If I am exploring options for retirement and investment custodians, Pacific Premier Trust is likely a contender on my list.

This review will provide insights into the operations of Pacific Premier Trust and the range of services it offers, including self-directed IRAs and 401(k) rollovers. Before making a commitment, it is essential to consider the fees associated with their services and take note of the complaints that some clients have raised.

By the end of this article, you will have a clearer understanding of whether Pacific Premier Trust aligns with my financial goals.

What Is Pacific Premier Trust?

Pacific Premier Trust is a reputable financial institution specializing in trust services, investment management, and retirement accounts. Established to offer a variety of account types, their focus is on delivering exceptional trust administration with a strong commitment to transparency and client satisfaction.

As a trust company, they provide a range of financial products designed to secure financial stability and support effective investment strategies. With a dedication to regulatory compliance and fiduciary responsibilities, my goal is to enhance the user experience for all our clients.

How Does Pacific Premier Trust Work?

Pacific Premier Trust operates by providing clients with a streamlined account setup process, allowing them to effectively manage their financial assets and navigate the complexities of investment planning. Clients can easily navigate our intuitive online platform, which offers a range of account types such as traditional IRAs and self-directed accounts. They can also have a clear understanding of the fee structures associated with these accounts.

The company prioritizes transparency in its custodial fees and ensures that clients have efficient withdrawal processes in place, allowing them to access their funds promptly when necessary.

What Are The Services Offered By Pacific Premier Trust?

Pacific Premier Trust offers a wide range of financial services to cater to the unique needs of its clients. These services include asset management, trust services, and retirement planning, ensuring that clients receive a comprehensive suite of solutions.

The user’s focus lies in a range of account types that cater to diverse investment strategies. They prioritize providing their clients with tailored solutions that perfectly match their financial goals.

It is worth mentioning that the user offers self-directed IRAs and alternative asset custody services. These services provide investors with greater flexibility in their investments while ensuring compliance with regulatory requirements.

1. Self-Directed IRA Services

Pacific Premier Trust offers Self-Directed IRA services that empower individuals to have full control over their retirement savings. With these services, individuals gain access to a wide variety of investment options that go beyond the conventional stocks and bonds. With its distinctive account capabilities, this service empowers users to expand their investment horizons and delve into a wide range of options including real estate, precious metals, and private equity. They are motivated to work closely with a financial advisor in order to create personalized investment strategies that match their financial goals.

With self-directed IRAs, the user has the opportunity to explore a wide array of assets, including cryptocurrency, limited partnerships, and tax liens. This grants them the flexibility to innovate their investment approaches. This level of versatility is particularly beneficial, as it allows the user to leverage opportunities outside of conventional markets, potentially leading to higher returns.

In the long run, self-directed accounts often have lower fees than traditional retirement accounts. This can help enhance overall savings over time. By maximizing the benefits, they strategically position their portfolio to work towards achieving long-term financial independence.

2. 401(k) Rollover Services

At Pacific Premier Trust, they offer top-notch 401(k) rollover services. Their team of experts helps clients smoothly move their retirement accounts into self-directed IRAs or other investment vehicles. His objective is to guarantee efficient management of their retirement savings, while also minimizing tax implications and maximizing investment returns. The service provided enables clients to access a wider array of investment options. The assistant strives to ensure a seamless rollover process, assisting individuals in navigating the intricacies of retirement planning.

The process begins with a thorough consultation to gain an understanding of the financial goals of each client and to provide an explanation of the various options that are available. They guides clients through the necessary paperwork, ensuring compliance with IRS regulations to avoid any penalties.

After the funds are transferred, clients are granted access to a wide range of investment options, such as real estate, precious metals, and stocks. This enables them to effectively diversify their portfolios. By offering flexibility, individuals are empowered to shape their financial future and align their investments with their personal values and life stages. This not only enhances potential returns but also gives them greater control over their financial decisions.

3. Alternative Asset Custody Services

Pacific Premier Trust offers alternative asset custody services that allow clients to invest in a wide range of unique assets, including real estate, commodities, and private placements. This approach ensures a diversified portfolio and maintains compliance with regulatory standards. They offer a range of services including asset protection and strategic guidance, allowing clients to effectively navigate the risks associated with non-traditional investments. Our user-friendly online platform allows clients to conveniently access their alternative investments, with a strong emphasis on transparency.

The service offered encompasses a diverse range of asset types, catering to different investment objectives. These include hedge funds, structured products, and digital assets, providing clients with increased flexibility. By aligning with the strategies of each client, the custody solution efficiently manages alternative investments and enhances their protection against market volatility.

