As interest in cryptocurrency investing grows, many individuals are exploring new avenues to incorporate digital assets into their retirement portfolios, seeking to benefit from a self-directed IRA that offers tax benefits.

Coin IRA, based in Woodland Hills, California, stands out as a popular option, offering a unique approach to cryptocurrency IRAs with low fees and a focus on customer service.

This overview covers Coin IRA, including the cryptocurrencies available, the services offered, fees, and customer reviews, highlighting its reputation as an industry leader in crypto investments.

Whether you’re a seasoned investor or just starting out, understanding Coin IRA can help you make informed decisions about your financial future by exploring diverse investment options and strategies.

Coin IRA’s key takeaway is its focus on secure storage and fund management.

What Is a Crypto IRA?

A crypto IRA is a specialized retirement account that allows individuals to invest in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin while enjoying tax benefits typically associated with traditional IRAs. This type of investment vehicle is crucial for those looking to diversify their retirement portfolios with digital assets, enabling investors to take advantage of the burgeoning cryptocurrency market within a tax-advantaged structure. By leveraging a crypto IRA, individuals can benefit from asset protection and regulatory compliance under IRS regulations, which adds another layer of security to their investment strategy while aiming for financial security in retirement.

What Is Coin IRA?

With an A+ rating from the Better Business Bureau, Coin IRA emphasizes secure storage and asset protection for investors. Coin IRA, based in Woodland Hills, California, is a prominent provider of cryptocurrency IRA services, offering investors a secure and compliant way to incorporate digital assets like Bitcoin, Ethereum, and Litecoin into their retirement portfolios. The firm utilizes IRS-approved custodians and provides cold storage solutions for enhanced online security. As an industry leader, Coin IRA specializes in facilitating crypto investments through IRS-approved custodians, ensuring that clients can enjoy the tax benefits associated with retirement accounts while managing their assets effectively. They’ll guide you through an IRA rollover and offer promotional cashback options. Their unique approach to fund management enables investors to achieve both diversification and financial security in the ever-evolving landscape of cryptocurrency.

What Cryptocurrencies Are Available with Coin IRA?

Coin IRA offers a robust cryptocurrencies selection, focusing on digital currency’s potential for financial security.Coin IRA provides a diverse selection of cryptocurrencies for investment, including well-known digital assets such as Bitcoin, Ethereum, and Litecoin, allowing investors to tailor their portfolios according to their financial goals. Cryptocurrency diversification and risk management are crucial in today’s market, as they enable individuals to mitigate risks while enhancing their potential for growth through strategic investment opportunities.

This extensive range offers each asset’s unique characteristics, from Bitcoin’s pioneering status and proven stability to Ethereum’s smart contract capabilities that promise innovation in decentralized applications and blockchain technology. By investing in Litecoin, investors can access faster transaction times and lower fees, making it particularly appealing for those looking at practical use cases in everyday transactions and fund diversification. Furthermore,

- Bitcoin: The first and most recognized cryptocurrency, widely accepted in various platforms.

- Ethereum: Not just a currency, but a platform for creating decentralized applications.

- Litecoin: Often seen as silver to Bitcoin’s gold, offers transaction efficiency.

This thoughtful selection emphasizes the importance of a diversified cryptocurrency strategy, allowing investors to respond effectively to market trends while potentially maximizing returns aligned with their individual investment objectives.

How Does Coin IRA Work?

Coin IRA’s process emphasizes investment management and advisory services tailored to investor needs.Coin IRA operates by providing a self-directed IRA structure that allows clients to manage their investments in cryptocurrencies while benefiting from custodial services, ensuring compliance with IRS regulations. The process begins with the establishment of an IRA account, after which investors can fund their accounts through various means, such as an IRA rollover, a direct contribution, or utilizing equity trust services. Once the funds are available, clients can execute transactions on the trading platform, with transaction fees typically associated with trading, all while receiving comprehensive fund management services that adhere to stringent financial regulations, ensuring compliance and IRS guidelines.

The initial step for clients is to complete an application, which is often straightforward and may be facilitated online.

Next, upon approval, they would typically transfer funds to their new account, paving the way for investment opportunities. This process allows for diverse funding options, including cash contributions or transfers from existing retirement accounts.

