If I am considering investing in precious metals, Reagan Gold Group is likely to be a significant option on my radar. This company provides a range of services, including gold and silver IRA rollovers, bullion sales, and secure storage options.

With an experienced team and a diverse selection of products, Reagan Gold Group aims to assist investors in navigating the complexities of precious metal investments. As with any investment, it is important to be aware of the potential risks involved.

This article will delve into the services they offer, the benefits of partnering with them, and how to get started on this investment journey.

What Is Reagan Gold Group?

Reagan Gold Group is a well-respected gold investment company that is committed to helping investors diversify their portfolios and protect their wealth by facilitating the purchase of precious metals, including gold and silver.

With a strong focus on educating investors, the company aims to offer clear and open information regarding the benefits of gold IRAs and their potential integration into retirement planning.

Understanding the complexities of IRS regulations and the current economic landscape is crucial for our clients. Through the sharing of their company history, the company has established itself as a reputable presence in the gold market, providing a dependable choice for individuals looking to safeguard their assets during periods of market instability.

What Services Does Reagan Gold Group Offer?

Reagan Gold Group offers a comprehensive range of services that assist clients in navigating the complexities of gold and silver investments. Specialized services such as gold IRA rollovers and the sale of gold and silver bullion are offered.

The client’s focus on storing precious metals guarantees a secure way to protect their investments. Furthermore, the assistant offers investment advice that provides valuable insights into market trends and diversification strategies, all customized to align with the user’s financial goals.

1. Gold and Silver IRA Rollovers

They offer gold and silver IRA rollovers as a service through Reagan Gold Group, enabling investors to transfer their retirement savings from traditional IRAs or 401(k) plans into a gold or silver-backed IRA. This strategy provides both diversification and protection against inflation.

The process begins with a thorough assessment of the current retirement account and a clear understanding of the investor’s specific goals. Typically, individuals consult with a financial advisor who specializes in precious metals to initiate this process. The advisor guides the investor through the necessary paperwork for a seamless transition, ensuring full compliance with IRS regulations.

Once the rollover is executed, the assets are allocated into approved gold or silver products, which can offer significant tax benefits, including tax-deferred growth.

These rollovers serve as a protective measure against market fluctuations, as precious metals tend to maintain their value during economic downturns. This makes them an appealing option for those seeking to safeguard their retirement savings.

2. Gold and Silver Bullion Sales

They specialize in the sales of gold bullion and silver coins at Reagan Gold Group, providing investors with a diverse range of high-quality precious metal products that serve as tangible assets for capital preservation and investment diversification.

Their offerings include popular gold bullion bars and exquisite silver coins, each with unique advantages tailored to various investment strategies. For instance, gold bullion is often preferred for its liquidity and stability, serving as a reliable safe haven during times of economic uncertainty. Conversely, silver coins offer a more accessible entry into the precious metals market.

It is essential for potential buyers to understand current gold prices, as fluctuations driven by market dynamics—such as geopolitical tensions and inflation rates—can significantly affect their purchasing decisions. Therefore, I encourage investors to stay informed about these trends to maximize their investment potential.

3. Precious Metals Storage

The precious metals storage service offered by Reagan Gold Group allows me to securely store my gold and silver assets in a safe, monitored environment, providing peace of mind and protection against theft or loss.

This aspect is particularly vital for individuals investing in gold IRAs, as the integrity of these precious metals directly affects both their value and compliance with IRS regulations. I have the flexibility to choose from various storage options, including private vaults and insured depositories, all crafted to meet the stringent requirements established by the IRS.

Each facility is equipped with advanced security measures, such as 24/7 surveillance and controlled access, ensuring that my assets remain secure. By utilizing these secure storage solutions, I not only enhance my investment performance but also strengthen my overall confidence in my financial future.

4. Numismatic Coins

At Reagan Gold Group, I have the opportunity to explore a selection of numismatic coins. These coins are often sought after for their collectability and potential appreciation in value, making them a distinctive component of an investment strategy focused on wealth preservation.

