Wondering if International Precious Metals is a reliable coin dealer? This guide will go over their claims and services to help you decide.

In this article, I will explore the different types of precious metals, including gold, silver, platinum, and palladium, and reveal the reasons behind their significant value. I will discuss their various uses, ranging from exquisite jewelry to essential industrial applications, as well as the factors that influence their market prices.

Additionally, I will outline investment strategies for those interested in incorporating these valuable assets into their portfolios. Whether you are a seasoned investor or simply curious about these remarkable metals, this exploration offers valuable insights for everyone.

About International Precious Metals

One of our main irritations is when a precious metal company neglects to provide fundamental details about their name, location, and competitive edge. Luckily, International Precious Metals does not suffer from that.

A strong “About Us” page clarifies their profile and the reasons behind your business decisions should you choose them. Located in Texas, the company offers a range of coins and precious metals.

Their low-pressure sales, wide range of services, and first-rate customer service help to list their benefits.

Though comparatively speaking, this is a somewhat small concern; the only thing lacking from this part is further details about their sales team and credentials. This About Us page generally does a great job of clearly outlining the offerings of the website.

Services They Offer

Those wishing to participate in the precious metal market can benefit from the several outstanding services provided by International Precious Metals.

First, International Precious Metals presents you the option to invest in a precious metal IRA, same as many other precious metal suppliers. The website lays out the opening a precious metal IRA process, clarifies the possible benefits, and explains how people might open the IRA.

Given the restrictions on what can be bought and invested in an IRA, it also lays a strong basis for expectations. Fortunately, you may open your IRA with International Precious Metals via an online form or by phoning a toll-free number.

This online form is especially crucial since we have observed far too many websites asking people to contact a phone number, therefore postponing the procedure.

Those who might like to purchase precious metals, however, are exempt from having an IRA. Indeed, International Precious Metals boasts among the biggest inventory we have seen on the internet of coins, bars, and bullion.

This covers gold, silver, platinum, palladium, and further metals. The coin choice is also really broad; there are many old, contemporary coins, heirlooms, and more.

Clicking on a coin exposes further information about that coin, including historical context and a description. While most coins may be bought online and have a price shown, a few are classified as “Call for price,” and it’s not apparent why. Fascinatingly, the page also offers a “notify me when price drops” choice.

Users using this option can learn when the price of a targeted coin decreases by a certain margin. Combining dynamic pricing with notification choices produces an interesting dynamic for consumers who wish to participate in precious metal investment but also track their expenditure.

International Precious Metals also provides a buy-back scheme at last. The website states that International Precious Metals would purchase back any item sold at the designated “buyback price.” Although purchasing other precious metal investments would be great, this buyback choice lets consumers be more adaptable with their funds.

Luckily, those who would want more information on the offerings of International Precious Metals have many of choices. People can go over to the “contact us” website, which offers several channels of communication with the business.

This covers phone, email, or digital form filling-in. Moreover, depending on a customer care agent on the other side of the digital line, there is a chatbot that might offer you live responses. Still, consumers can definitely interact with the business in a range of ways.

What Resources Does International Precious Metals Offer?

Like other websites in this field, International Precious Metals offers at least some materials aimed to keep their consumers informed and educated. Here International Precious Metals does rather well.

They first and most importantly have a part titled “Buyer’s Resources.” There are lots of pieces in this part aimed to guide buyers of precious metals regarding what they should purchase.

Articles on how to diversify, how to start with precious metals, and how to buy rare coins to increase the wealth of your family would be among examples here.

These pieces do a fantastic job of better clarifying possible methods and fundamental language; they are like extended blog postings.

The website then has a section on market watches. This is not very much. This is a quite simple chart with some data on the price movements of gold, silver, platinum, and palladium. Saying “a bit,” we mean a bit.

It just displays all of these precious metals’ 24-hour pricing; nothing more. This is a quite fundamental purpose, hence it is frustrating to see an otherwise strong website get one of the essentials so incorrect.

International Precious Metals has a blog as well. Once more, this site falls well short of what one would wish. The entry subjects are good: they address how to hedge against inflation or advice on investing in particular precious metals.

The frequency of blog entries is not very excellent. Entries arrive in 1-2 months. Late May is when we are writing this; the most recent article we wrote on April 10. As of right now, this month’s entries total just four. Running a blog is not very worthwhile if you are only going to update it seldom.

At last, this website features a rather outstanding FAQ section. This addresses simple queries, offers general knowledge, and is meant to address particular problems that arise during shopping—more especially, on the International Precious Metals website. It covers general knowledge, shipping and delivery, and order placing and returns.

