In an ever-changing financial landscape, I have observed that many investors are increasingly turning to precious metals as a reliable means of securing their wealth.

Goldcore stands out as a prominent player in this sector, providing a variety of services designed to assist individuals in navigating the world of gold and silver investment.

This article aims to clarify what Goldcore is, assess its legitimacy, and outline the range of services it offers, including bullion purchases, Precious Metals IRAs, and expert investment advice.

Additionally, it will discuss the benefits and risks associated with using Goldcore, allowing me to evaluate whether it aligns with my investment strategy.

What is Goldcore?

Goldcore is a leading investment platform specializing in gold and precious metals. Their focus is on providing investors with a reliable means of portfolio diversification and financial security.

Established to meet the increasing demand for gold investment, Goldcore offers a range of services tailored to the needs of both novice and experienced investors, ensuring secure transactions and compliance with industry standards.

They concentrate on gold bullion, sourcing high-quality gold products to help clients safeguard their assets against market volatility and inflation risks. In a global market marked by uncertainty, I believe investing with Goldcore is a prudent strategy for long-term wealth preservation.

Is Goldcore a Legitimate Company?

When evaluating the legitimacy of Goldcore, I believe it’s crucial to assess various factors, such as customer reviews and the company’s regulatory compliance. I have seen that Goldcore has received positive testimonials from clients who commend its customer service, transparency, and adherence to industry standards. The company’s reputation as a trustworthy online broker is further bolstered by its commitment to secure transactions and asset protection, allowing me to engage in gold trading with confidence and minimal concern about fraud.

Along with customer feedback, I find that examining Goldcore’s regulatory compliance provides deeper insights into its legitimacy. The firm operates under stringent regulations, which enhances investor confidence and helps mitigate the risks associated with gold investments.

Furthermore, the industry awards and recognitions for outstanding service clearly reflect Goldcore’s dedication to excellence. Analyzing Goldcore’s ratings in the context of prevailing market trends further underscores its position as a reliable player in the gold investment arena.

Ultimately, the combination of regulatory adherence, customer satisfaction, and industry accolades positions Goldcore as a credible option for anyone navigating the complexities of gold trading.

What Services Does Goldcore Offer?

They provide a comprehensive range of services tailored to meet the diverse needs of investors interested in precious metals and gold investment. Their offerings include access to gold bullion, the establishment of precious metals IRA accounts for tax-advantaged savings, and professional investment advice to help clients navigate the complexities of the gold market.

Additionally, They offer market analysis and educational resources to enhance the user experience and inform investment strategies, ensuring that clients can make well-informed decisions about their portfolios.

1. Gold and Silver Bullion

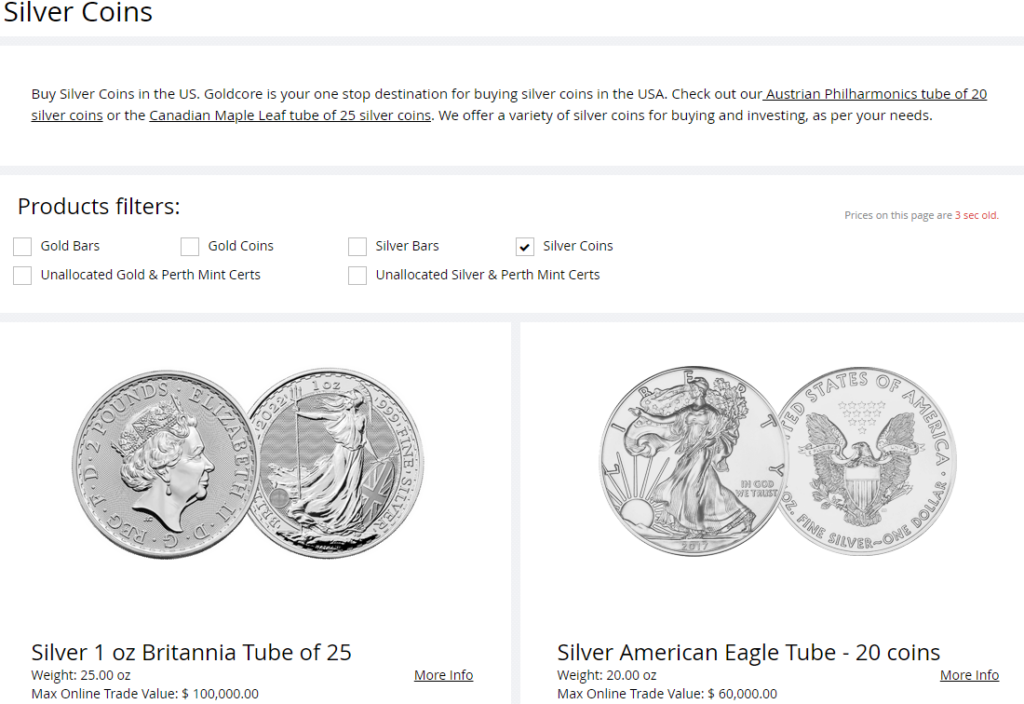

At Goldcore, they offer an extensive selection of gold and silver bullion, catering to both seasoned investors and newcomers to precious metals. Clients can easily purchase gold bullion in various forms, including coins and bars, ensuring they find the right products to meet their investment needs. Additionally, their platform facilitates the selling of gold and silver bullion, providing competitive pricing and a streamlined trading experience.