- With funds secured, clients explore various cryptocurrency assets available for trading, which often include well-known options like Bitcoin and Ethereum.

- Ahead of executing trades, it’s crucial to understand the transaction fees involved, as they can vary based on specific trades or platforms.

- Throughout these transactions, custodial services play an essential role, managing the crypto assets on behalf of the investors, ensuring these investments remain compliant with IRS guidelines.

Ultimately, this meticulous approach not only safeguards the tax-deferred growth benefits of the IRA but also enables investors to capitalize on the dynamic cryptocurrency trading market effectively, enhancing company reputation and market experience.

What Are the Fees for Using Coin IRA?

Understanding the fee structure, including transaction fees and annual custodial fees, is essential for effective financial strategies.Coin IRA is known for its competitive fee structure, offering low fees on transactions and annual custodial fees that appeal to a wide range of investors looking to maximize their crypto investments. The fees associated with using Coin IRA vary based on factors such as the type of account, the investment amount, and specific services utilized, making it essential for potential clients to understand the fee schedule before committing to a minimum investment in their digital assets. This transparent approach to fees ensures that clients can effectively manage their retirement portfolios without incurring excessive costs.

Understanding the various fees involved is crucial for those considering a Coin IRA. The main types of fees typically include:

- Transaction Fees: These may apply every time an investment is made or liquidated, which can impact overall profitability.

- Annual Custodial Fees: This ongoing charge is for the management and safekeeping of assets within the account.

- Additional Costs: These may encompass fees for setup, maintenance, or specific services ranging from account management to educational resources.

By familiarizing oneself with these expenses, investors can better plan their financial strategies and ensure a smoother journey towards achieving their retirement goals.

What Services Does Coin IRA Offer?

Coin IRA’s services encompass investment strategies, educational resources, and comprehensive market insights.Coin IRA offers a comprehensive suite of services designed to support investors in their cryptocurrency IRA journey, including advisory services, custodial services, and a secure trading platform tailored for digital assets. The company collaborates with Equity Trust Company to enhance self-directed IRA opportunities. These services not only streamline the investment process but also provide essential educational resources and tools to help clients make informed decisions about their cryptocurrency investments, ensuring customer service excellence. By focusing on customer service and support, Coin IRA positions itself as a reliable partner for individuals looking to navigate the complexities of crypto investments, ensuring peace of mind and financial security through sound investment strategies and online security measures.

Custodial Services

Coin IRA’s custodial services prioritize cold storage solutions and IRS compliance.Coin IRA’s custodial services are governed by IRS-approved custodians like Equity Trust Company, ensuring that all digital assets are stored securely and in compliance with federal regulations, benefiting from asset protection strategies. This layer of protection is crucial for investors looking to maintain the integrity of their cryptocurrency IRA, providing peace of mind in an increasingly volatile market. The custodial services include secure storage solutions that safeguard clients’ digital assets, making them a trusted option for those seeking to invest in cryptocurrencies for retirement.

These custodial services play a vital role in achieving and maintaining IRS compliance, which is essential for any retirement plan involving digital currencies. By adhering to stringent regulations, custodians mitigate potential risks that could complicate a client’s investment strategy.

They offer secure storage facilities that utilize advanced technologies to protect against unauthorized access and cyber threats. This comprehensive approach not only secures investments but also enhances the overall investment experience, allowing clients to focus on their financial future knowing their assets are well-guarded.

- Protection from market volatility

- Enhanced regulatory compliance

- Peace of mind for investors

- Industry-leading cold storage solutions

Trading Services

Coin IRA’s trading platform provides robust options for cryptocurrency trading and investment opportunities.The trading services offered by Coin IRA include an intuitive trading platform that enables clients to engage in cryptocurrency trading with ease and efficiency. This platform is designed to meet investor needs by providing real-time market data, allowing users to make informed decisions about their crypto investments. By leveraging advanced trading tools and features, Coin IRA enables investors to optimize their trading strategies and navigate the dynamic landscape of digital currency trading effectively.

With a user-friendly interface, this trading platform ensures that both novice and experienced investors can seamlessly explore the world of cryptocurrencies and benefit from a wide array of investment options. The built-in analytics tools provide comprehensive insights, enabling participants to track market trends and assess their portfolio performance.

