Are you in search of a reliable partner to guide my financial journey? Then, I believe Fisher Capital Group could be the answer.

This firm provides an extensive range of services, including investment management, financial and retirement planning, and tax strategies specifically tailored to meet individual needs.

I will discuss the benefits of working with their experienced team, potential risks involved, and how they compare to other investment firms.

Exploring what makes Fisher Capital Group a noteworthy option for my financial aspirations is essential for making informed decisions.

What Is Fisher Capital Group?

At Fisher Capital Group, they are a reputable investment firm that specializes in a comprehensive range of financial services, including portfolio management, risk assessment, and wealth management designed to meet diverse client needs.

Established with a strong commitment to transparency and trustworthiness, they take pride in delivering tailored financial solutions that align with individual financial goals. Whether clients are exploring investment options in stocks, mutual funds, or hedge funds, our dedicated team ensures they receive the highest level of care and professional advice in managing their investment portfolios.

What Services Does Fisher Capital Group Offer?

At Fisher Capital Group, they provide an extensive suite of services that addresses all aspects of personal finance, including investment management, financial planning, retirement planning, and tax planning. This comprehensive approach ensures that clients receive holistic support throughout their financial journeys.

They lead a team of experienced advisors who are committed to developing personalized investment strategies tailored to each client’s unique financial goals and risk tolerance. Utilizing a user-friendly online platform and advanced trading tools, they empower clients to make informed decisions regarding their wealth management and capital allocation.

1. Investment Management

At Fisher Capital Group, they focus on optimizing portfolios through effective asset allocation strategies and thorough risk management practices tailored to individual preferences and market conditions. They utilize comprehensive market analysis and economic indicators to craft a diversified investment portfolio aimed at maximizing returns while minimizing risks. They ensure that their clients are well-informed through continuous investor education and detailed performance reviews of their portfolios.

By emphasizing the importance of diversification, they help investors mitigate potential losses across various financial instruments, which is crucial for long-term investments. Performance evaluation is a vital component of their approach, providing insights into how well individual investment strategies are performing against established benchmarks.

Adapting to market volatility is not merely reactive for them; it’s about taking a proactive stance that involves timely adjustments to portfolios, ensuring they align with evolving market conditions. Through education and insights, their goal is to give the power to individuals to make informed decisions about their investments, reinforcing the value of strategic planning in their financial journeys.

2. Financial Planning

The financial planning services at Fisher Capital Group are specifically designed to assist clients in achieving their financial goals through comprehensive assessments and customized savings plans that reflect their unique circumstances and aspirations. They recognize that effective financial planning requires a thorough understanding of each client’s personal and financial situation, and they prioritize open communication to enhance the overall client experience.

Drawing on insights from behavioral finance, they develop actionable plans that guide clients toward financial stability and growth.

Establishing a robust financial strategy is crucial for anyone looking to secure their financial future. This process often begins with identifying and setting achievable financial goals, whether that involves saving for retirement, purchasing a home, or funding education.

By promoting financial literacy, they ensure that individuals can make informed decisions that align with their objectives, ultimately paving the way for successful investments and effective expense management. During the initial stages of client onboarding, they focus on educating clients about the various aspects of their financial journey, allowing them to take control of their financial destinies with confidence.

3. Retirement Planning

Retirement planning is a critical service that they provide at Fisher Capital Group, where they focus on assisting clients in building secure and sustainable retirement funds through strategic investments and individual retirement accounts tailored to their specific needs. They begin by assessing each client’s current financial situation and future aspirations to create a personalized plan that ensures a comfortable retirement lifestyle.

They emphasize the importance of early planning and regular reviews to adapt to changing market trends and individual circumstances.

By exploring a variety of retirement planning options, such as employer-sponsored savings plans, traditional and Roth IRAs, and other investment vehicles, individuals can effectively pave their path toward financial stability. Starting this journey early not only enhances the potential for significant investment returns but also fosters disciplined savings habits that can greatly impact long-term wealth preservation.