Adherence to strict regulatory compliance is a top priority for them. They take great care to secure all client assets in a way that minimizes risks and builds trust in their investment endeavors. With the increasing demand for alternative investments, it is becoming more and more important to efficiently navigate this complex landscape.

4. Escrow Services

They utilize the escrow services offered by Pacific Premier Trust to facilitate secure transactions between parties, enhancing financial security and ensuring that funds are handled appropriately until all contractual obligations are met. This service is especially valuable in real estate transactions and other high-value deals, where effective transaction management is crucial.

When disputes arise, the trust company ensures that all stakeholders involved are protected by providing strong mechanisms for resolving them.

By serving as a neutral third party, these escrow services assist in reducing the risks linked to financial transactions and offer peace of mind to both buyers and sellers. When handling earnest money deposits in home purchases or securing funds in mergers and acquisitions, the service ensures that the funds are not accessible to either party until all conditions specified in the contract are met.

The interests of all parties involved are safeguarded, which helps to foster trust and accountability throughout the process. This, in turn, leads to smoother transactions and greater satisfaction.

5. Private Placements

Pacific Premier Trust’s private placements offer exclusive access to unique investment opportunities that are not available to the general public. These opportunities are tailored for investors who are seeking to diversify their portfolios and explore innovative financial planning strategies. The trust company guides the user through the complexities of private placements, ensuring a thorough understanding of the associated investment risks and potential returns. Strong client relationships are maintained to provide this guidance.

Such placements frequently involve investments in private companies, real estate projects, or other alternative assets. These investments have the potential to generate high returns that are not commonly found in traditional markets. Investments of this nature not only enhance diversification strategies but also provide an opportunity to leverage expertise and risk appetite in a more dynamic manner.

For a comprehensive approach, one must possess a deep understanding and engage in strategic planning. It is crucial to evaluate financial goals, liquidity needs, and the prevailing market conditions in order to make well-informed decisions. By adopting this deliberate approach, private placements can be transformed into valuable components of a well-rounded investment strategy.

What Are The Fees Of Pacific Premier Trust?

I recognize that understanding the fee structure of Pacific Premier Trust is essential for clients who want to maximize their investment returns while minimizing costs.

The trust company offers transparent fee disclosures that detail the various service charges related to account maintenance, custodial fees, and transaction-related fees.

By clearly communicating its fee schedule, Pacific Premier Trust aims to foster trust and transparency in its relationships with clients.

1. Annual Maintenance Fees

Annual maintenance fees are charged at Pacific Premier Trust to ensure the ongoing management and oversight of client accounts, which greatly enhances the overall customer experience. The fees are clearly outlined in the fee structure, ensuring that clients have a comprehensive understanding of their financial commitments and avoiding any surprise costs. By adopting a transparent approach to fee disclosures, trust is fostered and individuals are encouraged to make well-considered choices.

Through the implementation of annual maintenance fees, all accounts are regularly monitored to ensure the safeguarding of assets and minimize the potential for errors. The fee plays a vital role in maintaining account integrity, allowing for efficient allocation of resources for compliance and reporting purposes. The commitment to maintaining high standards of service and security is evident throughout the year.

By gaining a thorough understanding of these fees, clients are empowered to make more informed financial decisions, leading to an improved overall experience with the trust.

2. Transaction Fees

The user acknowledges that transaction fees are applicable at Pacific Premier Trust for every trade or adjustment made to their investment portfolio. The fees are a reflection of the expenses linked to investment management. The trust company ensures that individuals are fully aware of the costs associated with their investments, allowing them to plan their strategies accordingly. Transparency in the fee structure is maintained to provide this information. Open communication is crucial in preventing any potential misunderstandings regarding fees.

The fees can arise from a range of activities, including the buying or selling of securities, transferring assets, and the rebalancing of portfolios. With every transaction, there is a cost that can add up over time and affect overall profitability.

Therefore, understanding the fee structure is crucial for the user, as it allows them to evaluate the benefits of each transaction in relation to the potential fees. By understanding the timing and circumstances under which these fees are relevant, the user can make more informed choices that are in line with their financial objectives. This will help them adopt a more strategic approach to managing their portfolio.

3. Wire Transfer Fees

Wire transfer fees at Pacific Premier Trust are applied as a service charge for fund transfers, guaranteeing clients secure and prompt access to their accounts. The fees reflect the operational expenses associated with processing transactions and ensuring financial security during the transfer process. Clients are encouraged to familiarize themselves with these charges in order to better manage their financial activities.

