In today’s ever-changing financial landscape, I find that gold still stands strong as a symbol of stability and wealth. That’s why I’m excited about Goldline, a well-known name in the precious metals world. They offer a wide range of products and services that cater to both seasoned investors and those just starting out.

This guide dives into Goldline’s history, the variety of gold and other precious metals they provide, and the additional services that really make them stand out. I’ve included customer reviews, compared their offerings with other dealers, and looked into whether investing with Goldline is a smart move for anyone’s portfolio.

If you’re thinking about buying gold for the first time or looking to expand your investments, this guide will give you the insights you need to make informed decisions.

What is Goldline?

I’ve come across Goldline, a well-established company that really knows its stuff when it comes to gold investment and precious metals. They offer a wide range of options for both newcomers and experienced investors alike.

Whether I’m looking for gold coins, bullion, or other precious metals, they’ve got various investment strategies that can be customized to fit my needs. Plus, they make sure the whole experience is transparent.

What I really appreciate is their focus on customer service. Goldline is there to help me navigate the sometimes tricky waters of online trading, so I can make informed decisions about my financial assets.

History and Background

I love learning about Goldline’s rich history, which goes all the way back to its founding. It started with a simple goal: to provide quality precious metals to investors looking for security and growth in their portfolios.

Over time, Goldline has really made a name for itself in the gold market, offering a range of services and products that cater to both new and seasoned investors. Their growth shows a true commitment to transparency, trustworthiness, and industry standards, which has helped them build a solid reputation among financial services providers.

Founding and Growth of the Company

I founded Goldline with a clear vision: to provide investors like myself with a reliable source for purchasing gold and other precious metals. From the start, I aimed to establish the company as a trusted partner in the investment space. Since then, we’ve seen some significant growth, expanding our product range and fine-tuning our investment plans to meet the diverse needs of our clients. This growth has really been driven by my commitment to customer satisfaction and providing educational resources that help investors make informed choices.

Thanks to some key strategic decisions—like enhancing the online shopping experience and offering personalized investment consultations—we’ve managed to navigate those pesky market fluctuations successfully. I know how important it is to adapt to economic changes, so I’ve rolled out innovative sales tactics and diversified our offerings. These efforts haven’t just boosted our market presence; they’ve also helped me build stronger relationships with our clients.

By prioritizing transparency and support, I’ve consistently hit impressive customer satisfaction ratings, which has only reinforced our reputation as a leader in the precious metals investment industry.

Products and Services Offered

I love that Goldline has such a wide range of products and services tailored for investors like me who are interested in precious metals. Whether I’m looking for gold coins and bullion or gold bars and IRAs, they’ve got something for both my short-term trading strategies and my long-term investment goals.

Plus, I really appreciate the educational resources they offer. They help me navigate my investment options and understand market insights, ensuring I can make smart decisions about my financial future.

Types of Gold and Precious Metals Available

At Goldline, I can choose from a variety of gold and precious metals, like gold coins, bullion, and gold bars, each with its own unique features and perks. These options really cater to different investment strategies, helping me diversify my portfolio while securing physical assets that have a solid reputation as a stable store of value.

Whether I’m in the market for an IRA-eligible investment or just looking for a straightforward way to hedge against inflation, Goldline offers an extensive and flexible product range.

For those of us who appreciate artistry and historical significance, gold coins are often super appealing. They come with unique designs and can sometimes command higher premiums, which adds an extra layer of interest. On the flip side, bullion—typically in the form of gold bars—works great for those prioritizing weight and ease of storage. It’s a cost-effective way to acquire larger quantities of gold without the fuss.

And let’s not forget about other precious metals available through Goldline, like silver and platinum. Each of these metals has its own unique benefits and market dynamics that can really enhance the resilience of my investment portfolio against volatility.

Additional Services and Benefits

Goldline isn’t just about selling precious metals; they really go the extra mile to make the whole customer experience better. I appreciate how they focus on education, offering resources and advisory services that help me develop effective investment strategies that fit my goals.

Their commitment to customer service means my inquiries, transactions, and account management are handled smoothly and transparently, which definitely builds my trust and satisfaction.

