When exploring options for managing my retirement savings, I find that Advanta IRA offers a comprehensive range of services designed to provide me with greater control over my financial future.

With offerings that include self-directed IRAs, 401(k) rollovers, and specialized health and education savings accounts, Advanta IRA equips me with the necessary tools to diversify my investment portfolio.

This article provides a breakdown of the key services offered, their benefits, associated fees, safety measures, and a step-by-step guide to opening an account. With this information at hand, I can make informed decisions about my retirement planning.

What Services Does Advanta IRA Offer?

At Advanta IRA, they take pride in offering a comprehensive suite of custodial services designed to meet the diverse needs of their clients. My primary focus is on self-directed IRAs, which allow individuals to maintain complete control over their retirement accounts.

This flexibility enables investors to select from a wide array of investment options, including real estate, gold IRAs, and other alternative investments. I strive to make the account setup process straightforward, ensuring a seamless experience from the beginning.

Additionally, they prioritize regulatory compliance and provide ongoing account management to assist clients in navigating the complexities of retirement planning.

1. Self-Directed IRA Services

At Advanta IRA, their self-directed IRA services give the power to me to make informed decisions about my retirement accounts. I have access to a diverse range of investment options, allowing me to tailor my portfolio to align with my specific retirement goals.

This flexibility enables me to explore various asset classes, including real estate and precious metals, thereby enhancing the potential for long-term growth. The tax benefits associated with self-directed IRAs are substantial, as they allow for tax-deferred growth, which can contribute to a more robust retirement fund.

I appreciate the transparency of the fees and account features, which provides me with peace of mind as I navigate my investment strategies. By prioritizing client satisfaction, Advanta IRA equips me with the knowledge and support necessary to ensure that my unique vision for retirement is met with tailored guidance.

2. 401(k) Rollover Services

They offer 401(k) rollover services at Advanta IRA, providing a seamless transition from former employer retirement accounts to a self-directed IRA. This transition enabled me to have greater control over my investment strategies. By rolling over my 401(k), I can explore a broader range of investment options that align with my retirement goals.

The rollover process allowed me to transfer my funds without incurring penalties, maintaining the tax-deferred status of my savings. With a self-directed IRA, I am give the power toed to diversify my portfolio beyond traditional stocks and bonds. This means I can engage in real estate investments, precious metals, private equity, and more, enhancing my retirement account management.

This flexibility not only promotes personalized retirement planning but also opens doors to potentially higher returns. By taking advantage of these diverse opportunities, I can strategically work towards achieving a more secure financial future, making informed decisions that resonate with my unique investment philosophy.

3. Health Savings Account (HSA) Services

With Advanta IRA’s Health Savings Account (HSA) services, they enable individuals to save for medical expenses while taking advantage of various tax benefits. An HSA can effectively complement a retirement savings strategy by offering additional flexibility and investment options.

These accounts assist individuals in budgeting for current healthcare costs and provide a tax-free growth opportunity for future expenses. Contributions made to HSAs are tax-deductible, and any interest or investment earnings within the account grow tax-free. Moreover, when funds are utilized for qualified medical expenses, withdrawals are also tax-free, making HSAs a powerful tool with triple tax advantages.

Individuals have the option to choose from a variety of investment vehicles, including cash holdings, stocks, bonds, and mutual funds, allowing for tailored financial growth based on their unique needs. By understanding the different types of HSAs available, individuals can enhance their financial planning, ensuring they maximize these benefits as part of a comprehensive approach to their overall financial health.

4. Education Savings Account (ESA) Services

They provide robust Education Savings Account (ESA) services designed to assist families in saving for educational expenses while benefiting from tax-deferred growth. My ESAs offer a variety of investment options to maximize savings potential.

This flexibility in investment choices allows individuals to select assets that align with their financial goals, whether they prefer stocks, bonds, or even real estate. By leveraging tax-deferred growth, you can significantly enhance my savings, enabling my funds to grow without the immediate burden of taxes.