Highlights of International Precious Metals

Ignoring the inventory of International Precious Metals for a few more sentences would be negligent. Simply said, it’s among the most strong collections we have ever seen. It offers a range of online choices, is dynamic and easy to use. This inventory and the website of International Precious Metals can thus help you to locate a great variety of coins, bullion, and bars.

International Precious Metals provides a great range of services as well; you may utilize this website for one-stop purchasing. It provides sufficient to fulfill all of your needs related to precious metal.

The webpage is quite user-friendly. Apart from the extensive range of services, there are several customizing choices including price reduction alerts and filters enabling you to identify exactly what you are looking for.

Generally speaking, the materials on the website are really strong. The material is accurate, presented free from political influence—not usually the case on these websites—and intended to guide purchasers.

They both respond to certain issues on the website and do a good of impartially outlining the advantages of precious metals. These tools also improve the general openness of the website and can assist to make users more at ease.

Few and far between are the drawbacks of this website; that is clearly a positive feature! The existing issues are somewhat minor: Some resources, like the blog and market monitoring chart, are somewhat thin. Their benefits from further filling out would be extremely clear.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

Customer Reviews of International Precious Metals

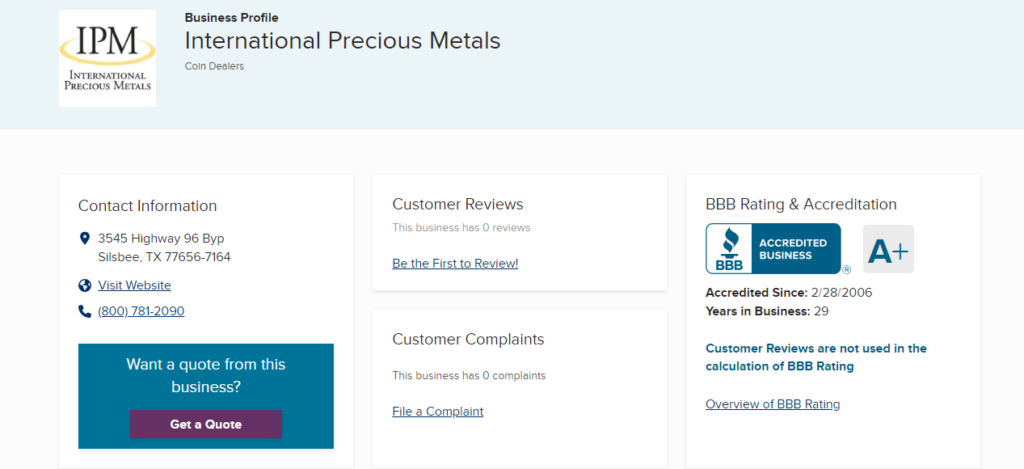

Any website depends greatly on customer evaluations since the data entered by past users can provide users a far, far better impression of the performance of the business. Given how strong the website and marketing appeared to be, it is startling that we really battled to locate reviews for their offerings. Having said that, we discovered encouraging things.

With 27 reviews listed, Google had an average of 4.9 out of 5 stars. Reviews especially mentioned the staff’s knowledge, friendliness, and politeness. They also cited a quite good shopping experience, with several consumers claiming that online buying and customer care correspondence was equally good.

Furthermore recognized as BBB accredited and with an A+ rating from the Better Business Bureau is the company. Though the company had no evaluations, there were also no complaints—something somewhat unique in this sector.

What Are the Different Types of Precious Metals?

In the realm of investment and asset allocation, I recognize the importance of understanding the various types of precious metals to make informed decisions.

Precious metals such as gold, silver, platinum, and palladium hold significant roles in global markets due to their unique properties and diverse applications, ranging from jewelry to industrial uses. Each metal possesses distinct characteristics that impact their demand dynamics and pricing strategies, making them appealing options for investors seeking to diversify their portfolios.

Furthermore, these metals act as a hedge against inflation and market volatility, solidifying their reputation as safe-haven assets.

1. Gold

I recognize that gold has consistently maintained its status as one of the most sought-after precious metals, largely due to its historical significance as a wealth preservation tool and a safe haven asset during market downturns.

Over the decades, I have observed that gold’s allure has only intensified as investors continually seek stability amidst fluctuating economic conditions and geopolitical tensions. The current market performance demonstrates how gold prices react to inflationary pressures and currency fluctuations, making it an appealing option for those looking to diversify their portfolios.

With the emergence of various trading strategies, including ETF trading and futures contracts, I notice that market sentiment often shifts in response to global events, creating investment opportunities that astute investors look to capitalize on. Understanding these dynamics provides me with crucial insights into how gold can play a pivotal role in both short-term gains and long-term wealth accumulation.