By prioritizing comprehensive educational materials, Goldline give the power tos me to make informed decisions about my investments. They get that every investor is unique, so they offer personalized advisory services tailored to my risk tolerance and financial aspirations.

This commitment to client education not only boosts my knowledge but also gives me the confidence to navigate the complex world of precious metals. Plus, their responsive customer support team is always ready to help me with any questions, ensuring I get the guidance I need to achieve long-term financial success.

With all these thoughtful initiatives, Goldline really positions itself as a trusted partner in my investment journey.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

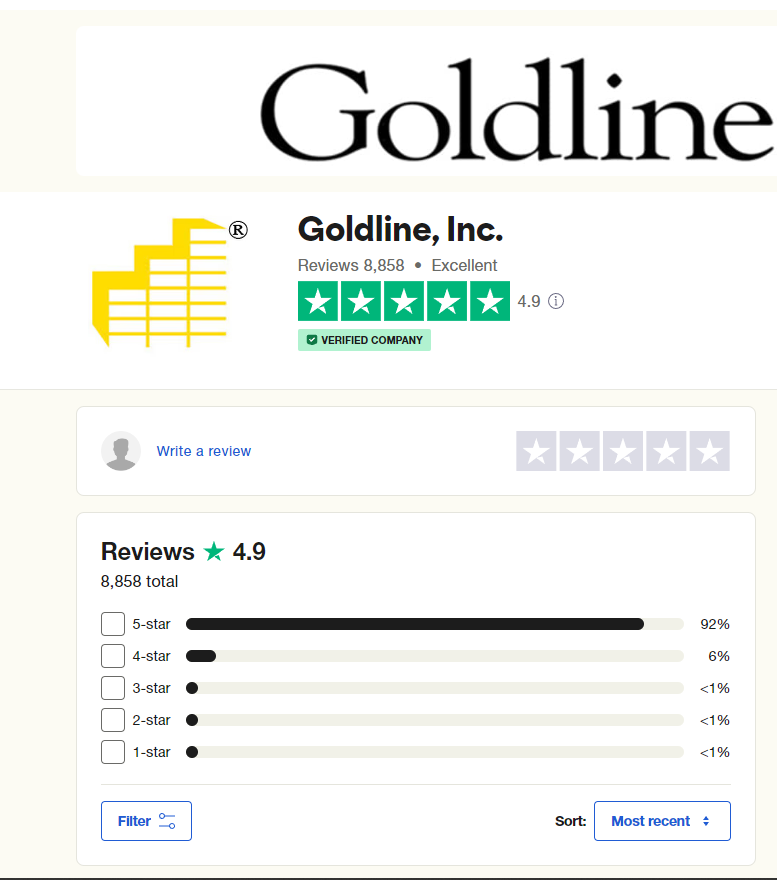

Customer Reviews of Goldline

I find that customer reviews of Goldline offer some really valuable insights into what the user experience is like. It’s interesting to see both the positive feedback and the areas where there’s room for improvement.

A lot of clients rave about the firm’s transparency, educational resources, and customer service, which really helps build trust and satisfaction. On the flip side, I’ve also noticed some reviews mentioning challenges, like delivery times and transaction fees.

This gives a balanced view of what the company has to offer and how it performs in the gold investment market.

Positive Experiences and Testimonials

I’ve come across a lot of customers who rave about their experiences with Goldline. They often talk about how easy online trading is and how great the products are. Many users express their satisfaction with the customer service and appreciate the educational resources that boost their confidence in making investment decisions.

The testimonials really show the reliability and trustworthiness that Goldline has built through its commitment to being transparent and offering quality service.

On top of all that, customers frequently highlight how seamless the whole user experience is, praising the website’s intuitive design that makes buying a breeze. They love the wide variety of products available, which is perfect for both beginners and seasoned collectors. Another common note is the personalized attention they receive—many mention that customer service reps take the time to answer their questions and give tailored advice.

Plus, the educational support, like webinars and articles, has really helped customers boost their knowledge, give the power toing them to make informed choices. The overall vibe from all these user testimonials is clear: Goldline has really positioned itself as a trustworthy partner in their investment journeys.

