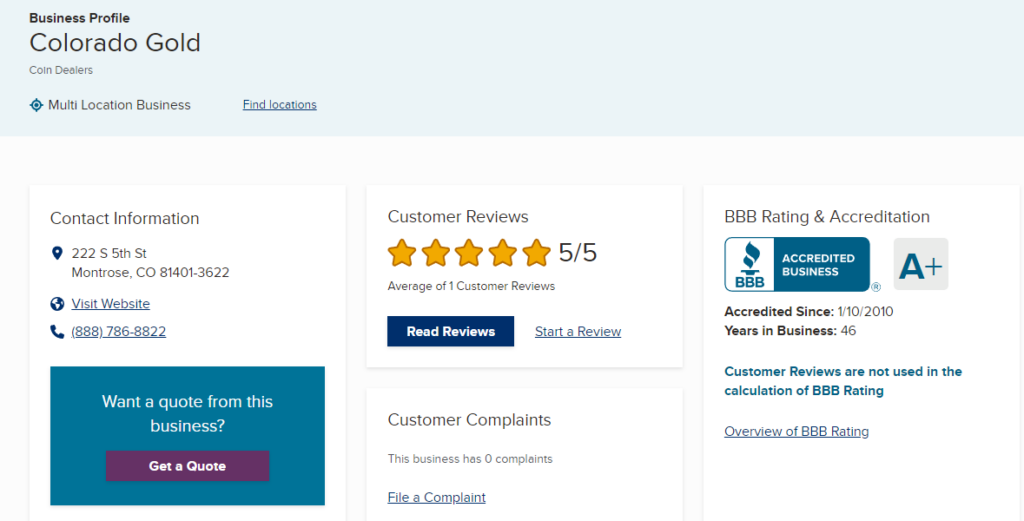

When evaluating a coin dealer, it is essential to prioritize trustworthiness and reliability. Colorado Gold has established itself as a reputable entity within the precious metals market.

With a substantial history of satisfied clientele, this gold dealer emphasizes service quality and transparency, ensuring that each transaction is secure and adheres to the highest industry standards. The numerous positive customer reviews demonstrate Colorado Gold’s commitment to fostering long-term relationships built on trust and customer satisfaction.

1. Reputation and Experience

The reputation of Colorado Gold is founded on years of experience within the precious metals industry, positioning itself as a trusted entity among gold dealers. With a steadfast commitment to adhering to industry standards and obtaining necessary trust seals, the company has cultivated a loyal customer base that values its expertise and reliability. This strong reputation serves as a testament to their dedication to ethical practices and customer satisfaction.

Throughout the years, Colorado Gold has consistently demonstrated an unwavering commitment to transparency and authenticity, which not only enhances their credibility but also assures clients regarding the quality of their investments. By remaining informed about market trends and regulatory changes, the company ensures compliance with the highest industry benchmarks, thereby reinforcing its status as a reputable dealer.

Their extensive knowledge of gold and other precious metals, coupled with effective customer engagement, has further solidified their valuable position within the marketplace, attracting both novice investors and seasoned collectors.

2. Customer Reviews

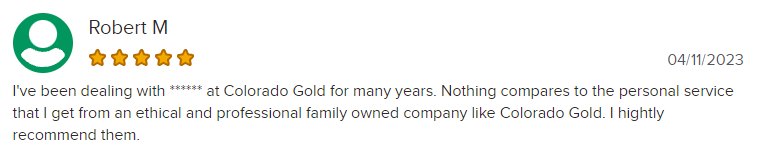

Customer reviews serve a vital function in assessing the reliability of a dealer, and Colorado Gold presents an impressive collection of positive testimonials that underscore the quality of their service and responsiveness. These reviews not only reflect the satisfaction of previous clients but also provide valuable insights into the dealer’s communication practices and levels of customer service. Such feedback is essential for establishing trust and ensuring a favorable buying experience.

For example, numerous customers have commended Colorado Gold for their prompt communication, often highlighting how inquiries were addressed with detailed responses in a timely manner. This attentiveness not only demonstrates the dealer’s commitment to customer satisfaction but also enhances the overall purchasing journey.