- Real-time insights: Users receive instant updates on market fluctuations, allowing for quick reactions to price changes.

- Enhanced security: The platform incorporates robust security measures, ensuring that investor data and digital assets are adequately protected.

- Responsive support: A dedicated customer service team is readily available to assist with any inquiries or challenges that might arise.

As a result, Coin IRA, based in Woodland Hills, California, not only enhances the trading experience but also builds a foundation of trust and reliability for investors looking to venture into cryptocurrency.

Storage Services

To safeguard clients’ investments, Coin IRA offers secure storage services through an IRS-approved custodian that utilize advanced cold storage techniques, ensuring that digital assets are protected from potential threats and cyber attacks. This method of storage is particularly important in the cryptocurrency IRA space, where security concerns are prevalent, allowing investors to have confidence in the safety of their assets within their self-directed IRA accounts. By prioritizing secure storage solutions, Coin IRA helps clients maintain the integrity of their investment portfolios while adhering to industry best practices.

In today’s digital landscape, the significance of secure storage services cannot be overstated. With the rise in popularity of cryptocurrencies, the risk of theft and hacking has escalated, making robust security measures crucial. Coin IRA implements a variety of strategies to ensure that clients’ digital assets are not just stored, but stored safely. These include:

- Cold Storage Solutions: Assets are stored offline, significantly reducing the risk of online attacks.

- Multi-Signature Wallets: Requiring multiple approvals for transactions enhances security, making unauthorized access extremely difficult.

- Regular Security Audits: Ongoing evaluations help in identifying potential vulnerabilities, ensuring that the security protocols remain effective.

By integrating these protective measures, Coin IRA fosters a trust-based relationship with its clients, enableing them to navigate the cryptocurrency market with peace of mind.

What Are the Reviews for Coin IRA?

Customer reviews for Coin IRA vary widely, with many clients praising the company’s customer service and ease of use while others express concerns regarding specific experiences, highlighting the importance of understanding the broader company reputation. As with any financial service provider, it is essential for prospective investors to review feedback from current and past clients to gauge the reliability and effectiveness of Coin IRA’s offerings. This transparency can help individuals make informed decisions regarding their cryptocurrency IRA investments, including potential IRA rollover options.

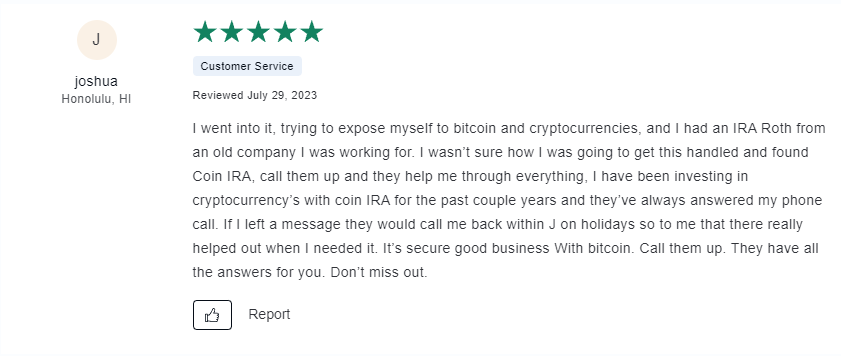

Positive Reviews

Positive reviews for Coin IRA often highlight the exceptional customer service and the range of investment opportunities available, making it an attractive option for investors seeking to enter the cryptocurrency market, especially with promotions like cashback offers. Clients commend the company’s knowledgeable staff for providing valuable insights and support throughout the investment process, which enhances the overall experience. This favorable feedback reflects Coin IRA’s commitment to addressing investor needs and ensuring a smooth transition into the world of crypto IRA investments.

Many users have expressed satisfaction with how the company balances a comprehensive suite of options, from Bitcoin, Ethereum, Litecoin, to other altcoins, thereby catering to diverse investment appetites.

- Clients appreciate the transparency in fees, allowing them to make informed decisions without unexpected charges.

- The user experience on their platform is often praised for its intuitive design, making it accessible even for those new to cryptocurrency.

The responsive nature of their customer service team means that questions and concerns are met with immediate attention.

This level of support not only builds trust but also fosters a sense of belonging within the community, a critical aspect for those ready to invest in the evolving digital asset landscape.

