Fisher Precious Metals is a beacon for those interested in commodity diversification. Established with a focus to secure asset management and simplifying IRA gold investing, this prestigious company offers a diverse range of bullion bars and coins for the discerning investor.

Notably, their competence in gold and silver trading enables clients to achieve their financial goals through tangible assets. Fisher Precious Metals exudes confidence in a complicated market, providing insight that is as dazzling as the metals they trade.

Company’s Background and Reputation

Forging a distinguished route within the precious metals sector, Fisher Precious Metals was founded on the vision of guiding investors through the terrain of investment options, strongly entrenched in the wisdom and insights of its founders, Lynn and John Fisher.

Positioning itself as a beacon of knowledge and dependability, the company has thrived not only in trade but also in maintaining a high degree of confidence among its customers. The Fishers set out on a mission to provide more than simply commodities, imbuing their company with a level of care and expertise that reflects their personal dedication to investor success.

Founding and Development

Lynn and John Fisher founded Fisher Precious Metals by combining their expertise in numismatics and precious metal trading to create a firm that values integrity and outstanding service.

Their effort has resulted in a company that provides smart ideas and tools to strengthen and diversify investor portfolios.

Accreditation and Industry Recognition

The Fishers’ extensive expertise of coin collection has earned them accolades from the American Numismatic Association, solidifying their image as reliable bullion brokers.

The Gemological Institute of America gives certificates that demonstrate the company’s caliber, as proven by its ability to assess and trade with unwavering accuracy.

The firm celebrates its achievement and recognition in the precious metals sector after being named USA Bullion Dealer of the Year for 2018.

Customer Feedback and Trust Ratings

Though consumer testimonials are sparse on feedback platforms such as Trustpilot and BBB, the brief but good reviews praise the company’s service quality and dependable counsel.

These insights reflect Fisher Precious Metals’ long-term impact on its clientele, even pointing to prospects for increased outreach to demonstrate the Fishers’ trust and contentment.

Investment Options for Fisher Precious Metals

Fisher Precious Metals is a premier location for broadening one’s investment portfolio, offering a wide range of investment-grade bullion and innovative asset types. Their extensive selection appeals to both experienced investors and those considering gold IRA options for the first time.

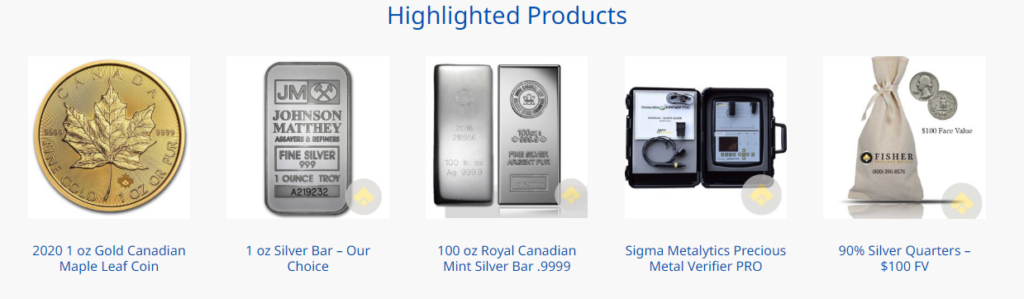

A Wide Range of Bullion Products

Fisher Precious Metals’ collection is centered around its extensive bullion choices. Investors can select from gold, silver, platinum, and palladium products, demonstrating their dedication to building a comprehensive precious metals portfolio. High-quality items are available in different forms, including:

Gold coins, bars, and rounds from prestigious international mints

Silver bullion offers a combination of collectability and investment value.

Premium platinum pieces bring a modern edge to wealth storage.

Palladium is considered an emerging asset in the precious metals market.

Exploring Precious Metals IRA.

Fisher Precious Metals takes a reinforced approach to retirement planning, offering not only gold IRA options but also comprehensive support. Clients are helped through the process of setting up a precious metals IRA, which includes:

Assistance in selecting IRA-approved bullion while adhering to IRS restrictions.

Collaboration with reliable IRA custodians.

Providing instructional tools about the benefits of integrating precious metals in retirement portfolios.

Unique offerings: Diamonds & Fine Jewelry

Aside from normal bullion selections, Fisher Precious Metals offers diamond investment pieces and beautiful jewelry. Unlike regular dealers, this extension gives investors with:

Elegant diamond jewelry that blend aesthetic enjoyment and investment worth.

Fine jewelry expertly designed to represent modern trends as well as timeless elegance.

Fisher Precious Metals does more than just trade commodities; they also emphasize their role as a facilitator of wealth growth by taking a diversified approach to precious metals and gemstone investments.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

Comprehensive Services and Advice.

Fisher Precious Metals’ service approach revolves around knowing the nuances and complexity of the precious metals industry. They prioritize providing honest precious metals guidance, guided by a strong client-first mindset.

This approach is exemplified by their provision of expert consulting suited to the specific needs of each investment.

Non-commissioned bullion traders

Fisher Precious Metals’ traders operate free of commissions, demonstrating their commitment to real advise. This policy of non-commissioned bullion advise ensures that all recommendations and strategies given with investors are objective and put the investors’ best interests first.

Fisher Precious Metals advocates for a transparent and trust-based relationship with their customers by avoiding commission-based incentives.

Guidelines for New Investors

New investors may find it difficult to enter the precious metals market. Understanding market trends, distinguishing various bullion types, and developing a successful investment strategy necessitates a strong support structure.