Clients frequently recognize the professionalism and expertise of the staff, which facilitates a smoother and more well-considered choices process. By addressing both strengths and areas for improvement, these reviews function as a comprehensive resource for potential buyers, reinforcing Colorado Gold’s reputation as a credible and trustworthy option in the marketplace.

3. Accreditation and Memberships

Accreditations and memberships in professional organizations serve as key indicators of a dealer’s legitimacy and commitment to industry standards. Colorado Gold possesses several accreditations that underscore its dedication to ethical business practices and consumer rights, thereby ensuring that customers can trust the quality of its offerings. Membership in recognized industry groups further validates its status as a reputable gold dealer.

These affiliations include membership in the Professional Numismatists Guild (PNG) and the Industry Council for Tangible Assets (ICTA), both of which are distinguished organizations known for their rigorous membership requirements. By aligning itself with such reputable entities, Colorado Gold not only enhances its credibility but also demonstrates compliance with established best practices within the industry.

These memberships necessitate ongoing education and adherence to strict ethical guidelines, providing clients with additional assurance that they are engaging with a dealer committed to transparency and integrity in all transactions.

4. Insurance and Storage Options

Security is an essential aspect of precious metal investments, and Colorado Gold places a high priority on it by offering comprehensive insurance and secure storage options for clients. By providing fortified storage facilities combined with extensive insurance coverage, Colorado Gold ensures that investments are safeguarded against theft or loss, instilling confidence in customers throughout the buying and selling processes. Additionally, efficient delivery options further enhance the security and reliability of transactions.

Recognizing the importance of protecting valuable assets, Colorado Gold implements advanced security protocols within their facilities, which include state-of-the-art surveillance systems and controlled access measures. These features are specifically designed to deter unauthorized access and provide an additional layer of protection for each client’s investment portfolio. Clients have the flexibility to choose from various storage solutions, whether in a private vault or a secure facility, tailored to their individual needs.

Such meticulous attention to security not only protects physical assets but also cultivates trust, enabling investors to engage with confidence in the market.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Are the Pros and Cons of Buying from Colorado Gold?

When contemplating a purchase from Colorado Gold, it is imperative to evaluate the advantages and disadvantages in order to make an informed decision.

On one hand, Colorado Gold is esteemed for its dependable customer service, transparent pricing, and compliance with industry standards, which contributes to its popularity among investors. Conversely, prospective buyers should also take into account the investment risks inherent in the volatile nature of the precious metals market, along with any dealer fees that may influence their overall investment.

1. Pros

One of the most significant advantages of purchasing from Colorado Gold is its commitment to exceptional service quality, which is crucial in enhancing the overall customer experience. Investors value the transparent pricing, extensive range of products, and the reliability of transactions that accompany buying from a reputable gold dealer such as Colorado Gold.

Plus these attributes, the company’s knowledgeable staff is consistently available to assist customers with their inquiries, ensuring that each individual comprehensively understands their options. This personalized approach fosters trust and encourages the development of long-term relationships with clients.

Colorado Gold provides a diverse selection of investment opportunities, ranging from bullion coins to collectible items, catering to both seasoned investors and newcomers to the market. This extensive product catalog, combined with the company’s strong market reputation, positions Colorado Gold as a preferred choice for individuals seeking to invest in precious metals with confidence.

2. Cons

While Colorado Gold presents a variety of advantages, it is essential to consider the potential disadvantages prior to making a purchase. Some customers may encounter higher dealer fees compared to other dealers, which could impact overall investment returns, particularly for those intending to buy in bulk. The volatility inherent in the precious metals market introduces significant investment risks that buyers should be prepared to manage.

Furthermore, it is important for buyers to recognize that dealer fees can vary considerably depending on the specific products selected, potentially leading to unanticipated costs if one is not vigilant. The lack of transparency regarding pricing can exacerbate these issues, as individuals may not fully comprehend what they are paying for. Additionally, fluctuations in the market may result in financial losses if the value of gold or silver decreases after purchase, placing investors at risk.