This strategy is particularly valuable for those anticipating future educational costs, as effective financial planning can make a substantial difference in managing those expenses. Ultimately, with personalized strategies and diverse investment paths, ESAs give the power to me to take control of my educational funding journey.

5. Coverdell Education Savings Account (CESA) Services

At Advanta IRA, they also offer the Coverdell Education Savings Account (CESA), which enables families to save for qualified education expenses while enjoying unique tax benefits. This account type provides a diverse range of investment options, facilitating financial independence in education funding.

With a CESA, you can contribute up to $2,000 annually per beneficiary, which significantly alleviates the financial burden of education over the years. One of the most compelling features is the tax-free growth on investments, along with tax-free withdrawals for qualified expenses such as tuition, books, and certain K-12 education costs.

Families have the flexibility to explore various investment vehicles, including stocks, bonds, mutual funds, and even real estate. This makes CESA a versatile choice within the broader context of retirement and education planning. Whether you are looking to fund higher education or support younger students, integrating a CESA into a comprehensive financial strategy can maximize asset growth while minimizing tax implications.

What Are the Benefits of Using Advanta IRA?

Utilizing Advanta IRA for my retirement planning offers numerous benefits that enhance my financial security and investment performance. One of the most significant advantages is the access to a diverse range of investment options that extend beyond traditional assets.

This flexibility allows me to implement personalized investment strategies tailored to my individual retirement goals.

1. Greater Investment Options

One of the standout features of Advanta IRA is the extensive range of investment options they offer to their clients, allowing for substantial asset diversity. From traditional investments such as mutual funds to alternative options like real estate and gold IRAs, the possibilities are extensive.

This variety enables individuals to tailor their retirement portfolios according to their specific financial goals and risk tolerance. By incorporating alternative investments, such as private equity or cryptocurrency, Advanta can help clients enhance their portfolios with assets that often behave differently than those driven by the stock market. This balance not only mitigates risk but also capitalizes on various market trends, ultimately fostering a more resilient retirement strategy.

The guidance they provide at Advanta IRA enables investors to make informed decisions, ensuring they understand the potential rewards and challenges associated with each investment type.

2. Tax Advantages

I appreciate the significant tax advantages that Advanta IRA offers, which are essential for maximizing the growth of my retirement accounts. The options available provide tax-deferred growth and favorable treatment of capital gains, allowing me to retain more of my hard-earned money.

Specifically, traditional IRAs enable me to contribute pre-tax income, effectively lowering my taxable income during the contribution years while the funds grow tax-deferred until withdrawal. On the other hand, Roth IRAs provide the benefit of tax-free withdrawals in retirement, which is a substantial advantage for anyone anticipating higher tax rates in the future.

By incorporating these account types into a comprehensive retirement planning strategy, I can effectively manage my taxable income now or enjoy tax-free income later, ultimately providing flexibility and security for my financial future.

3. Control Over Investment Decisions

At Advanta IRA, I appreciate the unparalleled control I have over my investment decisions, which is a key feature that sets our service offerings apart. Our self-directed accounts give the power to me to make choices that align with my unique financial objectives and risk tolerance, backed by comprehensive investor resources.

This level of autonomy not only enhances my portfolio management but also significantly supports my retirement goals. By staying informed about market trends and utilizing educational tools, I can navigate my investment landscape more effectively.

I have access to resources such as personalized consultations, webinars, and extensive research materials, which ensure that I remain well-informed and confident in my strategies. This proactive approach to investment discipline helps me develop a deeper understanding of various asset classes and their potential impacts, allowing for a more strategic alignment with my long-term financial aspirations.

4. Ability to Diversify Retirement Portfolio

At Advanta IRA, they enable clients to effectively diversify their retirement portfolios, which helps reduce investment risks while enhancing the potential for returns. With access to a broad range of investment vehicles, they assist clients in implementing sound asset allocation strategies tailored to their individual financial planning needs.