Recognizing this, Fisher Precious Metals experts provide individualized investment strategy advice, allowing investors to navigate the market with confidence. This meticulous and instructive approach defines the Fisher Precious Metals investment experience for both seasoned and new investors.

Personalized consulting to understand specific investment objectives.

Clear explanations of market dynamics and possible investment vehicles

Hands-on coaching in developing a diverse and robust precious metals portfolio

Their candid and comprehensive guidance reflects family wisdom, enhancing Fisher Precious Metals’ stability and integrity in the field of precious metals investing.

Security Measures for Safe Transactions

When it comes to precious metal transactions, investors are more concerned about the security and safety of these assets.

Fisher Precious Metals recognizes this need and hence provides powerful solutions to ensure that every transaction and storage choice is impenetrable, demonstrating their commitment to secure precious metals storage, insured investment protection, and safe bullion transfers.

Secure Storage Facilities

Fisher Precious Metals works with some of the world’s most reputable depositories, including Grand Cayman, Canada, and Delaware, which are well-known for their stability and security.

These businesses are fortified with cutting-edge security measures meant to prevent unwanted access, guaranteeing that clients’ important investments are constantly monitored and protected.

Ensure the Safety of Your Investment

Fisher’s commitment to their clientele includes a comprehensive insurance coverage that reinforces the protection of an investor’s money.

This insured investment protection covers the whole value of the precious metals in storage, providing investors with additional security and peace of mind knowing that their investments are not only physically but also financially protected.

Storage facilities employ multiple degrees of protection, such as biometric scanners, monitoring, and armed guards.

Clients are given a number of storage alternatives to meet their specific needs, whether personal allocation or commingled storage is preferred.

The confidentiality of the investor’s holdings is carefully preserved, assuring privacy and discretion in all storage-related problems.

With these secure and thorough precautions in place, investors may engage in safe bullion transactions and be confident that their precious metals are in safe hands.

Fisher Precious Metals Review: Analyzing Customer Experience

When considering investing in precious metals, prospective clients frequently seek reassurance in the form of customer satisfaction surveys and in-depth precious metals dealer assessments. Fisher Precious Metals, founded in 2007, has gained prominence for its client interactions and investment products.

Although there aren’t many, the client testimonials available, particularly those on the Better Business Bureau, reflect positively on the dealer’s devotion to service quality.

Positive reports express a sense of trust and expertise in transactions, emphasizing the advisors’ knowledge and patience.

Some clients like the straightforwardness and clarity of information, which allows them to make informed financial decisions.

Long-term clients value consistency of service and the knowledge that their portfolios are managed with integrity.

However, the little online presence in terms of extensive consumer feedback suggests a narrow clientele. Fisher Precious Metals’ constant, yet low number of reviews indicates consumer satisfaction, but it also emphasizes the need for greater interaction for a more thorough evaluation.

Thus, ambitious investors may discover a trustworthy partner in Fisher Precious Metals, but as with any investment venture, they should examine the breadth of existing experiences and complete their due research.

Fisher Precious Metals stands out in the financial sector for its unwavering dedication to delivering transparent pricing for its precious metal products. This transparency is critical for investors because it develops confidence and enables a complete grasp of the investment cost structure.

The company’s commitment to delivering a buyer-friendly policy guarantees that all parties are aware of the financial implications before entering into a deal.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Understanding Fisher Precious Metals Pricing

The company’s attitude to precious metals pricing transparency is highlighted by their easily accessible product pricing sheet, which is available for review on their official website.

This page completely shows the prices for various metals, providing complete disclosure of expenses and fees related with each commodity. This visibility into pricing enables investors to make informed decisions that align with their financial strategies.

First-Time and Subsequent Order Policy

Fisher Precious Metals offers personalized order policies for both new and repeat investors. For individuals new to the precious metals market, a $5,000 minimum order quantity is required, laying the groundwork for a strong investing portfolio.

In contrast, subsequent orders are not subject to such a minimum, giving investors greater flexibility and the ability to change their holdings in response to changing market conditions.

Pros and Cons of Choosing Fisher Precious Metals

Understanding the benefits and potential drawbacks of any financial partner is crucial for making informed trading selections in the domain of precious metals investment. Fisher Precious Metals offers a compelling combination of both.

Investing with Fisher Precious Metals has several advantages, including:

Pros

- An vast and diverse inventory that caters to a variety of investment demands, allowing for a customized portfolio.

- IRA-approved goods for tax-efficient retirement planning.

- A framework with non-commissioned bullion traders, ensuring guidance based on client needs rather than prospective commissions.

- Investors have access to a variety of storage alternatives, including secure vaulting in many locations.

- Individuals may face potential downsides, such as:

Cons

- A reduced volume of online customer reviews, which may not provide the detailed feedback that certain investors seek.

- A possibly complex price structure that may necessitate a closer study to fully grasp.

- Finally, while there are some aspects that may concern some investors, Fisher Precious Metals’ commitment to transparency and consumer education greatly aids in making sound investment decisions.

They prioritize establishing a balance between easily available investing possibilities and vigilant asset protection.

Conclusion

In conclusion, Fisher Precious Metals shines up as a complete guide for both seasoned investors and novices wanting to navigate the market’s complexity.

The company offers a wide range of bullion products, from standard gold and silver to more specialized options such as palladium and platinum, demonstrating a commitment to strategic asset diversification.

Fisher Precious Metals has gone to considerable measures to protect every transaction and investment, prioritizing client confidence and security. Their open pricing plan demonstrates their trustworthiness, providing potential investors with a clear and upfront cost structure with no hidden costs.

This kind of transparency promotes trust and client pleasure, both of which are essential components of any financial relationship.