The range includes popular options such as the American Gold Eagle and Canadian Maple Leaf coins, along with larger gold bars for those interested in making significant investments. These forms of bullion not only represent tangible assets but also serve as a hedge against market volatility, potentially enhancing gold investment returns over time.

By diversifying with precious metals, investors can reduce overall portfolio risk while capitalizing on favorable gold pricing trends, which often move inversely to equities. Incorporating both gold and silver into one’s investment strategy offers a balanced approach to wealth preservation and growth.

2. Precious Metals IRA

They offer the option to set up a Precious Metals IRA, which provides investors with a distinctive opportunity to integrate gold and silver into their retirement planning. This type of IRA enables tax-advantaged growth while offering protection against market volatility and inflation. By investing in physical precious metals within an IRA account, I can enhance my financial security and diversify my retirement portfolio.

The setup process is straightforward, making it accessible even for those who may be new to investing in precious metals. Typically, I start by selecting a trustworthy custodian to manage my IRA and then determine the minimum investment required by Goldcore.

Incorporating gold investment strategies not only helps safeguard my wealth but also aligns well with effective financial planning. As you navigate through economic uncertainties, these tangible assets serve as a hedge, ultimately resulting in a more resilient retirement strategy. This proactive approach gives you the power to take charge of your financial future, ensuring that your retirement savings are not just preserved but also positioned for potential growth.

3. Storage and Delivery

At Goldcore, they prioritize the security of their clients’ investments by providing reliable gold storage options and efficient delivery services. Customers have the flexibility to choose between allocated and unallocated storage solutions, ensuring that their gold is stored safely and in compliance with industry standards. I take care to ensure secure transactions throughout the shipping and handling process, offering peace of mind for investors.

With a variety of facilities designed to protect precious metals, my clients can feel confident knowing their assets are stored under stringent security measures. These measures include advanced surveillance systems and secure access controls to minimize the risk of theft or loss.

Regarding logistics and delivery, they emphasize a streamlined withdrawal process tailored to meet the individual needs of each client. Whether it’s a straightforward request for a small quantity or a more substantial transaction, they remain committed to facilitating a smooth experience that prioritizes safety and reliability at every step.

4. Investment Advice

At Goldcore, they provide expert investment advice to assist clients in developing effective strategies that align with their financial goals. With access to comprehensive market analysis and insights from seasoned investment advisors, it enable clients to navigate the complexities of the gold market with confidence. This personalized guidance is essential for making informed decisions regarding the buying and selling of precious metals.

Goldcore understands that grasping the intricacies of market dynamics is vital for maximizing returns in any investment landscape. So, it offers a variety of trading tools that give the power to me to assess market conditions effectively.

Through diligent analysis, investors gain valuable perspectives on price trends and global economic factors that can influence market behavior. This comprehensive approach equips them with the knowledge necessary to capitalize on investment opportunities, ensuring their strategies are not just reactive but also proactive.

Ultimately, by leveraging the insights from Goldcore, investors can refine their strategies, adapt to shifting markets, and enhance my potential for financial growth.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

How Does Goldcore Work?

Understanding how Goldcore operates is essential for maximizing the benefits of its investment platform, which facilitates seamless online trading of gold and precious metals. The process entails creating a user account, selecting appropriate investment options, and executing trades informed by comprehensive market analysis and insights.

By utilizing the latest trading features and tools, I can effectively capitalize on market trends and enhance my overall trading experience.

1. Purchasing Precious Metals

Purchasing precious metals through Goldcore is a straightforward and user-friendly process that allows me to buy gold and silver with ease. The online broker offers an intuitive platform where you can view available products, compare pricing, and execute trades quickly, ensuring high liquidity and competitive pricing.

Navigating the platform is effortless, thanks to its well-organized layout that categorizes various metals and provides real-time market updates. You can easily manage your purchases and monitor changes in your gold investment returns.

Regarding payment options, Goldcore supports a variety of methods, enhancing the convenience of secure transactions, whether you choose bank transfers or credit card payments.