While I appreciate that numismatic coins are valued for their rarity and historical significance, I recognize that bullion primarily derives its worth from its metal content, such as gold or silver. The market value of numismatic coins is influenced by factors including demand among collectors, the condition of the coins, and their historical context, whereas bullion pricing is primarily dictated by current market rates.

As an investor, I can effectively incorporate both numismatic coins and bullion into my diversification strategies, allowing me to balance tangible assets with the potential for appreciation. Historical trends indicate that numismatic coins have often outperformed bullion in value during economic downturns, highlighting their role as a hedge against inflation and market volatility.

5. Gold and Silver Investment Advice

At Reagan Gold Group, the investment advice provided is meticulously customized to cater to the distinct requirements of every client. They offer expert insights and guidance, drawing from their experience as a seasoned financial advisor to help navigate the complexities of gold and silver investments, particularly during periods of market volatility.

The personalized approach employed by the user not only enhances their clients’ understanding of diverse assets but also plays a pivotal role in shaping effective retirement strategies. The assistant helps clients by guiding them through different investment options, including mutual funds and exchange-traded funds. They make sure that clients have a clear understanding of the potential risks and rewards that come with each type of investment.

Through conducting thorough risk assessments, the user empowers their clients to make well-informed decisions that are in line with their long-term financial goals. Ultimately, the education and personalized guidance provided are crucial for individuals who aspire to create a stable financial future, instilling them with a sense of confidence as they work towards their retirement objectives.

Here are some prominent Regan Gold Group alternatives:

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Are the Benefits of Working with Reagan Gold Group?

Partnering with Reagan Gold Group offers numerous advantages for investors looking to bolster their retirement savings through precious metal investments. I appreciate the exceptional customer service, the diverse range of products available, and the company’s solid reputation for transparency and trustworthiness within the industry.

1. Experienced and Knowledgeable Staff

At Reagan Gold Group, they take pride in being part of an experienced and knowledgeable team that is fully committed to providing clients with the highest level of investment advice and support. The commitment of this company is evident in the many positive testimonials they receive and the high satisfaction rates reported by their clients.

The dedication of the company extends beyond mere transactions. The expertise possessed by the company is considered crucial in educating clients about the intricate nature of gold and silver investments. Through a focus on financial literacy, clients are empowered to take an active role in their investment journeys, enabling them to make well-informed decisions instead of adopting a passive approach. Consistent communication plays a crucial role in establishing trust, as regular updates and personalized guidance empower clients to navigate the dynamic market with assurance.

Through a focus on education and support, the assistant aims to assist clients in understanding the immediate benefits and long-term potential of their investments.

2. Wide Selection of Gold and Silver Products

I appreciate the extensive selection of gold and silver products offered by Reagan Gold Group, which includes bullion, coins, and other precious metals. This variety provides me with multiple investment options that can be tailored to fit my unique financial strategies and goals.

The diverse offerings range from popular gold coins like American Eagles and Canadian Maple Leafs to high-purity silver bullion bars. Each product serves distinct purposes: while I find that bullion is ideal for straightforward asset accumulation, collectible coins appeal to my aesthetic sensibilities and investment potential.

I can select items based on my risk tolerance and market predictions, which allows me to create a balanced portfolio. By investing in these tangible assets, I can better safeguard my wealth against economic fluctuations, ultimately aligning my assets with long-term financial stability and resilience.

3. Secure Storage Options

The secure storage options offered at Reagan Gold Group are essential for protecting investments. They allow clients to store their precious metals in a secure environment while also ensuring easy access for potential liquidation, maintaining liquidity when necessary.

These storage solutions come with comprehensive insurance coverage, which safeguards against unforeseen events that could threaten the value of the investment. I have implemented continuous monitoring systems to provide an additional layer of safety, ensuring that the stored assets remain secure at all times.

By utilizing these protective measures, clients can have peace of mind, knowing that their valuable holdings are not only well-protected but also easily convertible into cash if market conditions favor a strategic sell. This seamless access to their investments enhances their overall strategy and fosters greater confidence in their asset management approach.

