Disclaimer: We may receive compensation from some or all of the companies mentioned here, at no expense to our readers. This enables us to provide our reporting free of charge. The compensation and our detailed analysis influence the order in which companies are presented below.

In today’s ever-changing financial world, I’ve realized that securing my wealth from market volatility and inflation is crucial. That’s where Gold Safe Exchange comes in for me—it provides a really straightforward platform for buying, selling, and storing gold, which is great for both seasoned investors like me and those just starting out.

I want to dive into what Gold Safe Exchange is all about, including its features, safety measures, and all the perks that come with using this service. Whether I’m looking to diversify my assets or safeguard my financial future, understanding Gold Safe Exchange is key to enabling my investment journey.

Make sure your hard-earned money is protected with a Gold IRA

Gold IRAs help you protect your investments by providing the asset diversification and stability you need. Click on your state to get started.

What is Gold Safe Exchange?

Gold Safe Exchange is my go-to online trading platform for buying and selling precious metals, especially gold. It creates a secure and trustworthy environment that puts both buyers and sellers at ease.

As an investor, I love the variety it offers—whether I’m looking for gold bars, coins, or gold-backed assets, I can find just what I need to diversify my investment portfolio and protect my assets, especially when the market gets a bit shaky or inflation rears its head.

Plus, I’ve discovered the perks of adding gold to my Individual Retirement Accounts (IRAs) for some solid long-term financial security.

How Does Gold Safe Exchange Work?

I love using Gold Safe Exchange because it’s such a user-friendly trading platform. It makes buying, selling, and trading gold and other precious metals super easy with just a few simple steps.

The journey starts with setting up my account, where I can securely deposit funds and dive into a variety of options for gold transactions. Whether I’m interested in physical gold or digital gold, I know I have access to liquidity and the market, making it a great choice for any investor like me.

What Are the Features of Gold Safe Exchange?

I really appreciate all the key features that Gold Safe Exchange offers, which definitely enhance my experience while trading gold and precious metals securely and efficiently.

The user-friendly interface makes it a breeze for me to navigate, and the instant exchange capabilities mean I can jump on opportunities right away.

Plus, the secure storage options give me peace of mind knowing my investments are safe.

With competitive fees, each transaction feels seamless and hassle-free, making my trading journey much smoother.

1. Secure Storage

One of the things I really appreciate about Gold Safe Exchange is its secure storage solutions. They give me peace of mind knowing my gold investments are well-protected. The platform sticks to industry standards for compliance and even offers insurance options to cover potential risks, so I can relax knowing my assets are safe and sound.

I can’t stress enough how crucial secure storage is for gold assets. It not only protects my physical holdings from theft or damage but also reassures me that I’m meeting all regulatory requirements. With state-of-the-art security protocols like monitored vaults and advanced access controls, I know they’re keeping the storage environment secure.

Plus, the comprehensive insurance coverage adds another layer of protection. It allows me to feel confident that if the unlikely were to happen and I faced a loss, I could recover the value of my investments quickly. These measures aren’t just smart; they follow best practices in asset management and highlight how important it is to safeguard precious investments in today’s uncertain financial landscape.

2. Instant Exchange

The instant exchange feature of Gold Safe Exchange is a game changer for me. It lets me quickly jump into transactions, giving me immediate access to the gold market and boosting overall liquidity. Whether I’m buying gold bars or selling bullion, I can do it without any unnecessary delays, which really maximizes my trading potential.

With this instant exchange functionality, my transactions are processed almost in real-time. That means I spend way less time waiting around compared to traditional gold trading. I can hop on advantageous market conditions right away, ensuring I don’t miss out on price fluctuations that could impact my investments.

This feature really opens up the market for me, allowing me to trade seamlessly no matter where I am or what time it is. As a result, being able to execute trades quickly creates a more dynamic trading environment, which optimizes both my profitability and efficiency in gold investment strategies.

3. Low Fees

I take pride in knowing that Gold Safe Exchange offers low fees for its transactions, which makes it a great choice for both newbies and seasoned investors in the precious metals market. This cost-effective approach really helps me keep more of my profits, which is super important for managing my portfolio effectively and sticking to my long-term investment strategies.