This approach is essential in today’s unpredictable financial landscape, as relying solely on one type of investment can expose clients to significant market volatility. By incorporating a mix of traditional assets like stocks and bonds along with alternative options such as real estate and commodities, individuals can build a more resilient portfolio.

Diversification not only mitigates risk but also creates opportunities for growth across various sectors, leading to a more balanced and stable retirement strategy. By adopting this investment philosophy, clients can significantly enhance their potential returns, ultimately contributing to a more secure financial future.

What Are the Fees Associated with Advanta IRA?

Understanding the fees associated with Advanta IRA is crucial for effective financial management and planning. I ensure that our fee structure is transparent, allowing clients to make informed decisions about their investment options and account types.

1. Account Establishment Fee

The account establishment fee at Advanta IRA is a one-time charge that I find vital for the setup of my retirement account, ensuring a seamless onboarding experience. This fee varies based on the type of account I select.

It includes essential services such as account verification, document preparation, and access to customer support, all designed to create a smooth initiation process. By investing in a well-structured setup, I can expect a more streamlined interaction with my chosen retirement plans.

Understanding the purpose of these fees enhances my awareness and underscores the commitment to providing comprehensive support. Clear communication about these fees fosters trust, reinforcing the value of a transparent partnership between Advanta IRA and myself, promoting long-term relationships grounded in clarity and confidence.

2. Annual Maintenance Fee

They charge an annual maintenance fee at Advanta IRA, which supports ongoing account management and custodial services. This fee is structured to ensure that they provide clients with the highest level of service as they navigate their investment journeys.

By paying this fee, clients gain access to a variety of valuable services that significantly enhance their investment experience. These services include personalized account management, dedicated support staff, and educational resources that give the power to clients to make informed decisions about their portfolios.

The fee covers essential aspects such as compliance monitoring, reporting, and transaction facilitation, all of which are crucial for effective investment management. Ultimately, the annual maintenance fee represents not just a cost, but an investment in the professional support and infrastructure that clients require to confidently navigate the complex landscape of alternative investments.

3. Transaction Fees

At Advanta IRA, transaction fees are applied to each investment purchase or sale, ensuring that the costs are aligned with the services provided. Understanding these fees is essential for evaluating my overall investment performance and returns.

Typically, these fees are calculated as either a fixed amount or a percentage of the transaction value, depending on the investment type. For me, this means that every buy or sell order incurs a cost that, while it may seem minor at first, can accumulate significantly over time.

By being aware of these fees, I can accurately assess my net gains, as high transaction costs can erode potential profits. This understanding is crucial for effective financial planning, enabling me to make informed decisions about my investment strategy to enhance my overall financial outcome.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

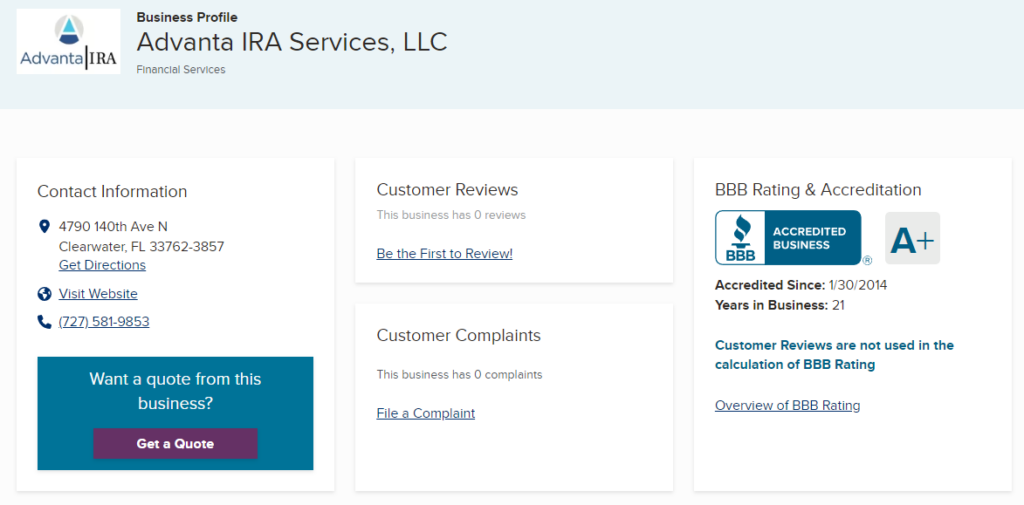

Is Advanta IRA Safe and Legitimate?

