In today’s ever-changing financial landscape, I’ve found that investing in precious metals is a solid way to safeguard my wealth and diversify my portfolio.

Capital Coin and Bullion really stands out to me as a key player in this space, offering a variety of services that make buying, selling, and storing precious metals a breeze.

From gold and silver to platinum and palladium, I’m diving into what Capital Coin and Bullion has to offer, along with the benefits and risks involved. I’m also figuring out how these precious metals can fit into my investment strategy.

Whether I’m a seasoned investor or just starting out, understanding the value of precious metals seems like it could be the key to my financial security.

What is Capital Coin and Bullion?

I’ve found that Capital Coin and Bullion is a top-notch online dealer when it comes to trading precious metals like gold and silver. They really cater to everyone, whether you’re a seasoned investor or just starting out.

What I appreciate most is their strong focus on customer service; they offer a bunch of services to help people diversify their investment portfolios with secure and authentic bullion and rare coins.

In a market where economic trends are always changing, I’ve noticed that investing in physical assets like bullion is becoming a go-to strategy for preserving wealth.

What Services Does Capital Coin and Bullion Offer?

Capital Coin and Bullion really have my back when it comes to navigating the world of precious metal investing. They offer a bunch of services that help me get the tools and resources I need for successful trading and managing my assets.

Whether it’s personalized investment strategies or a detailed buyer’s guide, they focus on making my experience top-notch while providing solid financial planning support. I appreciate their commitment to customer service, as it means I can get tailored financial advice and insights into market trends, allowing me to make informed decisions.

1. Buying and Selling Precious Metals

When I buy or sell precious metals at Capital Coin and Bullion, the whole process feels smooth and hassle-free. Whether I’m looking to snag some gold bullion, silver coins, or rare collectibles, I appreciate that they offer competitive pricing and genuine products.

It’s reassuring to know that each transaction aligns with current market rates and economic indicators. They really help me navigate the ins and outs of commodity trading, making it easier to understand the liquidity of my investments.

They don’t just stop at the basics; I get the lowdown on any transaction fees that might pop up during my purchases or sales, which helps me plan my investments much better. Plus, the shipping options are tailored to ensure my valuable assets are safe and arrive on time.

I can’t stress enough how important authenticity is to them—there’s a rigorous coin grading process that keeps quality assurance in check.

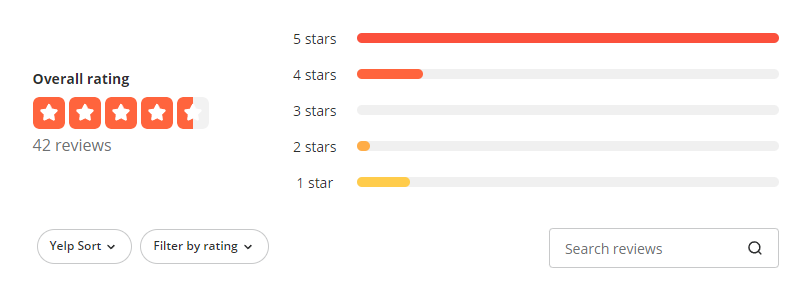

I love that they constantly analyze market trends, which helps me make informed decisions. And the testimonials from happy customers really highlight how reliable and transparent their service is, reinforcing my trust in this platform for all my precious metal transactions.

2. Storage and Safekeeping

Regarding storing and safeguarding precious metals, I really appreciate what Capital Coin and Bullion has to offer. They provide secure storage options that focus on keeping my investments safe and sound. Knowing the potential risks tied to physical assets, they offer insured storage solutions that meet industry standards and regulations. It’s a relief to know that my gold and silver bullion is protected against theft and damage, all while I can still easily access my assets when I need to.

In today’s financial climate, where the market can feel like a rollercoaster ride, picking the right storage solution is more important than ever. There are various options out there, from secure vaults to private safe deposit boxes, and they each come with different costs and accessibility levels. I have to think about insurance costs too, which can vary based on the value and type of metals I hold, just to make sure my investments are fully protected.

I also find it reassuring that advanced security measures are in place, like biometric access and 24/7 surveillance. These features really help safeguard my precious resources and give me peace of mind in this ever-changing investment landscape.

3. Investment and Portfolio Management

I really appreciate how Capital Coin and Bullion focuses on tailored investment and portfolio management services. They help me achieve my long-term investment goals through asset diversification and strategic planning.