By keeping my fees lower than many competitors, I feel confident that the platform is dedicated to my financial security and maximizing my investment potential. It’s reassuring to know that those reduced transaction costs mean I can funnel more of my capital into buying precious metals, which only boosts the value of my overall portfolio.

In an industry where fees can often chip away at my hard-earned gains, Gold Safe Exchange really stands out. It offers a sustainable model that supports wealth-building for anyone who gets the delicate balance of investing in precious metals.

4. User-Friendly Interface

The user-friendly interface of Gold Safe Exchange makes trading a breeze for me. I can easily navigate through all its features without breaking a sweat. Whether I’m setting up my account or making transactions, the platform really focuses on transparency and providing a great customer experience, which is perfect for both newbies and seasoned pros like me.

This intuitive layout not only keeps me satisfied but also helps newcomers hit the ground running, boosting their confidence as they dive into trading tools. Whenever I need help, the responsive customer service is right there, ready to assist, which definitely enhances my overall experience.

Plus, the platform offers a bunch of comprehensive educational resources that enable me to make informed trading decisions. It really shows their commitment to building a knowledgeable trading community. All of this comes together to create a positive environment where I feel enableed to explore and seize market opportunities.

5. Multiple Currencies Supported

I love that Gold Safe Exchange supports multiple currencies, which makes it super easy for me to engage in transactions in a global marketplace and cater to international buyers. This flexibility really enhances the platform’s accessibility and opens up a ton of trading opportunities in gold and other precious metals.

By accommodating different currencies, I find that the platform simplifies cross-border transactions. It attracts a diverse group of users like me who want to invest in precious metals without worrying about pesky currency conversion fees. This inclusivity keeps me in tune with emerging international trading trends, giving me an edge in the competitive market.

Plus, having multiple payment options boosts my confidence because I can pick the most convenient and cost-effective solution for my needs.

Ultimately, this versatility expands market access for me and opens up a world of investment opportunities to explore globally.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

Is Gold Safe Exchange Safe to Use?

When I think about investing in precious metals, safety is always at the forefront of my mind. That’s why I appreciate how Gold Safe Exchange prioritizes security.

They’ve put in place solid security measures and follow all the regulatory guidelines, which really helps create a trustworthy environment for people like me. Plus, I’ve seen plenty of positive customer reviews that emphasize their commitment to user safety, making it clear that they’re dedicated to providing a secure trading experience.

1. Regulation and Compliance

I run Gold Safe Exchange with a strong focus on regulatory compliance and industry standards because I believe it’s essential for ethical investing in precious metals. This commitment helps ensure that all transactions are fair and transparent, giving users the confidence they need to dive into the marketplace.

Regulatory compliance isn’t just about protecting users; it also creates a culture of integrity within the industry. By sticking to these guidelines, I’m reinforcing my dedication to ethical investing, making sure clients can trust that their investments are secure and managed responsibly.

In a time when consumers are more cautious about the ethical implications of their financial choices, this level of transparency is incredibly important. When investors know their transactions are backed by strict regulations, it really boosts trust in the marketplace, leading to a stronger and more credible investment environment.

2. Security Measures

The security measures at Gold Safe Exchange are pretty impressive, making sure my account stays safe and my data is protected throughout the trading process. They’ve got everything from advanced authentication techniques to insurance options for stored gold, which really boosts my confidence and shields my investments from potential risks.

With multi-factor authentication in place, I feel like there’s an extra layer of protection that makes unauthorized access almost impossible. They also have continuous monitoring systems that catch any suspicious activity in real time, so they can jump in quickly if something seems off.

I can’t stress enough how important these risk management strategies are. They give me peace of mind, knowing my financial assets are safe from theft and fraud. Plus, the insurance coverage for stored assets adds another layer of security, reassuring me that my investments are protected against any surprises that might pop up.

All of these initiatives not only build my trust but also create a secure trading environment I can rely on.