By having a clear understanding of the circumstances in which these fees are applicable, one is able to better strategize and plan their transfers. Wire transfer fees are commonly charged for both domestic and international transactions. Financial institutions impose these fees to ensure the necessary resources are available for verifying identities and preventing fraud. The charges highlight the significance of having financial security and support systems in place to safeguard personal and sensitive information.

Clients can make informed decisions regarding their transactions by being aware of the costs involved. This allows them to ensure that their funds are transferred securely and efficiently.

4. Account Closing Fees

The account closing fees at Pacific Premier Trust are applied when clients decide to close their accounts. These fees are clearly stated in the fee structure to ensure transparency. Clients have been providing feedback that highlights the significance of having a clear understanding of these fees beforehand, as they have the potential to impact the withdrawal process as a whole. His objective is to ensure a smooth and effortless process for clients who choose to close their accounts.

Understanding how fees are determined is crucial, as they can differ depending on the account type and services used. The fee structure reflects the administrative costs associated with closing an account and also serves as a reminder for clients to carefully consider their financial decisions.

Client reviews frequently highlight the need for more transparency regarding fees, indicating that better communication could greatly improve their overall experience. Hence, the feedback received plays a crucial role in shaping the organization’s policies and enhancing the effectiveness of the withdrawal process. This ensures that clients are adequately informed about any possible costs associated with it.

How to Recognize a Good Gold IRA Company

Investing in a Gold IRA can be a smart move for diversifying your retirement portfolio. However, choosing the right Gold IRA company is crucial for ensuring a successful investment experience. Here’s a comprehensive guide on how to recognize a reliable and trustworthy Gold IRA company.

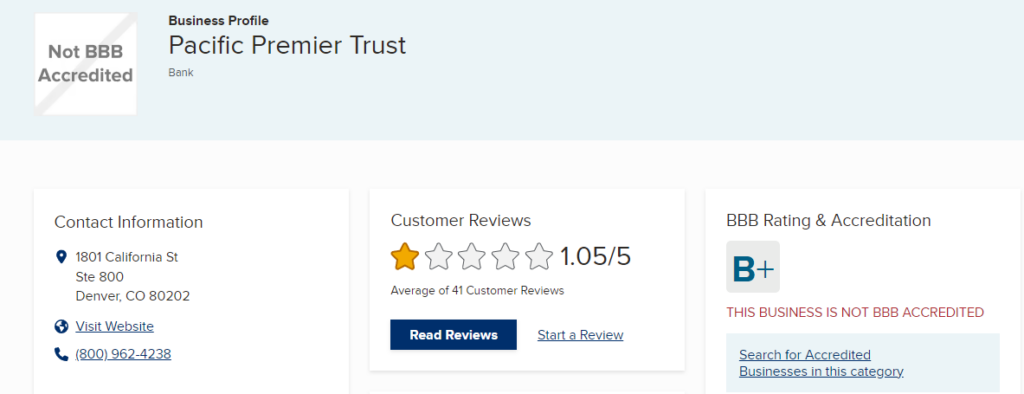

1. Reputation and Reviews

Customer Feedback

Look for reviews and ratings on platforms like Trustpilot, Better Business Bureau (BBB), and Consumer Affairs. Positive customer feedback and high ratings are indicators of a company with a strong reputation.

Industry Recognition

Check if the company has received any awards or recognition from reputable financial institutions or industry associations.

2. Transparency

Fee Structure

A good Gold IRA company should be transparent about its fees, including setup fees, annual custodial fees, storage fees, and any other costs. Avoid companies with hidden charges or unclear pricing.

Pricing

Ensure that the company offers competitive pricing for precious metals and check if they provide a price match guarantee.

3. Range of Products

IRA-Eligible Products

The company should offer a variety of IRA-eligible gold, silver, platinum, and palladium products. Make sure they meet IRS purity standards for inclusion in a Gold IRA.

Diverse Options

Look for a company that offers a range of products to suit different investment strategies and preferences.

4. Educational Resources

Information and Guides

A good company provides educational resources, such as guides, webinars, and articles, to help you understand the benefits and complexities of investing in a Gold IRA.

Consultations

Access to personalized consultations and expert advice is a valuable service that helps you make informed decisions.

5. Customer Service

Support Availability

Assess the availability and responsiveness of the customer service team. A reputable company should offer multiple contact methods, such as phone, email, and live chat.