4. Competitive Prices

I appreciate the competitive pricing offered by Reagan Gold Group for gold and silver investments, which ensures that I receive optimal value for my purchases based on current market trends while minimizing transaction fees.

By continuously monitoring fluctuations in gold prices and utilizing comprehensive market analysis, Reagan Gold Group positions itself to provide attractive deals that not only appeal to investors but also build trust with clients like myself. This strategic approach allows the company to remain flexible, adjusting prices in real-time to reflect current conditions while maintaining a commitment to long-term value.

Ultimately, the pricing strategy employed by Reagan Gold Group significantly enhances overall investment returns. With lower costs associated with acquisitions, I can maximize my gains, ultimately translating to more gold per dollar spent compared to competitors in the market.

What Are the Potential Risks of Working with Reagan Gold Group?

While I appreciate the many benefits that Reagan Gold Group offers to investors, it is crucial to remain mindful of potential risks. These include the limited availability of certain products and the inherent price fluctuations in the precious metals market, which can significantly impact investment performance.

1. Limited Availability of Some Products

One potential risk I face when working with Reagan Gold Group is the limited availability of certain gold assets and coins. This limitation can impact my purchasing decisions and may require me to act swiftly to secure my desired investments.

Market fluctuations and supply chain disruptions often play a significant role in determining the accessibility of various precious metals. As scarcity increases due to geopolitical tensions, regulatory changes, or shifts in consumer demand, I may find that my options are significantly constrained.

This reality underscores the importance of timing; waiting too long to make a purchase could lead to higher prices or even missed opportunities. By understanding these dynamics, I can adopt a more informed approach to strategizing asset acquisition, allowing me to navigate these challenges effectively as a savvy investor.

2. Potential for Price Fluctuations

One significant risk I encounter when investing in precious metals through Reagan Gold Group is the potential for price fluctuations, which can greatly affect investment performance and necessitate careful risk assessment.

These fluctuations are often driven by market volatility, which can arise from geopolitical tensions, changes in interest rates, or unexpected economic news. During times of uncertainty in the financial landscape, I notice that many investors turn to gold and silver as safe havens, resulting in increased demand and, subsequently, higher prices. Conversely, when economic stability is perceived, metals prices may decline.

To navigate these unpredictable shifts, I prioritize proactive strategies, such as diversifying across various assets and implementing stop-loss orders. These approaches help cushion my overall investment portfolio against potential risks.

How Can Someone Get Started with Reagan Gold Group?

Initiating my journey with Reagan Gold Group is a simple and efficient process. I begin by reaching out to their knowledgeable team to discuss my investment goals.

Following this conversation, I proceed to set up my account, which grants me access to a diverse range of investment options in gold and silver.

1. Contact Reagan Gold Group

The first step I take to get started with Reagan Gold Group is to contact their customer service team. During this initial interaction, I can schedule a consultation to discuss my investment goals and learn more about the services they offer.

Reagan Gold Group places significant value on this first conversation, as it establishes a solid foundation for a successful investment journey.

The company also maintains a user-friendly website, allowing me to fill out a contact form or engage with their informative social media platforms, such as Facebook and Twitter. This diverse range of communication options reflects their commitment to providing accessible support and guidance as I navigate the complex landscape of gold investment.

2. Consultation and Account Setup

During my consultation with Reagan Gold Group, they provide clients with personalized guidance on account setup, enabling them to align their investment strategies with their long-term financial planning and retirement goals.

This comprehensive consultation process includes detailed discussions on several essential topics, such as evaluating the client’s current financial status and future needs. Clients can expect to participate in thorough risk assessments to better understand their risk tolerance and market exposure.

They offer insights into selecting appropriate investment options for gold IRAs or other precious metals, ensuring that each choice aligns with their overall financial objectives. By examining market trends alongside individual circumstances, clients are enabled to make informed decisions, ultimately paving the way for a more secure financial future.