2. Silver

I recognize that silver is valued not only for its aesthetic appeal in jewelry but also for its diverse industrial applications, making it an essential component in various sectors, including electronics and renewable energy. This duality positions silver as a unique asset, where its role as an investment vehicle complements its significance within supply chains, particularly in industries that depend on its conductive properties.

As an investor, I often view silver as a hedge against inflation or economic downturns. Concurrently, I closely monitor the industrial sectors that analyze demand, understanding that shifts in technological innovation can lead to potential market fluctuations. Consequently, as advancements in solar energy and electric vehicles continue to gain traction, the sustained demand from these industrial uses may significantly impact silver’s overall market dynamics.

3. Platinum

I recognize platinum as one of the rarest precious metals, primarily extracted through mining, and I acknowledge its high demand in both the jewelry industry and catalytic converter production for vehicles.

In recent years, I have observed fluctuations in the production costs associated with platinum, influenced by various factors such as advancements in extraction technologies and shifts in global demand. As markets continue to evolve, I find that the strategic considerations for investors have grown increasingly complex. Many investors, including myself, are now examining market cycles to pinpoint optimal moments for investment.

The implementation of advanced extraction methods not only affects supply but also shapes pricing structures within capital markets, positioning platinum as a crucial asset for those looking to diversify their investment strategies. I anticipate a dynamic market forecast, driven by sustainability efforts and technological innovations, which are likely to impact the future value of this precious metal.

4. Palladium

I have observed that palladium has garnered significant attention in recent years, particularly due to its rising demand in the automotive industry for emissions control, establishing it as a valuable investment option.

This surge in demand can be attributed not only to regulatory changes advocating for cleaner vehicle technologies but also to the limited supply from major producing countries, which creates a favorable environment for price appreciation.

As I analyze financial models that forecast palladium’s potential growth in value, I notice that investors are increasingly turning to this metal, reflecting a strong interest in risk management strategies amid market fluctuations.

Ongoing market research suggests that the dynamics of palladium trading are influenced by geopolitical tensions and shifts in industrial consumption patterns, adding layers of complexity to an already vibrant investment landscape.

Why Are Precious Metals Valuable?

I recognize that precious metals possess intrinsic value, deeply rooted in their physical properties and historical significance. This quality makes them essential assets for wealth preservation, particularly during periods of economic instability.

I understand that the worth of these metals is often influenced by various economic indicators, such as inflation rates and currency fluctuations, which can dramatically sway market sentiment. When inflation rises, I notice that investors tend to flock to these assets as a hedge against the diminishing purchasing power of fiat currencies, consequently driving up demand and prices.

Additionally, I observe that significant shifts in currency values can lead to fluctuations in metal valuations; for instance, a weaker dollar typically results in higher prices for gold and silver. Valuation metrics, such as the gold-to-silver ratio and the supply-demand dynamics in the market, further clarify the complex interplay between economic conditions and the appeal of precious metals as safe havens.

What Factors Affect the Price of Precious Metals?

I understand that the pricing of precious metals is influenced by a complex interplay of factors, including supply and demand dynamics, economic conditions, and geopolitical events that can create market volatility.

1. Supply and Demand

The fundamental principles of supply and demand are essential in determining the pricing of precious metals, with any shifts on either side directly influencing market prices.

This relationship becomes even more complex when I analyze changes in supply chain logistics and demand dynamics across various industries. For example, when manufacturers face delays or disruptions in their supply chains, it can result in a scarcity of metals like gold and silver, subsequently driving prices upward. Conversely, if demand declines—potentially due to technological advancements that facilitate the use of alternative materials—I may observe a notable decrease in the values of precious metals.

Market forecasts typically reflect these dynamics, utilizing historical prices as benchmarks to inform traders and investors about potential future trends.

2. Economic Factors

Economic factors, including inflation rates, employment statistics, and overall financial stability, play a significant role in shaping investor behavior and the value of precious metals.

When inflation rises, I observe that the purchasing power of currency diminishes, leading many investors to seek safe-haven assets such as gold and silver. Additionally, fluctuating employment rates can serve as indicators of economic health or distress, directly influencing market confidence and guiding monetary policy decisions.

As central banks adjust interest rates to either promote or cool economic activity, I recognize that these actions have a direct correlation with capital markets and the appeal of precious metals as an investment strategy. By understanding these dynamics, I can navigate the complexities of market volatility and make informed decisions in an increasingly uncertain financial landscape.

3. Geopolitical Events

Geopolitical events, such as trade wars and regional conflicts, introduce a level of uncertainty that can significantly heighten market volatility and impact the prices of precious metals. This uncertainty often shifts my focus towards safe-haven assets like gold and silver, prompting me to reassess my risk management strategies.