Consequently, it is imperative for those interested in building a precious metals portfolio to conduct thorough research and assess all potential pitfalls associated with purchasing from this dealer.

What Are Some Alternatives to Colorado Gold?

Exploring alternatives to Colorado Gold offers investors a broader range of options for acquiring precious metals, particularly for those interested in competitive pricing or specific product offerings.

Numerous online coin dealers, local coin shops, and auction platforms provide distinct advantages, such as personalized customer service and potentially reduced dealer fees.

By understanding these alternatives, investors can make informed decisions that align with their financial objectives and investment strategies.

1. Other Online Coin Dealers

Other online coin dealers provide a variety of products that may either complement or compete with the offerings of Colorado Gold, allowing consumers to explore diverse pricing structures and customer service experiences. Each dealer occupies a unique position in the market that can significantly affect market liquidity and individual investment strategies, making it imperative for purchasers to evaluate their options with due diligence.

Upon examining the characteristics of these dealers, one may observe notable differences in their pricing structures, which are often influenced by factors such as order volume and market demand. While some competitors may present lower prices to attract clientele, the quality of service can vary considerably; therefore, it is essential to consider the responsiveness and expertise of their customer support teams.

Moreover, the range of available products can differ markedly, with certain dealers specializing in rare coins while others concentrate on bullion. Consequently, prospective buyers should carefully assess these factors in conjunction with their own investment objectives to make well-informed decisions.

2. Local Coin Shops

Local coin shops represent an alternative to Colorado Gold, providing personalized service and immediate access to products that cater to both collectors and investors. These establishments enable face-to-face interactions, which can enhance the purchasing experience and facilitate a more comprehensive understanding of current market trends and investment opportunities.

In contrast to larger retailers, local coin shops cultivate a community atmosphere where enthusiasts can share insights and tips. Customers often value the tailored recommendations offered by knowledgeable staff members who are passionate about numismatics.

The immediate availability of unique coins and collectibles in these local businesses allows buyers to complete their purchases on-site, thereby avoiding the wait times typically associated with online orders from larger competitors. Supporting these small enterprises not only strengthens the local economy but also helps preserve the rich tradition of coin collecting within the community.

3. Auctions and Marketplaces

Auctions and online marketplaces provide distinctive opportunities for acquiring rare coins and collectibles, often at more competitive prices compared to traditional coin dealers such as Colorado Gold. These platforms enable buyers to engage in bidding or purchase coins that may not be readily available in conventional retail environments, thereby offering potential investment advantages for discerning collectors.

The dynamic nature of online bidding can result in reduced prices, creating an environment where knowledgeable participants may obtain items at exceptional values. However, it is imperative to remain cognizant of the associated risks, including hidden fees, the possibility of bidding wars that can unexpectedly escalate prices, and the challenges related to verifying authenticity.

While Colorado Gold may offer a more curated selection and assured quality through its established reputation, exploring auctions can yield unique finds and enhance one’s collection. Ultimately, it is essential to evaluate both options in the context of individual investment objectives and risk tolerance in order to make well-informed purchasing decisions.

How Can You Ensure a Safe and Secure Transaction with Colorado Gold?

Ensuring a safe and secure transaction with Colorado Gold is essential for any investor seeking to buy or sell precious metals. By conducting comprehensive research, comparing prices, and verifying the dealer’s credentials, buyers can effectively mitigate the risks associated with online transactions.

Colorado Gold places a strong emphasis on transparency and customer satisfaction, thereby facilitating a confident decision-making process for its clients.

1. Research and Compare Prices

Researching and comparing prices is an essential initial step in facilitating safe transactions with Colorado Gold, allowing investors to make informed decisions based on prevailing market trends. By understanding the pricing landscape, clients can assess the competitiveness of Colorado Gold’s offerings in relation to other dealers and adjust their purchasing strategies accordingly.

Comprehensive research entails not only examining current prices but also analyzing historical pricing trends, which can provide valuable insights into potential future movements. Utilizing online resources and comparison tools enables buyers to efficiently evaluate various suppliers and identify optimal deals.

