Madison Trust Company is a leading provider of self-directed retirement accounts, enableing me to take control of my financial future.

In this article, I will explore the range of services offered by Madison Trust, including Self-Directed IRAs, Solo 401(k)s, HSAs, and ESAs. I will also delve into how the company operates, discussing the associated fees and the pros and cons of choosing Madison Trust.

Furthermore, I will address the legitimacy and safety of Madison Trust as a financial institution, providing guidance on the account-opening process. Additionally, I will share insights from real customers about their experiences with the company.

What is Madison Trust Company?

I am proud to be reviewing Madison Trust Company, a reputable financial institution that specializes in self-directed IRAs and a variety of trust services designed to enable investors in managing their retirement accounts. Their mission is to provide exceptional asset protection and personalized service, allowing clients to explore a diverse range of investment options, including real estate and alternative assets.

They place a strong emphasis on transparency and regulatory compliance, prioritizing the clients’ financial security while ensuring a seamless user experience through an intuitive online platform. Their dedicated management team is committed to upholding industry standards in financial technology and investment advisory, enabling our clients to confidently pursue their financial goals.

What Services Does Madison Trust Company Offer?

At Madison Trust Company, they provide a range of services designed to address the diverse financial needs of my clients, including self-directed IRAs, Solo 401(k)s, and Health Savings Accounts (HSAs).

By offering robust trust administration and custodial services, they support both individual investors and institutional accounts, facilitating their investment strategies.

Their brokerage services allow clients to explore alternative assets and real estate investments, ensuring a comprehensive approach to portfolio diversification and asset allocation.

They take pride in delivering personalized service and innovative solutions that align with my clients’ financial objectives.

1. Self-Directed IRAs

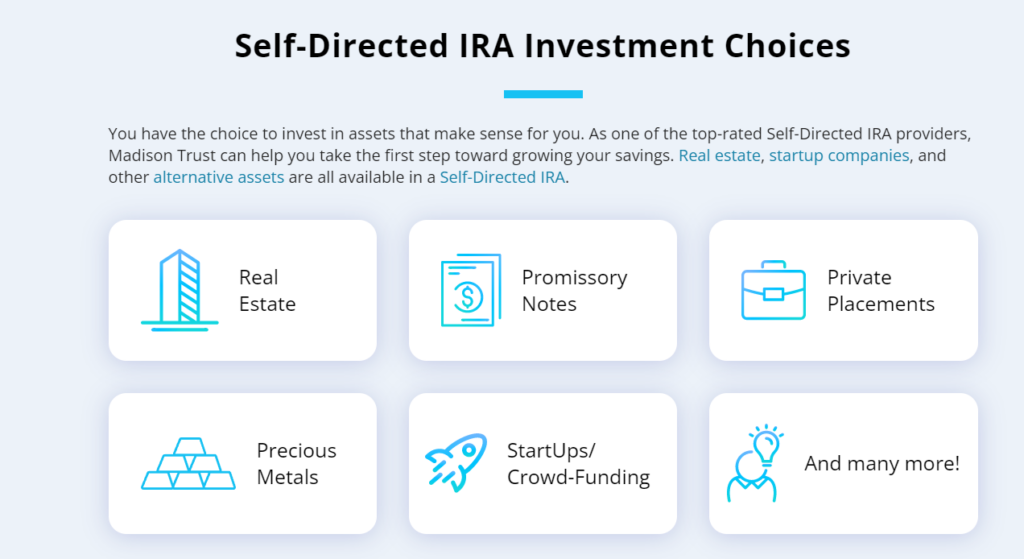

Self-directed IRAs at Madison Trust Company offer me enhanced control over my retirement accounts by allowing me to choose from a broad spectrum of investment options, including real estate and alternative assets. This flexibility not only enhances my portfolio diversification but also provides significant tax advantages, as I can manage my investments within a tax-advantaged account structure.

With the ability to select investments that align with my personal financial goals, these retirement accounts cater to a diverse range of preferences, such as commodities, precious metals, and peer-to-peer lending opportunities. This freedom of choice enables me to develop a more tailored investment strategy, which has the potential to yield higher returns compared to traditional IRAs.

Additionally, the self-directed approach supports asset protection, which is essential for safeguarding my wealth against market volatility. By aligning my investment decisions with my long-term retirement objectives, I find that these accounts serve as powerful vehicles for maximizing both growth and security, making them an increasingly appealing option for informed investors like myself.

2. Solo 401(k)s

The Solo 401(k) offered by Madison Trust Company stands out as an exceptional retirement savings option tailored for self-employed individuals and small business owners. This plan allows me to maximize my contributions while enjoying substantial tax benefits.

With higher contribution limits compared to traditional retirement accounts, I have the flexibility to develop robust investment strategies that align with my financial goals.