Proactive Assistance

Look for companies that offer lifetime support and are proactive in addressing customer inquiries and issues.

6. Storage Options

Secure Storage

Ensure the company partners with reputable, IRS-approved depositories for secure storage of your precious metals.

Location Choices

Some companies offer multiple storage locations, both domestically and internationally, allowing you to choose the option that best fits your needs.

7. Buyback Program

Ease of Liquidation

A good Gold IRA company should offer a straightforward and fair buyback program, allowing you to sell your precious metals at market value without excessive fees.

8. Regulatory Compliance

Licensing and Accreditation

Verify that the company is properly licensed and accredited to operate in the precious metals industry.

Compliance with IRS Guidelines

Ensure that the company adheres to IRS regulations for Gold IRAs, including product eligibility and storage requirements.

9. Longevity and Stability

Established History

Companies with a longer track record in the industry are often more reliable. Research how long the company has been in business and its history of customer satisfaction.

By carefully evaluating these factors, you can identify a reputable Gold IRA company that aligns with your investment goals and provides a secure and beneficial experience for managing your precious metals retirement account. Investing wisely today can lead to a more secure financial future tomorrow.

Is Pacific Premier Trust Worth It?

Evaluating whether Pacific Premier Trust is worth my consideration involves assessing the value it provides through its diverse range of services, investment opportunities, and customer support. By analyzing investment returns, custodial fees, and overall client satisfaction, I can determine if the trust aligns with my financial goals. Ultimately, I measure the worth of Pacific Premier Trust by balancing costs against benefits.

Along with these core factors, I believe it’s essential to evaluate the trust’s approach to risk management and how effectively it tailors its services to meet my individual needs. Strong communication and transparency are vital for fostering a trusting relationship, particularly in the complex realm of investments. I find it crucial to assess the variety of investment options available and how they can contribute to my long-term financial security.

The quality of service, including responsiveness and the expertise of customer support professionals, plays a significant role in shaping my overall experience. This, in turn, can lead to more informed investment decisions that enhance my financial outcomes.

How To Post a Pacific Premier Trust Review?

When it comes to posting a Pacific Premier Trust review, you’ll find that the process can be quite straightforward if you have a clear understanding of the necessary steps to take. It is important for you to clearly document your concerns and provide any relevant information that can help in addressing the issue at hand. By following the designated channels for submitting complaints, you can ensure your issues are addressed effectively, reinforcing the company’s commitment to customer relations.

To start, you gather all the necessary documentation, including account statements, correspondence, and specific details related to your issue. You will find this comprehensive collection of data extremely helpful in clearly articulating your concerns during the complaint process.

Afterwards, you can visit the company’s official website or customer service portal to become acquainted with the necessary procedures and timelines for submitting complaints.

Effective communication is crucial. You make an effort to express your concerns in a constructive and polite manner, which increases the chances of reaching a favorable resolution.

You diligently keep track of every interaction regarding your complaint, which is essential for maintaining transparency and accountability during the resolution process.

Frequently Asked Questions

What are the fees associated with a Pacific Premier Trust?

Pacific Premier Trust charges an annual account maintenance fee of $250 per year. In addition, there may be transaction fees or other expenses related to the specific assets held in your account.

How do I connect with Pacific Premier Trust about their fees?

If you have a complaint about the fees charged by Pacific Premier Trust, you can contact their customer service team at 1-800-493-3299. They will work with you to address your concerns and find a resolution.

Are there any hidden fees or charges with Pacific Premier Trust?

No, Pacific Premier Trust is transparent about their fees and charges. All fees are clearly disclosed and can be found in the account agreement and fee schedule.

What if I am not satisfied with the service provided by Pacific Premier Trust?

If you are not satisfied with the service provided by Pacific Premier Trust, you can submit a formal complaint through their website or by contacting their customer service team. They will work with you to address your concerns and find a resolution.

How can I avoid paying unnecessary fees with Pacific Premier Trust?

To avoid unnecessary fees with Pacific Premier Trust, it is important to carefully review the fee schedule and account agreement. Additionally, regularly monitoring your account and staying in communication with your account manager can help you avoid unexpected fees.

What is Pacific Premier Trust’s policy on fee refunds?

Pacific Premier Trust’s policy on fee refunds varies depending on the specific circumstances of the refund request. It is best to contact their customer service team to discuss your situation and see if a refund may be possible.

Pacific Premier Trust

Is Pacific Premier Trust a reliable investment company? Find out the answer in this detailed Pacific Premier Trust review.

Product In-Stock: InStock

4