Gold Avenue offers a compelling opportunity for me as an investor seeking to diversify my portfolio through precious metals.

This resource delves into the inner workings of Gold Avenue, outlining the various products available, including gold and silver bars as well as coins. It also addresses the benefits and risks of investing through this platform, providing me with guidance on how to open an account and the associated fees.

With insights drawn from customer reviews, I can gain a comprehensive understanding of whether Gold Avenue aligns with my investment objectives.

What Is Gold Avenue?

Gold Avenue is an innovative online platform designed to streamline the buying and selling of gold and other precious metals. This platform serves as an attractive investment option for individuals seeking to diversify their portfolios and enhance their financial stability.

With a user-friendly interface and a strong market reputation, Gold Avenue ensures a seamless experience for investors at all levels.

How Does Gold Avenue Work?

Gold Avenue serves as a user-friendly online platform that enables me to navigate the trading landscape of gold and other precious metals with ease. The account setup process is straightforward, and the transaction procedures are streamlined for efficiency.

The platform provides a range of tools for investment analysis, ensuring that I can make well-informed decisions in the dynamic gold market.

What Are the Products Offered by Gold Avenue?

At Gold Avenue, they offer a diverse range of products tailored for investors, which includes various forms of physical gold, such as gold bars and gold coins, along with silver bars and coins. This selection accommodates different investment strategies and preferences within the precious metals market.

Each product presents unique advantages regarding liquidity and asset diversification, making them appealing to both new and seasoned investors alike.

1. Gold Bars

I recognize that gold bars are a popular investment option provided by Gold Avenue, offering investors a tangible asset that has historically served as a reliable store of value during uncertain economic times. These bars are available in various weights and purity levels, which allows me to tailor my investment size and strategy according to my financial goals.

Along with their historical stability, I value that investing in gold bars offers exceptional liquidity, making it straightforward for me to buy or sell as market conditions change. Holding gold physically provides me with a sense of security that is particularly reassuring during turbulent times. I also appreciate the various storage options available, whether in secure vaults offered by banks or private services, which help mitigate the risks associated with theft or loss.

Including gold in my investment portfolio can be a strategic decision, as it often functions as a hedge against inflation and market volatility. This solidifies its role as a critical component for anyone looking to diversify their assets effectively.

2. Gold Coins

I view gold coins offered by Gold Avenue as both collectibles and strategic investments, often considering them a reliable hedge against inflation and economic instability. Their intrinsic value as gold bullion, along with their historical significance, makes these coins an appealing option for those looking to diversify their portfolios.

Over the years, I have observed various types of gold coins emerge, each with unique features and historical contexts. From classic bullion coins to limited edition pieces, these coins not only showcase exquisite artistry but also reflect market trends and investment objectives from different eras.

For example, the iconic American Gold Eagle and the South African Krugerrand have significantly influenced modern investment strategies. I recognize that as economic conditions fluctuate, the demand for tangible assets like gold coins can surge, offering a sense of security during uncertain times.

As a result, I believe that carefully selected gold coins can be a vital component of a well-balanced investment portfolio.

3. Silver Bars

I recognize that silver bars present a valuable investment option through Gold Avenue, enabling me to incorporate precious metals into my portfolio at potentially lower costs compared to gold. These bars not only enhance diversification but also serve as a hedge against market fluctuations.

In recent years, I’ve observed a significant surge in demand for silver, driven by its various industrial applications and an increasing interest among investors like myself who are looking to diversify their assets. Silver bars typically carry lower premiums than coins, making them an appealing choice for both new and experienced investors.

Before making a purchase, I understand the importance of considering factors such as storage solutions and security, as physical silver requires proper safeguarding. Additionally, I recognize that liquidity can fluctuate based on market conditions, so it’s crucial for me to understand how easily I can convert silver bars to cash as part of my overall investment strategy.

4. Silver Coins

Silver coins available through Gold Avenue offer me an excellent opportunity to enhance the diversity of my investment portfolio by combining the advantages of tangible assets with the aesthetic appeal of numismatic value. These coins represent a practical choice for those of us looking to invest in liquid assets that reflect market demand.

Among the various types available, I can choose from historical pieces to contemporary bullion coins, each catering to different collector preferences and investment strategies. Every coin not only possesses intrinsic silver value but also has the potential to appreciate based on its rarity and demand, which can significantly enhance my returns.

By incorporating silver coins into my investment portfolio, I can effectively hedge against market volatility while benefiting from the tangible nature of these assets. Their liquidity allows for easy buying and selling, making them a strategic asset for anyone who values adaptability in investment analysis.

What Are the Benefits of Investing in Gold Avenue?

Investing in Gold Avenue offers a range of benefits that meet various investor needs. This includes exceptional customer support, extensive educational resources, and the potential for substantial capital growth through precious metals such as gold and silver.

These advantages play a crucial role in promoting financial stability and creating a well-rounded investment portfolio.

