uDirect IRA Services offers a distinctive approach to retirement investing, give the power toing individuals to take control of their financial futures through self-directed accounts.

This overview examines how Udirect operates, showcasing its diverse investment options—from real estate to precious metals—and the benefits of tax-advantaged investing. It will also highlight the features that differentiate Udirect from other providers, assess potential drawbacks, and provide insights into customer experiences.

If I am contemplating a more hands-on approach to retirement savings, I will continue reading to determine if Udirect is the right fit for my needs.

What Is uDirect IRA Services?

They offer a comprehensive range of IRA services through uDirect IRA Services, specifically designed to help individuals manage their retirement accounts effectively. As a self-directed IRA provider, they give the power to investors with the flexibility to choose from a diverse array of investment options, including stocks, bonds, mutual funds, real estate, and alternative investments such as precious metals and gold IRAs.

With a strong emphasis on customer service and competitive fees, uDirect IRA distinguishes itself in the marketplace, ensuring that clients receive the support they need for their financial planning and retirement goals. In this review, I will explore the unique features and benefits of utilizing Udirect IRA Services for retirement savings.

How Does uDirect IRA Services Work?

They operate uDirect IRA Services by enabling clients to establish self-directed IRA accounts, which provide them with exceptional control over their retirement investments. The account setup process is both straightforward and efficient, allowing clients to easily navigate various funding options, including rollovers from traditional or Roth IRAs, all while ensuring compliance with regulatory standards.

Their online platform is designed with user experience in mind, and they offer custodial services that support a wide range of investment vehicles. This give the power to clients to manage their portfolios effectively and monitor their performance on a regular basis.

What Are The Features Of uDirect IRA Services?

uDirect IRA Services offers a range of features designed to meet the diverse needs of investors aiming to maximize their retirement savings through self-directed IRAs. With flexible account types that accommodate various investment strategies and comprehensive brokerage services, they ensure that clients have the tools necessary for effective portfolio management.

Key features include access to direct investments in real estate, stocks, bonds, and precious metals, as well as clearly defined withdrawal rules that support strategic financial planning and risk management.

1. Self-directed IRA Accounts

Self-directed IRA accounts offered by Udirect IRA give the power to me to take control of my retirement savings by selecting my investment options. I can choose from traditional assets like stocks and bonds, as well as alternative investments such as real estate and precious metals.

This flexibility allows me to align my investment strategies with my personal financial goals while also opening up a wide range of opportunities for asset diversification. With the advantage of tax-deferred growth that comes with these self-directed accounts, I have the potential to enhance my retirement savings without the immediate burden of tax liabilities.

This approach not only helps mitigate risks associated with market fluctuations but also enables me to explore various avenues such as cryptocurrencies, private placements, or even tax liens, all of which can significantly strengthen my portfolio’s resilience.

Ultimately, self-directed IRAs serve as a solid vehicle for anyone, including myself, who seeks a more hands-on approach to securing their financial future.

2. Real Estate Investment Options

At Udirect IRA Services, they facilitate real estate investing within self-directed IRAs, give the power toing clients to diversify their portfolios and explore lucrative opportunities in the real estate market.

This flexibility is essential for individuals seeking to maximize returns while minimizing risk through a varied investment strategy. By utilizing options such as rental properties, they enable investors to benefit from consistent cash flow and potential appreciation over time.

Udirect IRA also offers innovative crowdfunding opportunities, allowing clients to participate in larger real estate projects without the need for substantial capital.

This approach not only enhances asset diversification but also provides the opportunity to engage in different sectors of the market, allowing clients to tailor their investments to align with personal financial goals.

3. Precious Metals Investment Options

They provide clients with the opportunity to invest in precious metals through gold IRAs, strategically enhancing their retirement portfolios.

This investment approach not only diversifies their assets but also serves as a secure hedge against market volatility. By opting to include metals such as gold, silver, platinum, and palladium, they enable investors to leverage the intrinsic value these commodities possess, which often retains strength during economic downturns better than traditional securities.

Gold IRAs also offer significant tax advantages, including tax-deferred growth until withdrawal, which can substantially improve overall returns. By understanding the nuances of different precious metals and their unique market dynamics, they give the power to individuals to make informed decisions that align with their long-term financial goals.

4. Private Lending Investment Options

I have the opportunity to explore private lending investment options through Udirect IRA, allowing me to leverage my self-directed IRA for potential high returns while effectively managing associated risks.

This unique investment avenue enables me to finance loans for real estate projects, businesses, or personal borrowers, creating opportunities that traditional banking often overlooks.

To successfully navigate the private lending landscape, I understand the importance of conducting a thorough risk assessment by evaluating the borrower’s creditworthiness, current market conditions, and the potential for return on investment.