Understanding the importance of liquidity in the market is also critical, as it enables me to buy or sell assets swiftly without significantly impacting prices, ensuring that your trading experience remains both lucrative and seamless.

2. Setting up a Precious Metals IRA

Establishing a Precious Metals IRA with Goldcore is a streamlined process that significantly enhances my financial security as I seek to diversify my retirement portfolio. I find that navigating the compliance requirements is straightforward, allowing people to select their preferred precious metals to include in their IRA account.

To get started, I need to gather specific documentation, including identification, proof of address, and any prior retirement account statements. This information is essential for ensuring compliance with IRS regulations that govern IRA investments.

Once I have this documentation in order, I can collaborate with Goldcore’s asset management team to explore the various options available, including which types of precious metals align best with my investment strategy.

It is crucial for me to understand the fees associated with maintaining an IRA at Goldcore to make well-informed decisions. Ultimately, having a Precious Metals IRA not only serves as a hedge against inflation but also provides the potential for wealth accumulation over time.

3. Storing and Delivering Precious Metals

They offer secure storage and delivery options for precious metals, ensuring that the clients’ investments are well-protected and easily accessible. The delivery process is designed to be efficient, with clear communication regarding shipping and handling, allowing investors to track their assets at every stage.

Also, they provide various storage methods, including both allocated and unallocated options, to cater to different investment preferences and security requirements. I understand that the importance of security cannot be overstated; clients can have peace of mind knowing that their precious metals are stored in fortified facilities equipped with advanced surveillance systems.

When it comes time for delivery, they ensure a seamless process by utilizing trusted shipping partners to guarantee timely and secure transport. Clients also benefit from dedicated customer support, where representatives are ready to assist with inquiries and provide additional contact information whenever needed.

4. Receiving Investment Advice

Receiving investment advice from Goldcore plays a crucial role in effectively navigating the gold market. I have access to valuable market analysis and insights from experienced investment advisors, which allows me to make informed decisions about buying and selling precious metals.

These advisors offer a wealth of resources, including detailed reports on market trends and comprehensive training on various trading options. With this professional guidance, I can gain a deeper understanding of the intricacies of Goldcore growth, enabling me to optimize my investment strategies.

Accessing curated market data empower you as a savvy investor to seize profitable opportunities promptly. With the right resources and expertise at my disposal, you can confidently navigate the complexities of the gold market, significantly increasing my chances for long-term financial success.

What Are the Benefits of Using Goldcore?

Utilizing Goldcore as my investment platform presents numerous benefits that can greatly enhance my investment strategy. One of the primary advantages is the opportunity to diversify my assets through precious metals, which serve as a hedge against inflation and market volatility.

Furthermore, Goldcore offers avenues for potential growth within a secure and regulated environment, making it an appealing option for those of us seeking financial security.

1. Diversification of Assets

Diversification of assets is a fundamental principle of investing, and I recognize that Goldcore facilitates this by offering a variety of precious metals to enhance my portfolio. By incorporating gold and silver into my investment strategy, I can mitigate risks associated with market fluctuations and achieve a more balanced asset allocation.

Strategically integrating these precious metals into my diversified portfolio allows me to leverage gold investment fundamentals, which highlight the metal’s historical ability to preserve wealth. For instance, using gold as a hedge against inflation helps protect against the loss of purchasing power, while I can leverage silver for its industrial demand.

Goldcore provides tailored strategies that enable me to determine the optimal percentage of precious metals aligned with my financial goals and risk management requirements. Regular rebalancing will help me maintain my desired allocation, reinforcing stability even in volatile markets.

2. Protection Against Inflation

Investing with Goldcore offers a strong defense against inflation, enabling me to protect my purchasing power over time. Precious metals, particularly gold, have historically acted as a safe haven during economic downturns, making them a crucial element of a secure investment strategy.

Throughout history, periods marked by high inflation and economic instability have often coincided with surges in gold prices, reinforcing its reputation as a reliable store of value. For example, during the 1970s, gold prices rose dramatically as rampant inflation impacted currencies globally, leading discerning investors to turn to this precious metal.

In today’s environment, where inflationary pressures persist and uncertainties abound in the global markets, it is vital for me to reevaluate the role of gold in my portfolio. However, I also recognize the importance of understanding the risks associated with gold investments, particularly concerning price volatility and market fluctuations, to navigate these challenging times effectively.

3. Potential for Growth

The potential for growth in gold investments is significant, particularly when I leverage Goldcore’s comprehensive market analysis and insights. With the increasing global demand for gold, I can benefit from rising gold prices, ultimately enhancing the overall performance of my investment portfolio.

This uptick in demand can be linked to several factors, including economic uncertainty, inflation fears, and geopolitical tensions that often drive investors to seek safer assets. Goldcore’s updates offer valuable trading tools that give the power to me to make informed decisions based on real-time market data. By integrating these resources into my investment strategies, I can navigate the complexities of the gold market more effectively.