Negative Reviews

Negative reviews of Coin IRA often stem from specific complaints related to customer service experiences and unexpected fees, which can impact investor satisfaction and trust in the platform. While many clients appreciate the services provided, some have raised concerns regarding the clarity of fee structures and the responsiveness of support staff during critical times. It’s essential for potential investors to consider these complaints in conjunction with positive feedback to form a balanced view of Coin IRA’s overall reputation.

Such issues can dramatically affect overall investor satisfaction, prompting the need for future clients to weigh both the pros and cons carefully.

Is Coin IRA Legit?

Coin IRA has built a reputation as a legitimate player in the cryptocurrency IRA space, bolstered by its A+ rating from the Better Business Bureau and adherence to essential financial regulations. Investors can feel confident in the company’s commitment to compliance and transparency, which is fundamental for ensuring the legitimacy of their financial services. This established reputation allows potential clients to trust Coin IRA as a viable option for managing their cryptocurrency investments within a regulated framework.

The firm demonstrates a strong commitment to investor safety, regularly undergoing rigorous assessments designed to confirm its compliance with the laws governing financial institutions. Customers have praised Coin IRA for its trustworthy practices and exceptional customer service, further enhancing the company’s image as a reliable partner in the cryptocurrency market.

- The company is also subject to oversight by reputable agencies, which adds an additional layer of reassurance for cautious investors.

- User reviews indicate high levels of satisfaction and confidence in the firm’s operations, reflecting the overall positive sentiment surrounding its legitimacy.

In a rapidly evolving financial landscape, having a well-regarded entity like Coin IRA can be pivotal when it comes to navigating the complexities of cryptocurrency investments, providing assurance with IRS compliance.

How Does Coin IRA Compare to Other Crypto IRA Providers?

When comparing Coin IRA to other crypto IRA providers such as iTrustCapital, BitIRA, Bitcoin Advizers, BitcoinIRA, Blockmint, and Equity Trust Company, notable differences emerge in terms of fees, available cryptocurrencies, and customer reviews, which can significantly influence an investor’s choice. Each provider offers unique features and varying fee structures, making it essential for potential clients to evaluate their options thoroughly. By assessing factors such as the range of cryptocurrencies available and the overall customer experience, investors can make informed decisions that best align with their investment goals.

Fees

Coin IRA is often praised for its competitive fee structure, gaining attention in reviews despite some complaints about fees., particularly when compared to other crypto IRA providers, which can include various transaction fees and annual custodial fees that vary by account type. Understanding these fees is crucial for investors, as they can impact overall investment returns and portfolio performance significantly.

By taking the time to scrutinize the costs associated with each provider, an investor can uncover potential savings and ensure that their hard-earned money is working as efficiently as possible.

For example, while Coin IRA may charge a flat annual fee for account management, a consideration for those comparing options since 2017., others like iTrustCapital impose different rates based on asset size or trading frequency. Evaluating fees related to investment choices is equally vital.

- Transaction fees

- Custodial fees

- Account setup fees

Each of these elements can vary dramatically, making it essential for investors to conduct thorough research. In the long run, understanding the relative costs can enable investors to make informed decisions that enhance the longevity and profitability of their crypto IRA portfolios.

Available Cryptocurrencies

One key factor that sets Coin IRA apart from other crypto IRA providers is its extensive cryptocurrencies selection, which includes major digital assets like Bitcoin, Ethereum, and Litecoin, alongside newer cryptocurrencies. This diverse range of investment options allows clients to tailor their portfolios according to their specific financial goals and risk tolerance. By offering a broader selection of cryptocurrencies, Coin IRA enhances its attractiveness, especially for those seeking a self-directed IRA with diverse options. as a provider for those looking to invest in the expanding digital currency market.

Along with these well-known assets, Coin IRA also features several emerging cryptocurrencies, providing investors with opportunities to explore innovative projects that may yield significant returns. This flexibility is crucial, especially when comparing to competitors who often present a more limited assortment.

The ability to diversify investments across various sectors within the cryptocurrency landscape enables clients to:

- Mitigate risks by spreading investments

- Capitalize on market trends more effectively

- Gain exposure to high-potential tokens that may outperform traditional assets

Ultimately, having access to a wide array of digital currencies not only fosters growth but also aligns with the modern investor’s need for adaptability in an evolving financial environment.