I also prioritize identifying viable opportunities by analyzing various investment strategies, such as diversifying my loan portfolio or targeting specific sectors with higher growth prospects. By combining diligent research with sound risk management practices, I can significantly increase my potential for lucrative financial outcomes.

5. Tax-advantaged Investing

Tax-advantaged investing through uDirect IRA Services enables me to maximize my contributions while benefiting from tax-deferred growth on my retirement accounts.

This approach allows me to invest my funds without the immediate concern of taxes on my earnings, which can significantly enhance my overall retirement savings. By taking advantage of the high contribution limits available with self-directed IRAs, I can position myself more favorably for retirement.

Additionally, having the ability to diversify my investments—from real estate to precious metals—helps me mitigate risk while also providing opportunities for increased income later in life. These strategies contribute to a robust retirement plan that effectively leverages both immediate tax benefits and long-term wealth accumulation.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Are The Benefits Of Using uDirect IRA Services?

Utilizing uDirect IRA Services offers numerous benefits for investors seeking to optimize their retirement savings and investment strategies. I have observed enhanced client satisfaction, as evidenced by positive customer feedback, as well as comprehensive investor education programs that give the power to individuals to make informed decisions.

Udirect IRA truly positions itself as a leader in the self-directed IRA space. Furthermore, competitive analysis highlights its strengths in service reliability and account management, making it a favorable choice for those pursuing financial independence and long-term growth.

1. Flexibility and Control

One of the primary advantages I find in Udirect IRA Services is the flexibility and control it provides, allowing me to tailor my retirement investments according to my personal financial goals and risk tolerance.

This level of customization enables me to explore a diverse array of investment options, from real estate and precious metals to alternative assets, fostering a proactive approach to my retirement planning.

By actively engaging in the investment process, I can strategically align my portfolio with market trends and my own risk appetite. This give the power toment not only enhances my financial literacy but also instills confidence in my ability to make informed decisions.

As I navigate my unique financial landscape, I feel better equipped to adapt to changing economic conditions while striving for long-term growth and stability in my retirement funds.

2. Diversification of Investments

Utilizing uDirect IRA Services allows me to diversify my investments, which is a critical component of effective financial planning that can significantly reduce risk and enhance potential returns.

This platform enables me to allocate my assets across various classes, including stocks, bonds, real estate, and alternative investments, helping me to foster a well-rounded portfolio. By spreading my investments across different sectors and asset types, I can mitigate the risks associated with market volatility while capitalizing on numerous growth opportunities.

Strategic asset allocation allows me to adapt to market shifts and align my investments with my risk tolerance and long-term financial goals. Embracing such investment strategies is essential for anyone looking to secure their financial future while maintaining peace of mind amidst economic uncertainties.

3. Tax Advantages

Clients utilizing uDirect IRA Services can fully leverage tax-advantaged retirement accounts, which facilitate tax-deferred growth and support long-term financial objectives. This approach means that as my investments grow within these accounts, I do not incur taxes on the gains until I withdraw the funds during retirement.

I have the option to choose from various account types, such as Traditional IRAs, which offer immediate tax deductions, or Roth IRAs, which allow for tax-free withdrawals in retirement. The flexibility to invest in a diverse range of assets, including real estate and precious metals, further enhances my portfolio while capitalizing on these tax incentives.

Ultimately, these strategies give the power to me to maximize my retirement income, contributing to a more secure financial future.

4. Professional Guidance

At uDirect IRA Services, they provide clients with access to professional guidance from experienced financial advisors, which enhances their investment performance and overall experience.

This support is essential in navigating the complexities of self-directed IRAs, especially when individuals may feel overwhelmed by the numerous investment options available. With expert advisors alongside them, clients are give the power toed to make informed decisions that align with their unique financial goals and risk tolerance.

This personalized approach not only instills confidence in their investment strategies but also aids in optimizing returns, ensuring a more successful and rewarding investment journey. In this dynamic landscape, I understand that professional guidance is invaluable in maximizing the potential of retirement savings.

What Are The Potential Drawbacks Of uDirect IRA Services?

While I recognize that Udirect IRA Services provides several advantages, it is crucial for me to consider the potential drawbacks that may affect my investment experience. These include the possibility of higher fees in comparison to traditional IRAs and a more limited range of investment options.

1. Higher Fees Than Traditional IRAs

One of the notable drawbacks I have identified with uDirect IRA Services is that the fees associated with self-directed IRAs may be higher than those of traditional IRAs, potentially impacting overall investment returns.

For example, traditional IRAs generally follow a straightforward fee schedule that includes minimal maintenance charges. In contrast, the tiered pricing structure often found with self-directed options can introduce additional costs related to transactions, account management, and various asset types. Over time, this discrepancy in account costs can become more pronounced, as even minor fee differences can significantly erode the compounding potential of investments.

Therefore, clients considering Udirect should carefully evaluate how these higher fees might affect their long-term financial growth, particularly when compared to the more predictable fee structure of traditional IRAs, where they might benefit from lower fees and more straightforward investment paths.