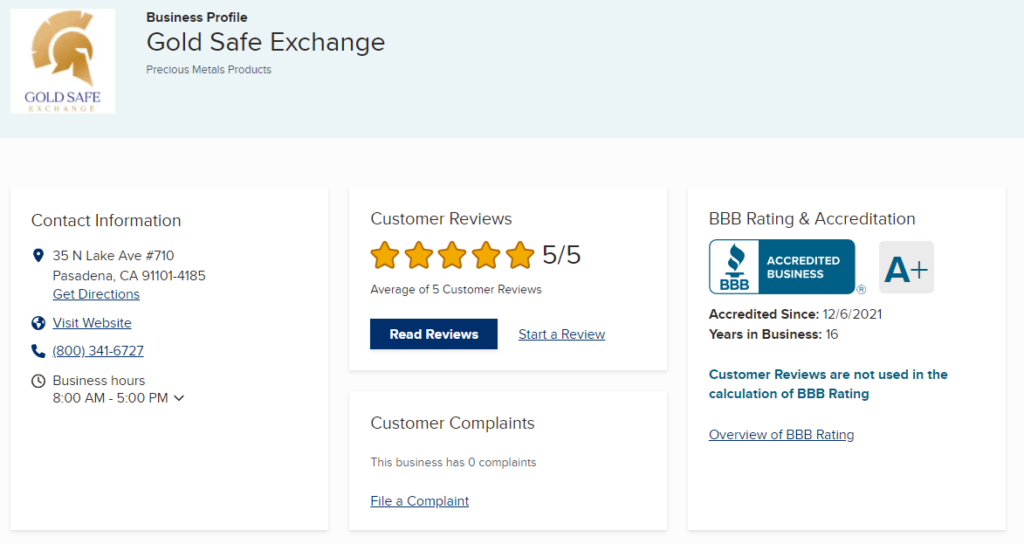

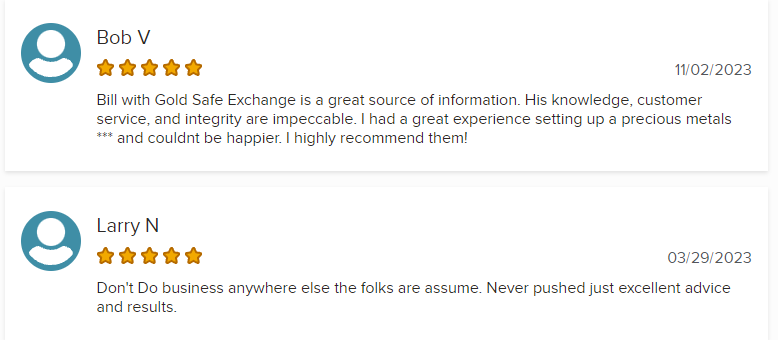

3. Customer Reviews

Customer reviews are super important for shaping the reputation of Gold Safe Exchange. They give potential users a peek into the overall user experience. I’ve noticed that many reviews rave about the platform’s reliability, customer service, and commitment to security, which helps build trust among buyers and sellers in the precious metals market.

By diving into user feedback, I can get a sense of how satisfied others are, which is really helpful when I’m making a decision. While there are plenty of positive comments about seamless transactions and great customer support, I’ve also seen some users raise concerns about issues like delivery times and pricing transparency.

It’s crucial for Gold Safe Exchange to tackle these complaints head-on. By resolving them quickly, they not only boost user satisfaction but also improve their overall business practices. This helps create a community of confident buyers and sellers who can trade without any worries.

How to Sign Up for Gold Safe Exchange?

Signing up for Gold Safe Exchange is super easy. I can quickly set up my account and start diving into the investment potential of gold and precious metals.

The whole user experience is designed to be smooth, walking me through every step from registration to my first transaction. It really helps me feel equipped to make informed decisions along the way.

How to Buy and Sell Gold on Gold Safe Exchange?

Buying and selling gold on Gold Safe Exchange is super easy and intuitive, which makes me feel confident navigating the trading platform.

Whether I’m interested in investing in gold bars, coins, or gold-backed assets, the platform offers clear guidance that helps me execute transactions efficiently and securely.

What Are the Benefits of Using Gold Safe Exchange?

Using Gold Safe Exchange has so many benefits for anyone looking to invest in gold and precious metals. It’s a great option whether you’re just starting out or you’ve been in the game for a while.

I appreciate how it helps with asset protection and offers the potential for long-term gains. The platform makes trading super smooth, plus it gives me access to important resources that help me make informed decisions.