At Advanta IRA, they prioritize safety and legitimacy, ensuring that the clients can invest with complete confidence.

They implement robust security measures and adhere to strict regulatory compliance standards to safeguard the clients’ assets and personal information.

1. Security Measures

They employ advanced security measures to safeguard client accounts, ensuring that all transactions are conducted securely and efficiently. Their commitment to account security is demonstrated through rigorous protocols and transparent communication with clients.

They utilize data encryption to protect sensitive information and provide secure online platforms that create a safe environment for account management. Prioritizing the safety of the clients is essential.

Additionally, they have implemented robust client verification processes to guarantee that only authorized individuals can access personal accounts. These multi-layered security protocols not only protect against unauthorized access but also enhance customer confidence in the services they offer.

Ultimately, this unwavering focus on security is vital for fostering overall customer satisfaction, allowing clients to engage with their accounts with the assurance that their investments are well-protected.

2. Regulatory Compliance

At Advanta IRA, they prioritize regulatory compliance to ensure they meet industry standards for account management and custodial services. Adhering to these regulations is essential for maintaining the trust of our clients and safeguarding the integrity of their investments.

By strictly following IRS regulations and implementing industry best practices, they not only protect client assets but also create a transparent and secure investment environment. This unwavering commitment to compliance reinforces the legitimacy of the services they provide, enabling clients to navigate their investment journeys with confidence.

Maintaining robust compliance frameworks helps mitigate the risks associated with non-compliance, allowing clients to focus on growing their portfolios without unnecessary concern about regulatory issues. A strong compliance program is central to their mission at Advanta IRA, where they strive to deliver reliable and trustworthy custodial services.

3. Reputation and Customer Reviews

The reputation of Advanta IRA is reinforced by a wealth of positive customer reviews and client testimonials that showcase their commitment to service excellence and client satisfaction. They encourage potential clients to explore the insights shared by their existing clients.

These testimonials not only reflect the trust clients place in the company but also highlight the seamless experiences they have while navigating their financial journeys. Satisfied clients frequently commend their knowledgeable staff, who are always ready to assist, ensuring that each interaction transcends mere transactions and focuses on building meaningful relationships.

This commitment to service excellence is evident in their prompt resolution of inquiries and the personalized attention provided at every stage. Ultimately, this fosters a community where financial goals are met with confidence and ease. Such positive feedback underscores the crucial importance of maintaining a strong reputation in the highly competitive financial services landscape.

How Do I Open an Account with Advanta IRA?

Opening an account with Advanta IRA is a straightforward process that is specifically designed to empower investors to take charge of my financial future.

Whether I am looking to establish a self-directed IRA or roll over my 401(k), I find the application process to be user-friendly and efficient.

1. Determine Eligibility

Determining eligibility is the initial step in my process of opening an account with Advanta IRA, as it ensures that I select the right account types that align with my financial planning goals.

I find it essential to thoroughly explore the various criteria that each account type requires, as these specifications can significantly influence my investment strategy. From self-directed IRAs that offer extensive freedom in asset choices to specialized accounts designed for alternative investments, understanding the eligibility guidelines is crucial.

Given that each individual’s financial situation and retirement aspirations can differ greatly, I recognize that choosing an account that aligns with my personal objectives can ultimately enhance my growth potential. Whether my focus is on retirement savings, tax advantages, or diversifying my portfolio, aligning eligibility criteria with my financial targets can set the foundation for a successful investing journey.