3. Purchase and Storage of Precious Metals

After completing the consultation and setting up the account, they guide clients through the process of purchasing precious metals with Reagan Gold Group. They provide options for secure storage that not only protect their investments but also ensure they remain easily accessible.

During the purchasing process, clients can take advantage of a variety of transaction methods specifically designed to maximize both security and ease of use. It is crucial for clients to select storage solutions that comply with IRS regulations, as this ensures their assets are protected within a tax-advantaged account.

Clients have the option of choosing segregated storage, where their metals are stored separately from those of other investors, or utilizing reputable vault facilities equipped with advanced security systems. This meticulous focus on storage not only safeguards precious metals but also provides clients with peace of mind, allowing them to concentrate on growing their investments while adhering to legal requirements.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What is Reagan Gold Group Review?

Reagan Gold Group Review is a comprehensive evaluation and analysis of the Reagan Gold Group, a company that specializes in precious metals investment and retirement planning.

Why should I read the Reagan Gold Group Review?

Reading the Reagan Gold Group Review can help you make an informed decision about whether or not to work with the company for your precious metals investment and retirement planning needs.

Is the Reagan Gold Group Review unbiased?

Yes, the Reagan Gold Group Review is an objective and unbiased assessment of the company, based on research and analysis of its services, customer reviews, and industry standards.

What information does the Reagan Gold Group Review provide?

The Reagan Gold Group Review covers various aspects of the company, including its history, services, fees, customer reviews, and overall industry reputation.

Is the Reagan Gold Group Review regularly updated?

Yes, the Reagan Gold Group Review is regularly updated to ensure that the information presented is current and reflective of the company’s latest practices and customer feedback.

How can I use the Reagan Gold Group Review to make a decision?

You can use the Reagan Gold Group Review to compare the company’s services, fees, and reputation with other precious metals investment companies, and ultimately make an informed decision that best suits your needs and goals.

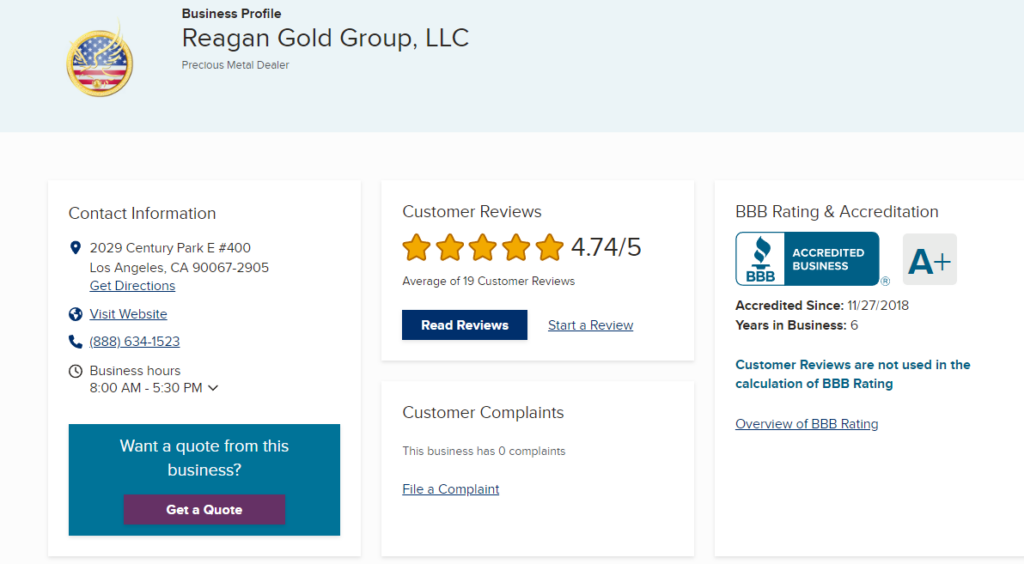

Reagan Gold Group

Is Reagan Gold Group a legit precious metals company? What are their pros and cons? Find out the answer in this Reagan Gold Group review.

Product In-Stock: InStock

3.8