By contributing both as an employee and employer, I can potentially save up to $66,000 annually, or $73,500 if I am age 50 or older. This feature makes the Solo 401(k) an appealing choice for those looking to accelerate their retirement savings.

Additionally, contributions to this type of account are tax-deductible, which significantly reduces my taxable income and provides immediate savings. The Solo 401(k) also allows for self-directed investments, enabling me to explore a variety of options, including real estate, precious metals, and other alternative assets. This level of control over my retirement portfolio is invaluable.

3. Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) offered by Madison Trust Company are an effective tool for individuals seeking to save for qualifying medical expenses while benefiting from significant tax advantages. By contributing to an HSA, I can invest my funds for potential growth, making it a prudent choice for addressing both current and future health-related expenses.

These accounts provide not only tax-deductible contributions but also enable tax-free withdrawals when used for eligible medical costs, thereby enhancing overall savings. Funds within an HSA can grow tax-free, presenting an excellent opportunity for long-term investment that can greatly improve my financial security.

By strategically utilizing HSAs, I can manage my healthcare expenses effectively while simultaneously building a financial cushion for unforeseen medical situations. This combination of immediate tax relief and long-term investment growth makes HSAs an invaluable asset in my financial planning strategy.

4. Education Savings Accounts (ESAs)

I find that Education Savings Accounts (ESAs) offered by Madison Trust Company present a strategic way for families to save for future educational expenses while benefiting from tax advantages. These accounts provide a diverse range of investment options, enabling families to grow their savings efficiently in preparation for the increasing costs of education.

Plus offering tax-free growth on contributions, ESAs allow families to withdraw funds for qualified expenses without incurring taxes, making this a financially prudent choice. The flexibility to invest in various options, from stocks to bonds and mutual funds, enables families to customize their savings strategy based on their individual financial circumstances.

Furthermore, the capability to utilize these accounts for different educational pathways—from private schooling to college tuition—ensures that families can effectively manage and allocate resources as their children progress through various stages of education. Overall, utilizing ESAs not only enhances financial planning but also eases the burden of educational expenditures.

How Does Madison Trust Company Work?

I utilize a streamlined process to ensure a smooth user experience for clients who are looking to open and manage their accounts, whether for self-directed IRAs or other investment vehicles.

My user-friendly online platform simplifies the account setup process, making it easy for clients to navigate their investment options and effectively track performance.

With a commitment to providing exceptional client support, I prioritize transparency and accessibility in all my service offerings.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Are the Fees and Costs Associated with Madison Trust Company?

Understanding the fees and costs associated with Madison Trust Company is essential for me to make informed investment decisions. Our fee structure is designed to be both competitive and transparent, covering account setup fees, annual maintenance fees, and transaction fees for various services.

This approach aims to enhance customer satisfaction while maintaining a high standard of service quality.

1. Account Setup Fees

I understand that account setup fees at Madison Trust Company are a one-time charge applied to establish an account, allowing clients to access our comprehensive range of financial products and services. This fee is crucial for initiating the investment journey and ultimately contributes to the quality of service we provide.

By investing this upfront amount, clients can unlock a wealth of opportunities designed to enhance their financial portfolios. These fees are an integral part of the onboarding process, facilitating the necessary administrative work involved in creating accounts tailored to individual investment goals.

Clients can expect a seamless integration into our investment ecosystem, which includes personalized guidance and access to innovative financial tools. Understanding the value behind these initial costs reveals how Madison Trust Company prioritizes long-term wealth management, offering services that extend beyond simple transactions and focus on building sustainable financial futures.

2. Annual Maintenance Fees

Annual maintenance fees at Madison Trust Company allow me to provide clients with ongoing account management and support throughout their investment journey. These fees are essential for maintaining transparency and service quality, ensuring that account holders receive the guidance and resources necessary to achieve their financial goals.

Furthermore, these fees are critical in enabling the company to allocate resources effectively, which allows for a high level of personalized service tailored to individual client needs. By investing in dedicated support teams and advanced financial tools, I can assure clients that their accounts are being managed with a strong focus on both security and growth.

This approach helps to cultivate a trustworthy relationship between clients and the company, as the emphasis on clear communication and transparent practices reinforces my commitment to service excellence—something that clients truly appreciate.

3. Transaction Fees

At Madison Trust Company, they apply transaction fees when clients engage in specific investment options or utilize our service offerings, which contribute to the overall customer experience. These fees are structured to remain competitive within the industry, allowing clients to maximize their investments while being fully aware of the costs involved.

The costs associated with transaction fees can vary based on the types of financial products clients choose to invest in, whether it be real estate, precious metals, or cryptocurrencies. Understanding how these transaction fees function is crucial for clients, as it enables them to make informed decisions that align with their financial goals.