Recent tensions, including escalations in specific regions and trade disputes among major economies, have fostered an environment where I remain increasingly vigilant as a trader. Consequently, the precious metals markets respond dynamically, reflecting the collective anxiety surrounding potential economic ramifications.

Implementing smart trading strategies may involve diversifying into these metals or closely monitoring geopolitical developments since even minor changes in diplomatic relations can lead to rapid fluctuations in market prices. These fluctuations can ultimately influence broader investment decisions.

How Can One Invest in Precious Metals?

I approach investing in precious metals through various avenues, such as physical ownership, precious metal exchange-traded funds (ETFs), mining stocks, and futures or options trading.

Each option presents its own unique benefits and risks, allowing me to tailor my investment strategy to align with my goals and risk tolerance.

1. Physical Ownership

Owning precious metals, such as gold and silver bullion, allows me to directly hold my assets while providing a sense of security and asset preservation. This tangible connection to wealth evokes strong emotional ties, which enhances the overall value I place on my investments.

While there are undeniable advantages to physically possessing these metals—such as protection against market volatility and inflation—I also recognize the significant challenges that come with it, particularly in terms of storage and security. Safeguarding these assets requires appropriate facilities, which can lead to substantial costs.

Additionally, accessing the market may become more complex if I decide to liquidate my holdings, making it essential to understand valuation metrics to ensure I receive fair compensation. Balancing these factors is crucial for anyone considering an investment in precious metals, and I approach this decision with careful consideration.

2. Precious Metal ETFs

I find that precious metal ETFs serve as an accessible and liquid investment vehicle, allowing me to gain exposure to the performance of metals without the need for physical storage.

This innovative financial product enables me to diversify my portfolio easily and benefit from the potential appreciation of metals like gold and silver. By tracking the price movements of these commodities, these funds provide a compelling alternative to direct ownership, alleviating concerns related to theft or the need for theft insurance. Additionally, I appreciate the flexibility to trade on major exchanges, which enhances market performance and investment returns.

However, it is essential for me to understand the potential risks involved, such as market volatility and management fees, as these factors can influence my overall trading strategies and long-term profits.

3. Mining Stocks

Investing in mining stocks allows me to gain exposure to the potential profitability of companies engaged in the extraction of precious metals, effectively linking my returns to the performance of the underlying commodities.

Several factors significantly influence these stocks, including production costs and geopolitical risks. Production expenses are crucial in determining profit margins, as fluctuations in labor, energy, and equipment prices can directly impact net income. Additionally, geopolitical stability plays a vital role; political unrest in resource-rich regions can disrupt operations and lead to unpredictable market reactions.

I also consider market capitalization, recognizing that larger companies may offer more stability, while smaller firms could present higher risks but potentially greater rewards. By employing careful resource allocation and financial modeling, I can better navigate this sector and optimize my portfolio.

4. Futures and Options

Engaging in futures and options trading allows me to speculate on the future prices of precious metals, presenting opportunities for potential profit in both rising and falling markets.

This type of trading not only offers avenues for profit but also requires a comprehensive understanding of market dynamics and the inherent risks involved. I recognize that market volatility can significantly impact my positions, potentially leading to substantial losses if not managed effectively.

Therefore, utilizing sound risk management strategies is essential, as it enables me to protect my investments against unpredictable price fluctuations. By employing limit orders, diversifying my portfolio, and practicing proper position sizing, I can enhance my chances of successfully navigating the complexities of the precious metals market.

Frequently Asked Questions

What is International Precious Metals Review?

International Precious Metals Review is a comprehensive report that provides an overview of the current state and trends in the international precious metals market, including gold, silver, platinum, and palladium.

Who publishes International Precious Metals Review?

International Precious Metals Review is published by a team of experts at a leading financial research and advisory firm, providing unbiased and reliable information on the precious metals market.

How often is International Precious Metals Review released?

International Precious Metals Review is released on a monthly basis, keeping investors and industry professionals up-to-date on the latest developments in the precious metals market.

What type of information is included in International Precious Metals Review?

International Precious Metals Review includes analysis and commentary on market trends, price movements, supply and demand dynamics, and other factors influencing the international precious metals market.

How can International Precious Metals Review benefit investors?

International Precious Metals Review can provide valuable insights and information to investors looking to diversify their portfolio and make informed decisions about investing in precious metals.

Is International Precious Metals Review available in multiple languages?

Yes, International Precious Metals Review is available in multiple languages, including English, French, Spanish, Chinese, and Japanese, to cater to a global audience interested in the precious metals market.