Reviews

The customer reviews for Coin IRA play a significant role in shaping its reputation as an industry leader in the cryptocurrency IRA space, attracting both positive and negative feedback from users. Understanding these reviews is vital for potential investors, as they reflect the overall customer experience and satisfaction levels associated with the company’s services. By analyzing customer feedback in conjunction with competitor reviews, investors can gain insight into the operational strengths and weaknesses of Coin IRA.

Delving deeper into the opinions expressed by customers reveals several important themes that merit consideration.

- Trust and Reliability: Many users emphasize the importance of trustworthiness in financial services, with several reviews highlighting Coin IRA’s commitment to transparency.

- Customer Support: Positive comments often mention the responsive and helpful nature of customer support, while criticisms sometimes revolve around delays or unaddressed inquiries.

- Comparisons with competitors such as BitcoinIRA, iTrustCapital, and Blockmint show that while some alternatives offer lower fees, they may lack in areas such as comprehensive educational resources, which Coin IRA provides.

Therefore, it’s crucial for prospective investors to weigh these factors carefully when considering their options in the cryptocurrency IRA market, especially given Coin IRA’s A+ rating from the Better Business Bureau and its location in Woodland Hills, California.

How to Open an Account with Coin IRA?

Opening an account with Coin IRA is a straightforward process that enables investors to begin their journey into cryptocurrency investments while leveraging educational resources for knowledge-based decision making. Prospective clients can start by filling out an application online, providing necessary documentation, and funding their accounts through various methods, including IRA rollovers. With a focus on simplifying the investment management process, Coin IRA ensures that clients have access to the tools and information needed to navigate the complexities of digital asset investments successfully.

To help individuals make the most of their experience, the process is clearly defined in a step-by-step format.

- Step 1: Access the Coin IRA website and complete the online application.

- Step 2: Submit essential documentation, such as identification and proof of residence, to verify identity.

- Step 3: Choose a funding method—whether through a direct deposit, bank transfer, or an IRA rollover.

Throughout this journey, clients will find extensive support and educational resources available, including webinars, articles, and dedicated customer service, ensuring they feel confident and informed as they step into the world of cryptocurrency investing. Clients can also consult with financial advisors like Brenda Whitman and utilize services from partners such as BitIRA and Equity Trust Company for enhanced investment strategies.

What Are the Risks of Investing in Crypto IRAs?

Investing in crypto IRAs holds inherent risks that investors must consider, including market volatility, regulatory changes, and the complexities of managing digital assets, which can impact financial security if not approached with careful risk management strategies. As cryptocurrencies are subject to rapid price fluctuations and evolving regulatory landscapes, individuals must equip themselves with adequate market experience and knowledge to navigate these challenges effectively. Understanding these risks is crucial for investors looking to diversify their retirement portfolios while aiming for sustainable investment growth.

Frequently Asked Questions

1. Is Coin IRA a legitimate provider for crypto IRAs?

Yes, Coin IRA is a legitimate crypto IRA provider. They have been in business since 2017 and are a trusted source for investing in cryptocurrencies for retirement.

2. What cryptocurrencies are available with Coin IRA?

Coin IRA offers a variety of cryptocurrencies including Bitcoin, Ethereum, Litecoin, and Ripple. They also offer the ability to invest in cryptocurrency mining.

3. Are there any negative reviews for Coin IRA?

While Coin IRA has mostly positive reviews, there have been a few negative reviews regarding their customer service and fees. However, overall they have a good reputation in the industry.

4. What fees does Coin IRA charge?

Coin IRA charges a flat fee of 1% for their services, which is competitive compared to other providers in the market. They also have no hidden fees or commissions.

5. What services does Coin IRA offer?

Coin IRA offers a variety of services for investing in cryptocurrencies for retirement. This includes setting up a self-directed IRA, investing in individual cryptocurrencies, and even setting up a cryptocurrency IRA LLC.

6. Can I rollover my existing IRA into a Coin IRA?

Yes, Coin IRA allows for rollovers of existing IRAs into their platform. This makes it easy for individuals who already have a retirement account to diversify their portfolio with cryptocurrencies.