By transparently presenting these fees within the overall service framework, I enable clients to navigate their investment landscape with confidence. This approach not only enhances their overall experience but also builds trust, as clients can see the value of their investments and understand the role that fees play in shaping their financial journey.

What Are the Pros and Cons of Using Madison Trust Company?

When I consider Madison Trust Company as my partner for financial management, I find it essential to evaluate the pros and cons associated with their services.

The benefits include a diverse range of investment options, an excellent customer experience, and a strong commitment to service quality. However, I also recognize that there may be potential drawbacks, such as specific fees and account types that could impact my financial planning.

1. Pros

Utilizing Madison Trust Company offers several advantages, including a wide selection of investment options, personalized service, and a strong commitment to customer satisfaction. I value the flexibility of self-directed IRAs and the opportunity to invest in alternative assets, which provide significant potential for portfolio diversification.

This extensive variety enables me to explore unique investment choices, ranging from real estate and precious metals to cryptocurrency, allowing me to align my investments with my individual goals and risk tolerance.

The personalized service at Madison Trust Company ensures that I receive tailored support throughout my investment journey, fostering a sense of trust and satisfaction.

By focusing on my specific needs as an investor, the firm cultivates a collaborative approach that enables me to make informed decisions in line with my financial aspirations. Ultimately, Madison Trust Company not only enhances my investment prospects but also prioritizes my overall experience, reinforcing its commitment to exceptional client care.

2. Cons

While I appreciate the many benefits of using Madison Trust Company, I also recognize some potential drawbacks, such as specific fees associated with various account types and the investment risks linked to self-directed options. It is crucial for me to carefully consider these factors when determining my financial strategies and investment vehicles.

I understand the importance of meticulously analyzing the fee structure, as these charges can differ based on the account type and services I choose to utilize. For example, account setup fees and ongoing management costs could significantly diminish my investment returns over time.

When opting for self-directed investing, I acknowledge that I might encounter higher risks due to my limited experience or knowledge about certain markets and asset classes. Without proper guidance, the likelihood of making poor investment choices increases, potentially leading to significant losses that could overshadow the benefits of having flexible investment options.

Is Madison Trust Company Legitimate and Safe?

Determining the legitimacy and safety of Madison Trust Company is essential for potential clients considering our services for retirement accounts and investment management. I take pride in our strong regulatory compliance and unwavering commitment to transparency, which enhances our company’s reputation and provides clients with the reassurance they need regarding their financial security.

How to Open an Account with Madison Trust Company?

Opening an account with Madison Trust Company is a straightforward process that has been designed with user-friendliness in mind. I ensure that clients can easily navigate through the account setup steps.

Our platform offers interactive support and resources to assist me in selecting the best investment options tailored to my financial goals.

Customer Reviews and Testimonials

I recognize that customer reviews and testimonials are essential in understanding the experiences of clients who have utilized Madison Trust Company’s services for financial management and retirement accounts. The positive feedback we receive regarding our client support and service quality reflects our commitment to delivering an exceptional customer experience.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What is Madison Trust Company Review?

Madison Trust Company Review is a comprehensive evaluation of the services, fees, and overall performance of Madison Trust Company, a financial institution that specializes in self-directed individual retirement accounts (IRAs).

How does Madison Trust Company differ from traditional banks?

Unlike traditional banks, Madison Trust Company focuses exclusively on self-directed IRAs and does not offer services such as checking or savings accounts. This allows them to provide specialized expertise and a wider range of investment options for their clients.

What types of self-directed IRAs does Madison Trust Company offer?

Madison Trust Company offers a variety of self-directed IRA options, including traditional, Roth, SEP, SIMPLE, and solo 401(k) plans. Each plan has different eligibility requirements and potential tax benefits, so it’s important to consult with a financial advisor before making a decision.

What are the fees associated with Madison Trust Company’s services?

Madison Trust Company charges a one-time account setup fee and an annual account maintenance fee, as well as transaction fees for certain investments. They also offer optional services, such as account valuation and tax reporting, for an additional fee.

What are the benefits of using Madison Trust Company for my self-directed IRA?

Madison Trust Company offers a wide range of investment options, including real estate, private equity, and precious metals, which may not be available through traditional banks. They also have a user-friendly online platform and a team of experienced professionals to help guide clients through the investment process.

Is Madison Trust Company a safe and trustworthy institution?

Yes, Madison Trust Company is a highly reputable financial institution with over a decade of experience in the self-directed IRA industry. They are a member of the Better Business Bureau and have consistently received positive reviews from clients and financial experts alike.

Madison Trust Company

Is Madison Trust Company a reliable SDIRA company? What are their pros and cons? Find out the answer in this review.

Product In-Stock: InStock

4