2. Complete Application

Completing the application to open an account with Advanta IRA is a straightforward process that I find enhances user experience while capturing the essential information needed for account setup.

The application requires my personal details, such as identification, contact information, and financial background, to ensure compliance with regulatory standards. To facilitate seamless interactions, Advanta IRA provides multiple channels for submission, including an intuitive online form, downloadable PDFs, and direct assistance through customer support.

By prioritizing user-friendly design and clear instructions, Advanta IRA makes the entire process smooth and efficient, allowing me to focus on my investment goals without unnecessary hassle.

3. Fund the Account

Funding my account with Advanta IRA is a crucial step that allows me to explore a variety of investment options tailored to my retirement goals. I find the process to be both secure and user-friendly.

Once the account is established, I can easily facilitate funding through several methods, such as wire transfers and ACH deposits, which provide quick access to my funds. Rolling over funds from an existing retirement account presents a strategic opportunity to enhance my investment options without incurring immediate tax implications.

These various funding methods ensure that my account is adequately capitalized while emphasizing the importance of diligent account management. By consistently monitoring and adjusting my investments as needed, I can optimize potential returns and align them with my long-term financial objectives.

Therefore, understanding these funding options is essential for anyone, including myself, who aims to maximize their retirement planning effectively.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What is bullion?

Bullion refers to gold and silver that is officially recognized as being at least 99.5% pure for gold and 99.9% pure for silver, typically in the form of bars, ingots, and coins.

Is gold bullion subject to VAT?

Investment gold is not subject to VAT throughout the EU, including all gold bullion bars and coins purchased in the UK and EU.

Why is the gold price above the current spot price?

The price for physical bullion products is typically higher than the spot price due to costs associated with minting, manufacturing, refining, brokerage fees, transportation, insurance, and storage.

Are bullion coins exempt from Capital Gains Tax (CGT)?

In some jurisdictions, coins produced by national mints with a face value may be exempt from CGT. For example, in the UK, any coin produced by The Royal Mint with a face value is CGT-free.

What is the delivery process for bullion purchases?

Reputable dealers typically provide updates on the delivery date and supply a unique tracking number. All orders should be fully insured for the buyer’s peace of mind.

How can I ensure the legitimacy of a bullion dealer?

When considering a bullion dealer, it’s important to research their reputation and business practices. Legitimate dealers usually have a physical address, clear pricing policies, and verifiable credentials. Be cautious of dealers offering prices significantly below market value, as this can be a red flag for potential scams.

What should I look for in a bullion trading platform?

Look for platforms that offer competitive pricing, secure storage options, and transparent fee structures. Some platforms allow users to access professional market spreads and potentially earn from providing liquidity.

How is bullion stored securely?

Many bullion dealers and platforms offer secure storage options in professional vaults. These storage solutions typically include secure, insured vaults in multiple international locations.

How does Advanta IRA compare to other self-directed IRA custodians?

Advanta IRA is known for its exceptional customer service, low fees, and wide range of investment options, making it a top choice among self-directed IRA investors.

Can I rollover my current IRA to Advanta IRA?

Yes, you can rollover your current IRA to Advanta IRA without incurring any taxes or penalties. This process can be completed quickly and easily with the help of Advanta IRA’s knowledgeable staff.

What types of investments can I make with Advanta IRA?

With Advanta IRA, you can invest in a variety of alternative assets, such as real estate, private equity, cryptocurrency, and more. However, certain restrictions and guidelines do apply, so it is important to consult with an Advanta IRA representative before making any investment decisions.

What are the fees associated with Advanta IRA?

Advanta IRA has a transparent fee schedule, with all fees clearly outlined on their website. They are known for their low fees and do not charge any transaction or asset-based fees.

Advanta IRA

Is Advanta IRA a reliable self-directed IRA provider? What are their fees? Find out the answer in this detailed Advanta IRA review.

Product In-Stock: InStock

4