Regular assessments of one’s financial strategy are essential, as they allow for necessary adjustments in response to fluctuating market conditions and personal financial goals. This ensures that retirees remain on track to meet their needs throughout their golden years.

4. Tax Planning

At Fisher Capital Group, they focus on providing tax planning services that optimize financial outcomes while ensuring compliance with all relevant regulations and standards that apply to investments and income. Their team of tax advisors offers tailored strategies aimed at minimizing tax liabilities and enhancing overall financial health through careful planning and the appropriate use of financial products.

Transparency is a cornerstone of our advisory services, as they provide clients with clear insights into their tax obligations and effective strategies to navigate them.

They understand the nuances of tax regulations, recognizing that even minor oversights can lead to significant liabilities that may adversely impact investment strategies and overall portfolio performance. Proactive tax planning is essential—not just for minimizing potential tax burdens, but also for ensuring clients can fully leverage available tax credits and deductions.

By conducting thorough financial analyses, they can identify opportunities for tax savings while maintaining compliance with current standards. Their advisory services empower clients to make informed decisions that align with their long-term financial goals, ultimately positioning them for sustained growth and security.

What Are The Benefits Of Working With Fisher Capital Group?

Partnering with Fisher Capital Group offers a range of advantages, including personalized investment strategies specifically designed to meet individual client needs, while prioritizing customer satisfaction and long-term wealth building.

I benefit from the expertise of a seasoned team of advisors who provide a wealth of knowledge, ensuring that I receive professional advice and support throughout my investment journey.

Through regular performance reviews and comprehensive market analysis, I am give the power toed to make informed decisions that align with my financial goals and risk tolerance.

1. Personalized Investment Strategies

At Fisher Capital Group, they take pride in developing personalized investment strategies that align with a clients’ unique financial goals. They offer tailored asset allocation that caters to individual risk appetites and investment horizons.

This approach ensures that every investment decision is made with careful consideration of each client’s circumstances and the prevailing market conditions, allowing for flexibility and adaptability in dynamic financial environments. By fostering a deep understanding of my clients’ objectives, they build strategies that promote capital growth and wealth preservation.

Understanding individual client profiles is crucial, as it enables them to create strategies that resonate with their specific needs and aspirations. This level of investment education not only empowers the clients but also builds trust in the financial process.

Recognizing market trends allows them to align these bespoke strategies with the current economic climate, ensuring that investments remain relevant and effective. Ultimately, customized asset allocation enhances financial stability, providing clients with the peace of mind that comes from knowing their investments are working in harmony with their long-term goals.

2. Experienced Team of Advisors

At Fisher Capital Group, they lead a team of experienced advisors committed to delivering professional advice rooted in extensive industry knowledge and market insights. This ensures that clients can make informed decisions regarding their investment options.

They prioritize staying current with the latest economic indicators and regulatory changes, enabling clients with the information they need to navigate complex financial landscapes. Client reviews consistently highlight the depth of experience and commitment shown by their advisors, which has resulted in a high rate of customer satisfaction.

Their advisory team’s qualifications include advanced degrees in finance, economics, and wealth management, along with certifications such as CFA and CFP. By engaging in ongoing education, they remain at the forefront of industry developments and investment risks, translating this knowledge into actionable strategies for clients.

Their collective experience allows us to adeptly interpret market trends and provide tailored advice that protects clients from potential pitfalls. Consequently, the positive feedback they receive often reflects not just satisfaction but also a testament to our ability to foster long-term financial health through strategic planning and dedicated support.

3. Comprehensive Financial Planning

Their comprehensive financial planning services cover all aspects of personal finance, providing clients with a clear roadmap to achieve their financial goals through effective investment strategies and long-term planning. They take into account each client’s unique situation, crafting tailored plans that align with their aspirations and risk tolerance while preparing for potential market volatility and economic fluctuations.