It is also prudent to consider market conditions, including fluctuations in gold demand and geopolitical events, as these factors can significantly influence pricing.

By adopting a proactive approach and employing various analytical methods, investors can enhance their purchasing power while mitigating the risks associated with market volatility.

2. Verify the Dealer’s Credentials

Verifying the credentials of the dealer is essential for ensuring trustworthiness in any transaction with Colorado Gold, as it confirms their adherence to industry standards and ethical practices. Buyers should actively seek out relevant licensing and accreditations that demonstrate the dealer’s legitimacy and commitment to customer satisfaction.

To initiate this verification process, one should first ascertain whether Colorado Gold possesses the necessary state licenses required to operate within its jurisdiction. This information can typically be obtained by visiting the website or office of the state’s regulatory body.

Additionally, it is advantageous to confirm any memberships in reputable industry organizations, as these affiliations often necessitate compliance with rigorous standards of professionalism and ethics.

Prospective buyers may also wish to review testimonials and feedback from previous clientele, as this information can provide valuable insights into the dealer’s reputation within the market.

By undertaking these measures, customers can make informed decisions and feel more secure in their transactions.

3. Inspect the Products and Delivery Options

Inspecting the products and understanding the delivery options provided by Colorado Gold are essential steps in ensuring a satisfactory purchasing experience. Customers must obtain detailed information regarding product authenticity and delivery security, as these factors are crucial for protecting their investments.

By meticulously evaluating the quality of items, buyers can confidently differentiate genuine offerings from potentially counterfeit products. This diligence not only enhances the overall shopping experience but also cultivates trust in the brand.

Exploring delivery options that emphasize tracking and insured shipping is equally important; such measures guarantee that products arrive safely and as anticipated. When organizations prioritize both product inspection and secure delivery, they enable consumers to make informed decisions.

Ultimately, this approach fosters a more transparent marketplace, where customer satisfaction and peace of mind are the primary objectives of each transaction.

4. Understand the Return and Refund Policies

Understanding the return and refund policies of Colorado Gold is essential for safeguarding customer rights and ensuring investment security. Clear and equitable policies provide reassurance to investors, enabling them to make purchases with confidence, knowing they have recourse in the event of dissatisfaction.

These policies establish a comprehensive framework for addressing grievances and also enhance the overall consumer experience by promoting transparency in transactions. By adhering to industry standards, Colorado Gold demonstrates a commitment to ethical business practices, ensuring that customers possess a clear understanding of their rights when engaging in purchasing activities.

Such policies foster trust between the company and its clientele, allowing investors to feel confident that any issues that may arise will be adequately addressed. Ultimately, robust return and refund policies can play a significant role in the decision-making process for potential buyers, promoting customer loyalty and encouraging repeat business.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

Is Colorado Gold Review a reliable coin dealer?

Yes, Colorado Gold Review is a highly reputable and reliable coin dealer that has been in business for over 40 years. They have a proven track record of providing quality services and products to their customers.

What types of coins does Colorado Gold Review offer?

Colorado Gold Review offers a wide variety of coins, including gold, silver, platinum, and palladium coins. They also offer rare and collectible coins from various time periods and countries.

What is the process for purchasing coins from Colorado Gold Review?

The process for purchasing coins from Colorado Gold Review is simple and straightforward. You can either visit their physical store or make purchases online through their secure website. They also offer phone and email ordering options.

Are the coins sold by Colorado Gold Review authentic?

Yes, Colorado Gold Review ensures that all the coins they sell are 100% authentic. They source their coins from reputable suppliers and have a team of experts who verify the authenticity of each coin before it is sold.

Does Colorado Gold Review offer any guarantees on their coins?

Yes, Colorado Gold Review offers a 30-day money-back guarantee on all their coins. If you are not satisfied with your purchase for any reason, you can return the coin within 30 days for a full refund.

What sets Colorado Gold Review apart from other coin dealers?

Colorado Gold Review stands out from other coin dealers due to their industry experience, exceptional customer service, and competitive pricing. They also offer educational resources and market insights to help customers make informed decisions when purchasing coins.