1. Diversification of Portfolio

One of the primary benefits I see in investing in Gold Avenue is the opportunity to diversify my portfolio with precious metals, which can serve as a hedge against inflation and market volatility. By allocating assets in gold and silver, I can enhance my overall investment strategy and improve my risk management.

This approach not only strengthens the resilience of my investment portfolio but also provides a safety net during uncertain economic times. Incorporating these precious metals allows for better asset management, ensuring that fluctuations in traditional markets do not disproportionately impact my wealth.

As part of my comprehensive financial planning strategy, gold and silver serve as stability anchors, helping to mitigate risks associated with equities and bonds. This dual-pronged approach to diversification effectively safeguards my investments, making it a prudent choice for securing my financial future.

2. Protection Against Inflation

Investing through Gold Avenue provides a robust safeguard against inflation, as precious metals like gold have consistently maintained their value, particularly during periods of economic uncertainty. This characteristic makes gold an attractive option for investors looking to protect their wealth.

Gold’s role as a hedge against inflation is rooted in its intrinsic value, which remains resilient against currency fluctuations and economic downturns. When central banks increase the money supply to foster growth, the purchasing power of fiat currency typically diminishes, prompting many investors to seek gold as a stable alternative.

Historical instances, such as the hyperinflation in Germany during the Weimar Republic or the oil crisis of the 1970s, illustrate how gold has effectively preserved wealth when traditional assets have struggled. Its limited supply, coupled with steady demand, positions gold as a distinctive investment that can serve as a bulwark against inflationary pressures that may threaten economic stability.

3. High Liquidity

One significant advantage I find in investing with Gold Avenue is the high liquidity of precious metals, which allows me to quickly buy or sell assets based on market conditions. This feature is crucial for capitalizing on investment opportunities in a timely manner.

Having access to a liquid market give the power tos me to strategize effectively and make informed decisions as prices fluctuate. Gold Avenue provides seamless market access, enabling me to engage in trading with ease and confidence.

This not only enhances my ability to respond to emerging trends but also minimizes the risks associated with prolonged holding periods. As my investment strategies evolve, the capability to efficiently navigate the market landscape becomes increasingly valuable, making precious metals an attractive asset class for those of us seeking stability and growth.

4. Potential for High Returns

Investing in Gold Avenue offers the potential for high returns, especially during periods of market volatility when demand for precious metals tends to increase. This dynamic can greatly enhance the return on investment for informed investors like myself.

As economic uncertainty persists, I find that many individuals are increasingly viewing gold as a safe haven asset. The stability that gold provides often results in an appreciation in value, making it an appealing choice for those looking to strengthen their portfolios.

Market trends suggest that during economic downturns, traditional investments such as stocks may struggle, while gold typically demonstrates resilience. This countercyclical behavior allows for a more favorable investment outlook. By incorporating gold into a diversified strategy, I can effectively hedge against risks and optimize overall returns.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Are the Risks of Investing in Gold Avenue?

Investing with Gold Avenue presents numerous benefits; however, it is crucial for me to consider the associated risks, such as market fluctuations and the potential costs linked to storage and insurance.

Conducting a thorough risk assessment allows me to navigate these challenges effectively while ensuring compliance with relevant regulations.

1. Market Fluctuations

Market fluctuations represent a significant risk factor when I consider investing in Gold Avenue, as the prices of gold and silver can change rapidly due to global events and economic indicators. It is essential for me to remain aware of these price fluctuations in order to make informed investment decisions.

Understanding how these fluctuations occur is crucial for anyone, including myself, who intends to navigate the complex landscape of precious metal investments. Various factors, such as inflation rates, currency strength, geopolitical tensions, and shifts in demand, can significantly influence gold prices.

For a strategic investment analysis, I find it essential to monitor market trends and assess the potential risks associated with timing and portfolio allocation. By employing various hedging strategies or diversifying my investments, I can mitigate the adverse effects of volatility while also capitalizing on the growth potential that gold often presents during uncertain times.

2. Storage and Insurance Costs

Investing in physical gold through Gold Avenue entails storage and insurance costs that can affect my overall investment returns. It is essential for me to understand these expenses for effective financial planning and portfolio management.

When I consider gold purchases as part of my investment strategy, I keep in mind that these costs can vary significantly based on the storage facility I choose and the level of insurance coverage I require. For example, opting for higher security measures, such as vault storage in fortified facilities, may result in increased monthly fees that could diminish my potential profits. Additionally, ensuring adequate insurance to protect against theft or damage contributes to the overall financial commitment.

By carefully assessing these factors, I can make informed decisions that strike a balance between the appeal of physical gold as a safe haven asset and the implications of cost management on my portfolio’s growth.

3. Counterparty Risk

Counterparty risk is an important consideration when I invest in Gold Avenue, as it pertains to the reliability and trustworthiness of the platform and its associated entities. It is essential for me to ensure that I am dealing with a reputable platform to effectively mitigate this risk.

This necessitates conducting thorough research into the platform’s compliance with industry standards, as well as evaluating its risk management protocols. I look for transparency in operations, adherence to regulations, and a proven history of positive customer experiences. By scrutinizing the platform’s financial health and the credibility of its partners, I can gain valuable insights into its reliability.