By mixing traditional precious metal investments with cryptocurrency options, they give me a well-rounded approach to wealth management that takes into account market volatility and economic trends. Their experienced financial advisors work closely with me to develop personalized strategies that boost capital growth and ensure I have liquidity when I need it.

In today’s fast-paced financial world, having a well-researched investment strategy is more important than ever. Integrating precious metals and cryptocurrencies into my diversified portfolio not only helps me manage risks but also positions me to take advantage of various market opportunities.

By tapping into insights about market fluctuations, I can make informed decisions about my investments. Financial literacy is key for me to understand these assets, as it helps me navigate toward sustainable growth while protecting my funds against inflation and economic uncertainties.

This dual approach really enables me to strengthen my financial resilience in an ever-changing marketplace.

What Types of Precious Metals Does Capital Coin and Bullion Deal With?

I’ve found that Capital Coin and Bullion offers a great selection of precious metals, giving me the chance to explore different asset classes like gold, silver, platinum, and palladium. Each of these metals has its own unique benefits and investment potential, which is perfect for someone like me with varying risk appetites and market interests.

As I keep an eye on economic indicators and how they shift, I realize that understanding the specific qualities of each metal is essential for making smart decisions about asset allocation and crafting a long-term investment strategy.

1. Gold

I’ve always seen gold as a cornerstone of precious metal investing. It’s like a safe haven for keeping my wealth intact and a solid hedge against inflation. With its historical value and market stability, gold bullion is a key piece of my investment puzzle. At Capital Coin and Bullion, I can find a variety of gold products, from coins to bars, catering to both beginners and seasoned investors like myself.

The importance of gold in my investment strategy really hits home, especially when the economy gets shaky. Things like geopolitical tensions, currency fluctuations, and changing interest rates can really shake up gold prices. That’s why I make it a point to stay informed about market trends.

By adding gold to my portfolio, I not only spread out my risk but also take advantage of its potential for appreciation, particularly during market downturns. Plus, I love using trading platforms that provide real-time data and analytics. They really help me make informed decisions about my gold investments, allowing me to navigate the twists and turns of this ever-changing market with confidence.

2. Silver

I find silver to be not just a favorite among collectors but also a solid investment option. It often acts as a more volatile counterpart to gold, which gives me some unique trading opportunities in the bullion market. At Capital Coin and Bullion, I can find a variety of silver products that cater to both investors like me who are looking to diversify assets and numismatic enthusiasts who appreciate those rare coins. To really make the most of my investments, I know it’s essential to understand the factors that influence silver prices for effective market analysis.

Historically, silver has shown some impressive resilience during economic downturns, which makes it a valuable hedge against inflation and currency fluctuations. As market trends change, I recognize the potential of silver to help safeguard my portfolio against those unpredictable shifts in the global economy. This precious metal not only balances out equities and other asset classes but also reflects sentiments in various sectors, from industrial demand to geopolitical tensions.

For anyone putting together a buyer’s guide, diving into silver’s historical performance and its role in a diversified investment strategy is really important for making informed decisions.

3. Platinum

Platinum might not get as much attention as its flashier friends, gold and silver, but it offers a unique opportunity for me as an investor because of its rarity and industrial demand. Since it’s a precious metal with a different market dynamic, I’ve learned that understanding platinum’s price volatility and the economic indicators can really help shape my investment strategies. Capital Coin and Bullion has a range of platinum products available, making it an interesting option for diversifying my assets.

What I find particularly appealing about platinum is its limited supply, especially in industries like automotive manufacturing where it’s used in catalytic converters. Plus, compared to other metals, it has shown some historical stability, which could serve as a potential hedge against inflation and currency fluctuations.

Of course, I know there are risks to consider when investing in platinum, like its sensitivity to economic downturns and the ever-changing technological demands. That’s why I keep a close eye on global market trends and industrial usage rates; they can significantly influence performance and pricing over the long haul.

4. Palladium

Palladium has really caught my eye lately, especially with its crucial role in the automotive industry. It’s become a valuable investment opportunity in the world of precious metals. With the market trends swinging up and down and the growing demand for palladium in catalytic converters, I’m definitely interested in exploring its potential for capital growth. I found that Capital Coin and Bullion has a great selection of palladium products, which makes it easy to get in on this booming market.