This holistic approach not only enhances the client experience but also fosters trust and collaboration between clients and myself as their advisor.

By integrating essential components such as budgeting, savings, and risk management, they help clients build a solid foundation of financial stability that supports their wealth-building efforts. Understanding the principles of behavioral finance allows clients to make informed decisions and minimizes emotional reactions during market fluctuations.

This well-rounded strategy equips individuals with the tools to manage their finances effectively while enabling them to identify opportunities for growth and investment. Each step they take focuses on refining their financial literacy and instilling confidence in their financial journey.

4. Transparent Fee Structure

At Fisher Capital Group, they are dedicated to maintaining a transparent fee structure, ensuring that clients are fully informed about all advisory fees and commissions related to their investments. This commitment significantly enhances the client experience.

I firmly believe that clarity in pricing fosters trust and enables clients to make informed decisions regarding their financial futures. By providing comprehensive explanations and thorough documentation, they emphasize my dedication to transparency and client satisfaction in every interaction.

This level of transparency sets Fisher Capital Group apart from many competitors, as numerous firms tend to obscure their fee structures, leaving clients feeling confused and uncertain. Understanding the various fees associated with financial products is essential, as it directly influences investment returns and plays a crucial role in the decision-making process.

By creating an environment where clients can openly review costs without hesitation, they cultivate long-lasting relationships founded on trust and reliability, as evidenced by positive client feedback. This approach not only allows clients to navigate their financial journeys with confidence but also fosters a collaborative atmosphere where their financial goals can be efficiently achieved.

Below are some alternatives for Fisher Capital Group:

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Are The Risks Of Working With Fisher Capital Group?

While I appreciate the robust financial services provided by Fisher Capital Group, it is essential for clients to be aware of the inherent risks associated with investing. This includes factors such as market volatility and potential losses that can affect investment returns.

Understanding these risks is crucial for making informed decisions regarding wealth management and capital allocation. I emphasize the importance of implementing risk management strategies to mitigate these potential downsides while pursuing long-term financial objectives.

1. Market Volatility

Market volatility represents one of the most significant risks I face as an investor, characterized by rapid and unpredictable price movements that can directly impact investment valuations and overall portfolio performance. At Fisher Capital Group, I prioritize educating clients on the implications of market volatility and implementing strategies to manage risk effectively. This approach ensures that my clients can navigate these uncertain conditions with confidence. I believe that understanding market trends and economic indicators is essential for making informed investment decisions.

It is crucial for investors to recognize that various factors, such as geopolitical events, changes in interest rates, and shifts in consumer sentiment, can drive volatility in the marketplace. This unpredictability affects different asset classes, including equities, bonds, and alternative financial products, ultimately influencing investment returns.

Behavioral finance also plays a significant role, as emotions can lead to irrational decision-making during turbulent times. By educating investors about these elements and equipping them with sound risk management strategies, I strive to minimize potential losses and enhance long-term portfolio performance, even amid the chaos of fluctuating markets.

2. Potential for Losses

Investing inherently involves the potential for losses due to various factors, such as market downturns, underperforming assets, or unforeseen economic events. At Fisher Capital Group, they prioritize risk management techniques designed to minimize potential losses while pursuing capital growth. Their team conducts comprehensive risk assessments and offers clients valuable insights into their investment portfolios, enabling them to navigate these challenges effectively.

They understand that no single investment strategy guarantees success, making diversification a crucial concept. By distributing investments across different asset classes, industries, and geographic regions, I can reduce exposure to specific risks. Financial analysis is essential in this approach, ensuring that each decision is informed by data-driven insights.

Implementing robust portfolio management techniques allows me to actively monitor investments and adjust strategies as market conditions change. Ultimately, a well-rounded investment strategy not only helps mitigate losses but also enhances the potential for long-term growth, underscoring the importance of a proactive and informed investment approach.