Understanding how well Gold Avenue safeguards assets against default provides me with further assurance. Ultimately, assessing these factors enables me to make informed decisions and fosters confidence in my investment choices.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

How to Open an Account with Gold Avenue?

Opening an account with Gold Avenue is a straightforward process that enables me to swiftly embark on my journey in trading precious metals. The onboarding experience is designed to be user-friendly, and I appreciate the comprehensive customer support available to assist me throughout the setup.

What Are the Fees and Charges?

I find that understanding the fees and charges associated with Gold Avenue is essential for making informed investment decisions, as these costs can significantly affect overall returns and investment strategies.

Gold Avenue prioritizes transparency in its fee structure, ensuring that I am well-informed about trading fees, storage costs, and any additional charges that may apply.

Is Gold Avenue a Reliable and Safe Platform for Investing?

When evaluating an investment platform, I find that the reliability and safety of Gold Avenue are crucial factors that significantly influence investor confidence. With its stringent security measures and commitment to regulatory compliance, Gold Avenue provides a secure environment for trading precious metals.

What Are the Customer Reviews and Ratings for Gold Avenue?

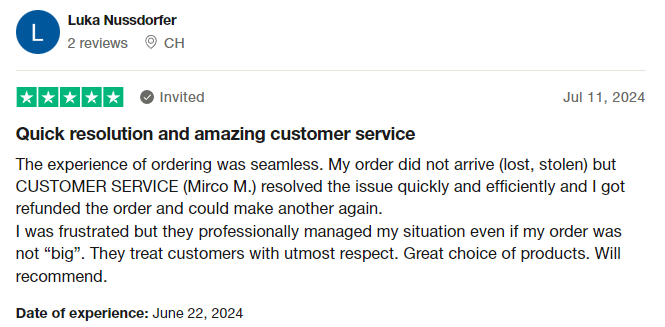

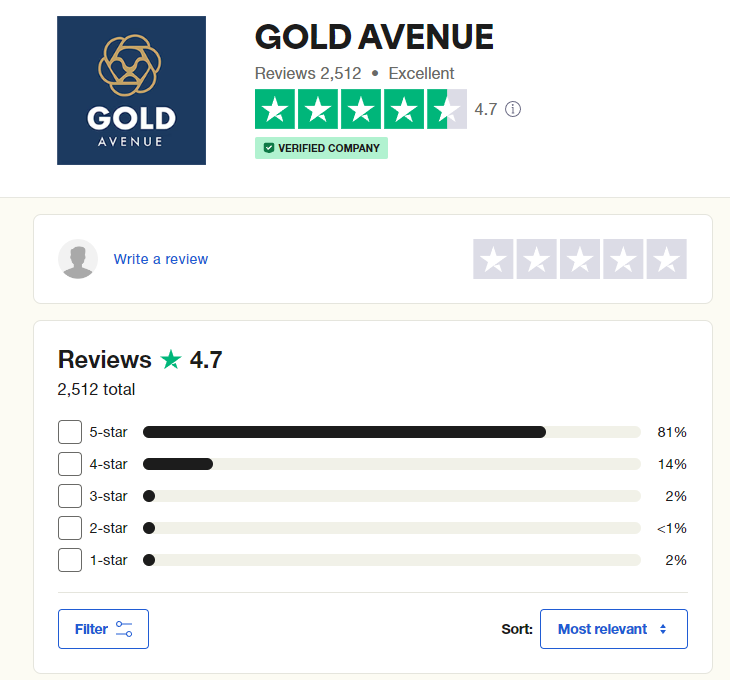

I find that customer reviews and ratings for Gold Avenue offer valuable insights into the user experience and satisfaction levels of investors who have engaged with the platform for buying and selling gold.

By analyzing these testimonials, I can help prospective users assess the platform’s reputation and overall performance.

Frequently Asked Questions

What is Gold Avenue Review?

Gold Avenue Review is a platform that offers reviews and analysis on various gold-related products and services.

How does Gold Avenue Review conduct its reviews?

Gold Avenue Review conducts thorough research and analysis, taking into consideration factors such as product quality, customer feedback, and industry reputation.

Can I trust the reviews on Gold Avenue Review?

Yes, you can trust the reviews on Gold Avenue Review. Our team of experts ensures unbiased and accurate information to help you make informed decisions.

Is Gold Avenue Review affiliated with any gold-related products or services?

No, Gold Avenue Review is an independent platform that aims to provide objective reviews and analysis for the benefit of consumers.

Are there any fees for using Gold Avenue Review?

No, Gold Avenue Review is completely free to use. We do not charge any fees for accessing our reviews and analysis.

How often are the reviews on Gold Avenue Review updated?

We strive to keep our reviews and analysis up-to-date. We regularly monitor and update information to provide our readers with the most current and accurate data.

Gold Avenue

Is Gold Avenue a reliable coin dealer? What are their pros and cons? Find out the answer in this Gold Avenue review.

Product In-Stock: InStock

4