This precious metal isn’t just about cars, either; it helps reduce automotive emissions and has important uses in industries like electronics and dentistry. The palladium market is influenced by a mix of factors, including mining output, geopolitical stability, and advancements in alternative fuel vehicles. Because of this, I see palladium as a smart asset to diversify my portfolio alongside my more traditional investments like stocks and bonds.

Incorporating palladium into my asset management strategy feels like a solid move. It could help me mitigate risks and potentially boost my overall returns, especially with all the market research highlighting its growing role in a sustainable economy.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Are the Benefits of Investing in Precious Metals with Capital Coin and Bullion?

Investing in precious metals with Capital Coin and Bullion has so many benefits that can really boost my overall investment strategy and give me some financial security, especially when the economy feels a bit shaky.

Their offerings make it easy to diversify my assets, which helps reduce investment risks while also acting as a buffer against inflation and currency fluctuations. Plus, with a solid selection of products and fantastic customer service, I feel confident navigating my investment journey.

1. Diversification of Portfolio

I find that diversifying my investment portfolio is key to managing risks and boosting potential returns, and precious metals are a big part of that strategy for me. By adding assets like gold, silver, and platinum, I can spread my risk around and cushion the blow of market volatility. I really appreciate the expert guidance from Capital Coin and Bullion on how to effectively allocate my assets to get the best financial performance.

In this crazy world of economic uncertainties and ever-changing markets, I often turn to precious metals as a solid safeguard against inflation and currency devaluation. These tangible assets not only act as a safety net during tough economic times but also hold their value, helping to keep my overall investment performance steady.

By strategically including these metals alongside my traditional securities, I feel like I’m building a more resilient financial plan that can handle both short-term market ups and downs and long-term economic shifts.

2. Protection Against Inflation and Economic Uncertainty

One of the main reasons I invest in precious metals is that they’ve got this solid track record of protecting against inflation and economic uncertainty. It’s comforting to know they’re a reliable way to secure my wealth. Gold, in particular, has this knack for holding its value during tough economic times, giving me that extra sense of security.

I’ve learned from Capital Coin and Bullion just how crucial it is to include these assets in my investment strategy to guard against market ups and downs.

Looking back at history, it’s clear that when inflation starts to climb, the value of precious metals usually goes up too. This means I can maintain my purchasing power. Take the 1970s oil crisis or the 2008 financial meltdown, for example—during those times, precious metals really shone, appreciating in value while traditional investments struggled.

By adding these tangible assets to my portfolio, I’m not just focusing on preserving my capital; I’m also boosting my financial literacy. This helps me make smart decisions that align with my overall investment goals.

3. Potential for Long-Term Growth

Investing in precious metals really opens up some exciting possibilities for long-term growth, especially as I keep an eye on how global economic indicators shift and demand changes. By getting a grip on market trends and what drives the prices of gold, silver, and other metals, I can set myself up for some serious capital growth. Capital Coin and Bullion has some great insights and financial products that help me craft effective long-term investment strategies.

Doing my market research is key to figuring out the right timing and spotting opportunities in the precious metals market. I know that things like geopolitical stability, inflation rates, and currency fluctuations all play into the value of these investments.

Plus, I’ve learned that understanding the ins and outs of metal grading, mining production levels, and the varying demand across industries can really boost my strategy’s effectiveness. To get the most out of my investments, I make it a point to stay informed with market analysis and educational resources that guide me through this ever-changing sector.

What Are the Risks of Investing in Precious Metals with Capital Coin and Bullion?

Investing in precious metals comes with a lot of perks, but I always keep an eye on the potential risks so I can make informed decisions. I know that market volatility can really shake things up, causing prices of gold and silver to fluctuate, which is something I have to navigate carefully.

Plus, there’s the ever-present risk of counterfeit products out there. That’s why I make it a point to work with trusted dealers like Capital Coin and Bullion, who really prioritize authenticity and security. It just gives me peace of mind.

1. Volatility of Market Prices

The ups and downs of market prices for precious metals like gold and silver can create both opportunities and challenges for me as an investor. I’ve noticed that price fluctuations often align with economic indicators, so it’s really important to get a handle on the market dynamics to reduce investment risk. That’s where Capital Coin and Bullion comes in—they offer some great market analysis tools that help me navigate these price changes effectively.