3. High Minimum Investment Requirement

One important consideration I have when working with Fisher Capital Group is the high minimum investment requirement, which may restrict access to certain investment options for some clients and potentially hinder their ability to diversify their portfolios. They are committed to making investments accessible while ensuring that their services effectively meet the needs of those focused on long-term wealth building. Understanding these requirements is essential for prospective clients as they evaluate their options.

Such limitations can discourage individuals with lower starting capital from entering the market, ultimately affecting their financial growth and satisfaction with the asset management experience. However, I recognize that there are viable alternatives for investors seeking more accessible financial products that align with their long-term goals.

Options like pooled investment funds or robo-advisory services can enable these clients to engage in a broader range of investment opportunities without the burden of high minimums.

This approach not only promotes greater inclusivity but also enhances the overall client experience by providing tailored solutions that cater to a variety of financial circumstances.

How Does Fisher Capital Group Compare to Other Investment Firms?

When I compare Fisher Capital Group to other investment firms, I recognize the importance of considering various factors such as fees, investment options, and client reviews that reflect their industry reputation and service quality.

They take pride in their competitive fee structure while delivering exceptional value through personalized advisory services and comprehensive market analysis. By understanding what sets them apart, clients can make informed decisions regarding their investment partnerships.

1. Fees and Charges

When comparing investment firms, a crucial factor to consider is the fees and charges associated with their services. These include advisory fees and commissions, which can have an impact on overall investment returns. Fisher Capital Group prioritizes maintaining a transparent fee structure, ensuring that clients receive clear information about all costs involved in their investment journey. This high level of transparency fosters trust and empowers clients to make informed financial decisions.

Understanding the various types of fees, including management fees and performance fees, is crucial for investors. Management fees generally encompass the continuous expenses associated with portfolio management, while performance fees are dependent on the investment firm achieving certain benchmarks. These fees serve as a reward for both the firm and its clients when successful investment strategies are implemented.

When evaluating these fees, it is important to acknowledge their potential to have a significant impact on net returns on financial products. By addressing these costs in a proactive manner, clients are able to develop effective strategies and optimize their portfolios, resulting in more successful long-term investment outcomes.

2. Investment Options

Fisher Capital Group stands out from other investment firms due to its wide range of investment options. They offer a wide variety of financial products, such as stocks, mutual funds, and venture capital opportunities, which are specifically designed to cater to the individual requirements of their clients.

The approach focuses on strategic asset allocation and risk management, with the goal of optimizing investment performance in different capital markets. Customers are presented with a multitude of choices, empowering them to construct a well-rounded investment portfolio that is in line with their financial objectives.

In addition to conventional investments, access to alternative assets like private equity and real estate is also offered, providing unique returns and a reduced correlation with market fluctuations. With a wide range of investment strategies at their disposal, clients can confidently navigate their financial landscape. Each portfolio management decision is carefully made to align with their long-term objectives, ensuring their financial goals are supported.

With a strong emphasis on comprehensive financial analysis, they work closely with clients to create customized investment plans that consider both present market conditions and future trends. The partnership ultimately fosters confidence and clarity throughout their financial journey.