As more institutional investors enter this space, I anticipate a surge in liquidity and demand for gold, which could lead to even more favorable pricing scenarios for those of us looking to capitalize on the enduring value of this precious metal.

What Are the Risks of Using Goldcore?

While I recognize the numerous benefits that Goldcore provides, it is essential to acknowledge the risks associated with investing in precious metals. Market volatility can have a significant impact on gold prices, and there are inherent risks that potential investors should be aware of, including the possibility of fraud.

Understanding these risks is crucial for me in developing an effective investment strategy that safeguards my assets.

1. Volatility of Precious Metals Market

The volatility of the precious metals market presents a significant risk that I must navigate when trading through Goldcore. Fluctuations in gold prices are influenced by various factors, including economic conditions, currency strength, and geopolitical events, making it essential for me to stay informed about market trends.

By understanding these elements, I can better anticipate shifts that may impact financial outcomes. For example, during periods of economic uncertainty, many investors, including myself, turn to gold as a safe haven, which drives up demand and prices. Conversely, strong economic indicators and a robust dollar can suppress gold values, resulting in a dynamic market landscape.

A comprehensive analysis of Goldcore provides valuable insights into these variables, allowing me to make more informed decisions. Recent market analyses emphasize that not only immediate events but also long-term trends—such as mining production levels and technological advancements—play critical roles in shaping gold price movements.

2. Potential for Fraud or Scams

The potential for fraud or scams in the gold market is a valid concern for me as an investor using Goldcore. However, I appreciate that the company implements significant measures to ensure secure transactions and protect clients. It is essential for me to understand the risks associated with fraudulent activities to maintain confidence in my investment.

Given the various schemes that target unsuspecting investors, I find it crucial to recognize the tactics employed by scammers, which often include misleading advertisements or fake bullion websites. Goldcore’s commitment to transparency and its robust customer support are valuable resources that guide me through the complexities of precious metal investments. By establishing a strong foundation of credibility, the company not only fosters my trust but also helps shield me from potential threats.

The regular educational resources provided by Goldcore give the power to me to make informed decisions, ultimately enhancing my confidence in navigating the ever-evolving gold landscape.

3. Storage and Delivery Risks

Storage and delivery risks can present challenges for me as an investor using Goldcore, especially concerning the security of physical precious metals. It is essential for me to understand the protocols in place for gold storage and the logistics of delivery to effectively mitigate these risks.

Given the inherently high value of precious metals, concerns such as theft, damage during transit, and improper handling become critical factors to consider. I must acknowledge that not all firms implement the same level of precautions when it comes to asset protection.

Goldcore addresses these issues through comprehensive security measures, utilizing advanced technology and secure facilities to ensure the safety of my assets. They have established a meticulous withdrawal process that guarantees a seamless transition whenever I decide to access my holdings.

This strategic framework significantly contributes to building trust and safeguarding investments while navigating the potential pitfalls associated with precious metals logistics.

Is Goldcore Right for You?

Determining whether Goldcore is the right investment platform for me requires careful consideration of my financial goals, investment approach, and risk tolerance. If I am seeking a reliable way to invest in gold and precious metals with a strong emphasis on security and customer support, Goldcore presents a viable option. Understanding my individual needs and how Goldcore aligns with them is essential for successful financial planning.

By evaluating the various Goldcore account types available, I can better ascertain which options best fit my investment strategy. Each account offers unique advantages, whether I am a seasoned investor or just beginning to explore the fundamentals of gold investment. Analyzing the features of Goldcore’s offerings will help clarify how they can support my wealth-preservation objectives and enhance my portfolio diversification.

Therefore, I will take the time to consider how Goldcore’s services align with my long-term financial aspirations and risk appetite.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What is Goldcore Review?

Goldcore Review is a comprehensive assessment and analysis of the services provided by Goldcore, a precious metals investment company.

Who can benefit from reading Goldcore Review?

Investors, both new and experienced, can benefit from reading Goldcore Review to gain insights on the performance, reputation, and customer satisfaction of Goldcore.

What are the key areas covered in Goldcore Review?

Goldcore Review covers important aspects such as fees and charges, customer service, investment options, and overall performance of Goldcore as a precious metals investment company.

How can Goldcore Review help in making investment decisions?

By reading Goldcore Review, investors can make informed decisions based on the objective analysis of Goldcore’s services. It can also help in comparing Goldcore with other similar companies to make the best investment choice.

Is Goldcore Review regularly updated?

Yes, Goldcore Review is regularly updated to reflect any changes in Goldcore’s services, performance, or customer satisfaction. This ensures that readers have the most current and relevant information.