I also keep an eye on factors like inflation rates, central bank policies, and supply chain disruptions, as these can seriously impact price fluctuations. Plus, geopolitical events, such as conflicts or trade tensions, can throw a wrench in the works and lead to unpredictable demand shifts.

It’s crucial for me to stay alert to all these elements since they can provide valuable insights that guide my strategic decisions. By closely monitoring market trends and using solid investment strategies, I can better position myself to capitalize on the inevitable changes in precious metals prices.

2. Storage and Insurance Costs

When I think about investing in physical precious metals, I always keep an eye on the costs related to storage and insurance. These expenses can really pile up over time, which can impact my overall investment returns and financial planning. That’s why I like what Capital Coin and Bullion offers—they have secure storage solutions that focus on keeping my assets safe while also being cost-effective.

If I don’t budget for these essential costs, I could end up with some unpleasant surprises that throw a wrench in my financial goals. It’s really important for me to figure out how these expenses fit into my bigger investment strategy because overlooking them could eat into the profitability of my precious metal holdings.

By grasping the impact of storage and insurance on my overall returns, I can make smarter decisions. It’s a good idea to explore different financial products that optimize these aspects, ensuring I take a well-rounded approach that protects my assets while boosting my long-term growth potential.

3. Potential for Counterfeit Products

The risk of counterfeit products in the precious metals market is something I take seriously. It really drives home the importance of authenticity and trust when I’m making investments. I always make sure to do my due diligence to verify the quality and source of my bullion and rare coins. That’s why I appreciate companies like Capital Coin and Bullion; they’re dedicated to providing authentic products and in-depth market research to help protect me from this kind of risk.

With more and more shady dealers popping up, I know I need to be extra vigilant. When I’m looking to make a purchase, I prioritize thorough market research. That means not just checking out the dealers’ reputations but also diving into customer reviews to see what others have experienced.

Spotting red flags when it comes to counterfeit products can save me from a significant financial hit and keep me protected as a buyer. I’ve learned that authentic dealers usually provide certifications and clear documentation, so I always ask for proof of authenticity before I commit to anything. By arming myself with knowledge and staying cautious, I can really reduce the risks tied to counterfeit goods and make informed purchases.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

FAQs on Bullion Investing and Trading

What is bullion?

Bullion refers to gold and silver that is officially recognized as being at least 99.5% pure for gold and 99.9% pure for silver, typically in the form of bars, ingots, and coins.

Is gold bullion subject to VAT?

Investment gold is not subject to VAT throughout the EU, including all gold bullion bars and coins purchased in the UK and EU.

Why is the gold price above the current spot price?

The price for physical bullion products is typically higher than the spot price due to costs associated with minting, manufacturing, refining, brokerage fees, transportation, insurance, and storage.

Are bullion coins exempt from Capital Gains Tax (CGT)?

In some jurisdictions, coins produced by national mints with a face value may be exempt from CGT. For example, in the UK, any coin produced by The Royal Mint with a face value is CGT-free.

What is the delivery process for bullion purchases?

Reputable dealers typically provide updates on the delivery date and supply a unique tracking number. All orders should be fully insured for the buyer’s peace of mind.

How can I ensure the legitimacy of a bullion dealer?

When considering a bullion dealer, it’s important to research their reputation and business practices. Legitimate dealers usually have a physical address, clear pricing policies, and verifiable credentials. Be cautious of dealers offering prices significantly below market value, as this can be a red flag for potential scams.

What should I look for in a bullion trading platform?

Look for platforms that offer competitive pricing, secure storage options, and transparent fee structures. Some platforms allow users to access professional market spreads and potentially earn from providing liquidity.

How is bullion stored securely?

Many bullion dealers and platforms offer secure storage options in professional vaults. These storage solutions typically include secure, insured vaults in multiple international locations.

Remember to always conduct thorough research and consider consulting with a financial advisor before making any investment decisions in precious metals or bullion.

Is Capital Coin And Bullion Review a reliable source of information?

Yes, Capital Coin And Bullion Review is an unbiased and trusted source of information, as it is run by a team of experienced professionals with extensive knowledge of the industry.

Does Capital Coin And Bullion Review offer any paid services?

No, all the information and services provided by Capital Coin And Bullion Review are completely free of charge.

Capital Coin and Bullion

Capital Coin and Bullion really stands out to me as a key player in this space, offering a variety of services that make buying, selling, and storing precious metals a breeze.

Product In-Stock: InStock

4