Negative Feedback and Complaints

I’ve noticed that while many customers have had great experiences with Goldline, there have been some negative comments and complaints floating around, mainly about delivery times and transaction fees. People have expressed concerns about how quickly their questions get answered and how well issues are resolved. This really shows how important it is for Goldline to tackle these complaints if they want to keep a solid reputation in the gold investment world. Understanding and resolving these concerns is key to building consumer trust.

Specifically, I’ve seen several customers mention delays in getting their orders, which are sometimes blamed on broader supply chain issues. That kind of thing can really shake confidence in the company’s reliability.

Transaction fees are also a hot topic; clients often feel these costs can be unclear and might even be higher than what competitors charge. This kind of dissatisfaction doesn’t just impact individual experiences—it also casts a shadow on how people view Goldline’s integrity and commitment to customer satisfaction.

If Goldline could engage more proactively with customer inquiries and make sure complaints are resolved effectively, they could turn those negative impressions into real opportunities for improvement, strengthening their position in the market.

Comparison to Other Gold Dealers

When I compare Goldline to other gold dealers, I find it really important to look at things like pricing, product range, and how the company is viewed in the industry. Goldline has really made a name for itself in the gold market, offering a wide variety of products and services that stack up well against the competition.

By understanding these differences, I can make more informed decisions and figure out which dealer aligns best with my investment goals.

Price Comparisons and Reputation

When I compare prices between Goldline and other gold dealers, it becomes clear just how competitive the market is. I often find that Goldline offers some pretty attractive pricing on a range of precious metals. This competitive edge, combined with their solid reputation in the industry, makes Goldline a great choice for anyone looking to invest in gold without sacrificing quality or value. Plus, keeping an eye on market conditions helps me figure out the best timing and options to consider.

Goldline’s pricing strategies reflect their cost structure and their knack for adapting to shifting market dynamics. Things like supply chain efficiencies, changes in gold prices, and overall economic conditions all play a big part in how they set their prices compared to other dealers.

Also, when I look at customer testimonials, it’s clear that Goldline is committed to transparency and educating their customers. This really reinforces their reputation as a trusted provider in the gold market. So, I always think it’s wise for investors to consider the current market environment and Goldline’s position among its competitors when making informed decisions about purchases.

Is Goldline a Good Investment?

Figuring out if Goldline is a good investment really comes down to a few key factors for me, like how legitimate the company is, what customers are saying, and the potential risks that come with investing in gold.

Since Goldline is well-known in the gold market, it has built up a reputation for offering quality products and secure transactions. That gives me some confidence that it could be a solid choice for anyone looking to protect their assets and diversify their portfolios.

Factors to Consider Before Investing

Before I dive into investing with Goldline, I make sure to think about a bunch of factors, like my investment strategies, risk tolerance, and how long I plan to hold my investments. Getting a grasp on market analysis and current trends really helps me navigate the twists and turns of the gold market, allowing me to make smart choices that fit my financial goals. Taking the time to evaluate these aspects ensures I have a more secure and rewarding investment experience.

I always take a step back to look at my overall financial situation and objectives, considering how gold fits into my broader portfolio. It’s important to remember that things like market volatility, economic indicators, and geopolitical events can really shake up the performance of precious metals. By doing my homework and maybe chatting with financial advisors, I can pick up some valuable insights into effective risk management techniques.

Having a clear investment strategy that matches my specific risk tolerance is key for making informed decisions. It helps me maximize potential returns while keeping an eye on minimizing losses.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What are Goldline Reviews?

Goldline Reviews refer to feedback and opinions provided by customers who have used Goldline’s products or services.

Why are Goldline Reviews important?

Goldline Reviews are important because they provide valuable insights and information for potential customers to make informed decisions about using Goldline’s products or services.

Where can I find Goldline Reviews?

You can find Goldline Reviews on various online platforms such as the company’s website, social media pages, and review websites like Yelp and Trustpilot.

Are Goldline Reviews reliable?

Yes, Goldline Reviews are reliable as they are provided by real customers who have had first-hand experience with the company’s products or services.

Can I trust Goldline Reviews?

Yes, you can trust Goldline Reviews as they are unbiased and reflect the opinions and experiences of actual customers.

How can I leave a Goldline Review?

You can leave a Goldline Review by visiting the company’s website or social media pages and following the instructions provided for leaving a review. You can also leave a review on third-party review websites.