2. Limited Investment Options

One potential drawback I have observed is that Udirect IRA may provide limited investment options compared to other self-directed IRAs, which could restrict certain strategies and asset classes for clients.

This limitation can significantly impact investors seeking to diversify their portfolios. With fewer choices available, individuals may struggle to align their investments with their specific risk tolerance or long-term financial objectives. The absence of varied asset classes, such as real estate, commodities, or international equities, can impede their ability to seize market opportunities.

Consequently, clients may face reduced overall investment flexibility, which can limit their potential for growth and adaptation in a constantly evolving financial landscape. Understanding the implications of these constraints is essential for anyone evaluating their retirement investment options.

3. Requires Active Management

As an investor using Udirect IRA Services, I recognize the importance of being prepared for the active management required to effectively oversee my self-directed IRA. This commitment demands both time and a certain level of investor education.

Active management involves making informed investment choices and continuously monitoring my portfolio’s performance while staying updated on market trends. It is crucial for me to understand the rules and regulations governing self-directed IRAs, as a lack of knowledge could lead to costly mistakes. By prioritizing my education as an investor, I can enhance my ability to navigate potential challenges and seize opportunities effectively.

The more I learn about the intricacies of managing my accounts, the better equipped I will be to optimize my investment strategy and work toward my long-term financial goals.

How To Open An Account With Udirect IRA Services?

Opening an account with Udirect IRA Services is a streamlined process that allows me to take control of my retirement accounts with both ease and confidence.

What Do Customers Say About Udirect IRA Services?

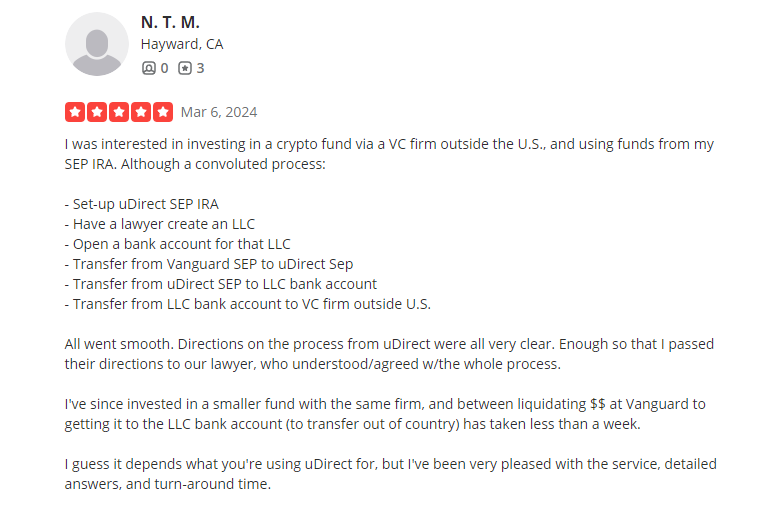

I find that customer reviews and client testimonials offer valuable insights into the user experience with Udirect IRA Services. They not only reflect overall satisfaction but also highlight areas where improvement may be needed.

Is Udirect IRA Services Right For You?

Determining whether Udirect IRA Services is the right choice for me requires a careful evaluation of my investment goals and retirement strategies in relation to the services they offer.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What is Udirect IRA Services Review?

Udirect IRA Services Review is a comprehensive review of the services provided by Udirect IRA, a company that specializes in self-directed Individual Retirement Accounts (IRAs). This review covers all aspects of Udirect IRA, including its features, benefits, and customer satisfaction.

What services does Udirect IRA offer?

Udirect IRA offers self-directed IRAs, which allow you to invest in a wide range of assets, such as real estate, private equity, and precious metals. They also offer account management services, educational resources, and customer support.

How does Udirect IRA compare to other IRA providers?

Udirect IRA is known for its low fees and ease of use, making it a popular choice among self-directed IRA investors. Unlike traditional IRA providers, Udirect IRA allows you to have more control over your investments and offers a wider range of investment options.

What are the benefits of using Udirect IRA?

Some of the main benefits of using Udirect IRA include the ability to diversify your retirement portfolio, tax advantages, and the potential for higher returns on your investments. Additionally, Udirect IRA offers excellent customer service and educational resources for self-directed IRA investors.

Is Udirect IRA suitable for everyone?

Udirect IRA is best suited for individuals who are interested in taking a more hands-on approach to their retirement investments. It may not be the right fit for those looking for a traditional, passive IRA investment. It’s always important to consult with a financial advisor to determine if Udirect IRA is a good fit for your specific financial goals and needs.

How do I get started with Udirect IRA?

To get started with Udirect IRA, you can visit their website and sign up for an account. You will need to provide some personal and financial information, as well as choose the type of self-directed IRA you want. From there, you can fund your account and start investing in the assets of your choice.