1. Diversification of Assets

One of the main reasons I love using Gold Safe Exchange is the chance to diversify my assets, which is super important for managing my portfolio effectively. By adding gold and precious metals to my investment strategies, I can balance out risks and boost my overall financial security, especially when the market gets a bit shaky.

This smart allocation helps me cushion potential losses and makes my portfolio more resilient against unexpected economic changes. I’ve noticed more and more investors are catching on to the idea of mixing different asset classes because it can really lead to more stable returns over time.

Gold Safe Exchange gives me a solid platform to access gold and other precious metals, acting as a great hedge against inflation and currency fluctuations. By weaving these assets into my investment mix, I can manage risks better, promote long-term economic stability, and keep my financial goals on track, no matter what the market throws my way.

2. Protection Against Inflation

Investing in gold through Gold Safe Exchange feels like a smart move for me, especially when it comes to protecting against inflation and preserving my wealth. With all the ups and downs in the economy, I find that gold-backed assets really serve as a solid hedge against inflation. They seem to maintain value and offer some much-needed stability during uncertain times.

Looking back at the historical price trends of gold, it’s clear that it has a knack for resilience, especially during economic turmoil and market volatility. When inflation rates creep up, I notice that the purchasing power of regular currency often takes a hit, but the intrinsic value of gold usually climbs. This just highlights how important it is to secure financial assets that are likely to appreciate when things get tough.

By choosing gold, I can not only protect my wealth but also enjoy some peace of mind, knowing that I’m relying on a strategy that has stood the test of time for economic stability. Insights from market analysts back this up too, suggesting that adding gold to my investment portfolio is a key step toward achieving lasting financial security.

3. Potential for High Returns

The potential for high returns makes Gold Safe Exchange super appealing for me as an investor looking to dive into the precious metals market. By keeping myself in the loop with market analysis and price fluctuations, I can make smart decisions that boost my investment potential and maximize those gains.

This platform not only gives me the chance to diversify my portfolio but also helps me tap into effective investment strategies. As market trends shift, I can keep an eye on key indicators that signal the right moments to buy or sell. Doing my homework allows me to spot accurate forecasts, helping me manage risks and jump on favorable opportunities.

By leveraging insights from historical data and current events, I can position myself strategically to capitalize on gold’s intrinsic value and hedge against economic uncertainties. In the end, that all adds up to enhanced profitability for me.

4. Easy Access to Gold Market

Gold Safe Exchange makes it super easy for me to dive into the gold market, letting me trade online without all the hassle that usually comes with traditional investing. I love that this accessibility puts me in the driver’s seat when it comes to my investment strategies, giving me a chance to explore the lucrative world of precious metals.

With their intuitive platform, I can quickly navigate market trends and execute trades in no time, which means I won’t miss out on any prime investment opportunities. The platform is packed with handy trading features, like real-time market analytics, customizable alerts, and a smooth transaction process that really makes my experience enjoyable.

Thanks to advanced technology, Gold Safe Exchange doesn’t just simplify trading; it also boosts transparency, making it much easier for me to make informed decisions. Whether I’m a newbie or a seasoned pro, the ease of online trading opens up the gold market and puts significant resources right at my fingertips.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What is Gold Safe Exchange Review?

Gold Safe Exchange Review is a comprehensive evaluation and analysis of the Gold Safe Exchange platform, a popular online platform for buying and selling gold.

Is Gold Safe Exchange a safe platform?

Yes, Gold Safe Exchange is a safe and secure platform for buying and selling gold. It uses advanced security measures to protect user data and transactions.

How does Gold Safe Exchange work?

Gold Safe Exchange works by connecting buyers and sellers of gold on its platform. Users can buy and sell gold directly with each other, with the platform acting as a mediator to ensure a safe and smooth transaction.

What are the fees for using Gold Safe Exchange?

Gold Safe Exchange charges a small transaction fee for each completed trade. The exact fee depends on the amount and type of gold being bought or sold.

Can I trust the sellers on Gold Safe Exchange?

Gold Safe Exchange verifies all sellers on its platform to ensure they are legitimate and trustworthy. Additionally, users can leave reviews and ratings for sellers, making it easier to find reliable sellers.

Is Gold Safe Exchange only for buying and selling gold?

No, Gold Safe Exchange also offers other features such as live gold price tracking and educational resources on investing in gold. It is a comprehensive platform for all things related to gold trading.