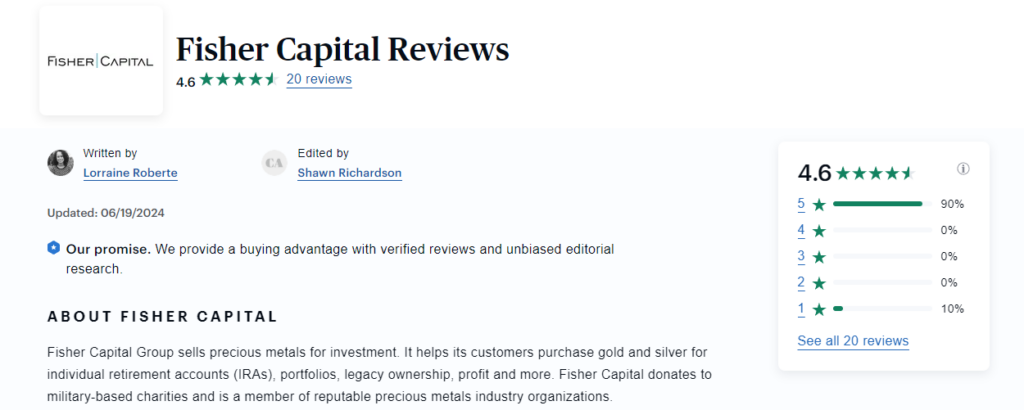

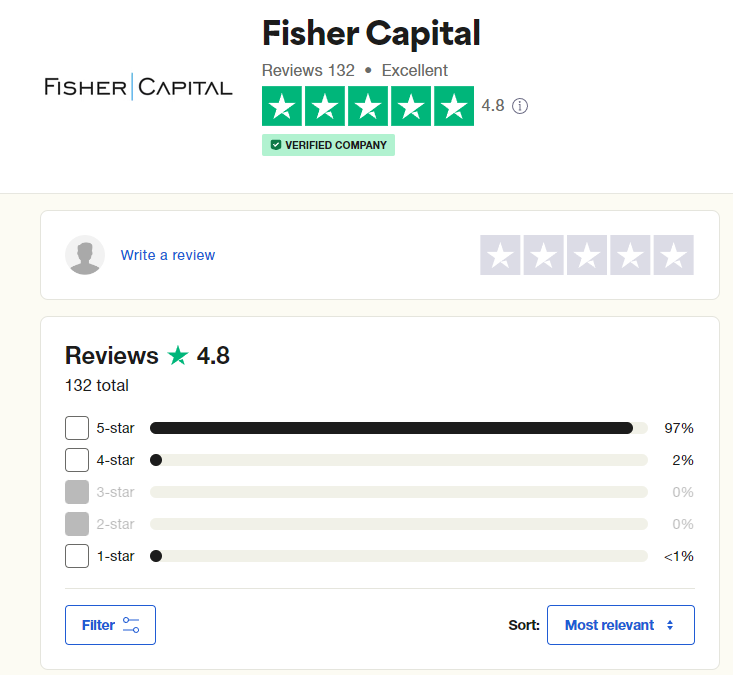

3. Client Reviews

Customer reviews play a vital role in assessing the caliber of services provided by Fisher Capital Group, serving as a reflection of customer satisfaction and the firm’s standing in the industry. They actively seek client feedback to continuously enhance their services and ensure they meet the diverse needs of their clients. Positive testimonials highlight the company’s dedication to being open, reliable, and delivering outstanding customer experiences.

The reviews have a significant impact on public perception and provide valuable insights for potential investors to assess the investment risks and financial stability of our firm. When people consider where to invest their hard-earned money, the experiences of past clients can be extremely helpful.

Additionally, promptly and effectively addressing any negative feedback demonstrates a strong commitment to enhancing the client experience. Through effective management of concerns, investment firms like ours have the ability to turn critical comments into opportunities for growth, thus strengthening our dedication to ensuring overall client satisfaction.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What is Fisher Capital Group?

Fisher Capital Group is a financial services company that provides investment management, wealth management, and financial planning services to individuals and businesses.

Is Fisher Capital Group a reputable company?

Yes, Fisher Capital Group has a strong reputation in the financial industry for their expertise and sound financial advice.

What types of services does Fisher Capital Group offer?

Fisher Capital Group offers a wide range of services, including investment management, wealth management, retirement planning, estate planning, and tax planning.

How can I contact Fisher Capital Group ?

You can contact Fisher Capital Group by phone, email, or by visiting their office. Their contact information can be found on their website.

Does Fisher Capital Group have a minimum investment requirement?

Yes, Fisher Capital Group has a minimum investment requirement of $100,000 for their investment management services.

Does Fisher Capital Group have a team of financial advisors?

Yes, Fisher Capital Group has a team of experienced and dedicated financial advisors who are committed to helping clients achieve their financial goals.