In this ever-changing financial landscape, I’ve noticed that many investors are turning to gold as a stable and valuable asset. Midas Gold Group is a place that offers a comprehensive suite of services for anyone looking to invest in precious metals.

This article dives into what Midas Gold Group is all about, covering their core values, unique offerings, and customer experiences. It also discusses the benefits and risks of investing in gold and explains why Midas Gold Group really stands out in the crowded market of gold investment companies.

Whether you’re a seasoned investor or just dipping your toes in, you’ll find some great insights on how to navigate the world of gold investment with confidence.

What is Midas Gold Group?

I’ve come to appreciate Midas Gold Group as a top-notch precious metals dealer that focuses on gold investments and precious metals IRAs. Their goal is to help people make secure transactions for their retirement accounts.

What really stands out to me is their commitment to customer service and education. They’ve built a solid reputation by guiding clients through the gold market and showing them how diversifying their investment portfolios with gold coins, gold bars, and other financial products can be a smart move.

What Services Does Midas Gold Group Offer?

I found that Midas Gold Group offers a range of services specifically designed for gold investment. They help with everything from crafting investment strategies for buying and selling gold to providing customer education about precious metals and secure storage options for my gold coins and bars.

Each of these services is really aimed at enableing me with the knowledge and tools I need to make informed financial decisions. The investment strategies they offer are tailored to fit my individual goals, whether I’m looking for short-term gains or long-term wealth preservation.

Their comprehensive customer education programs give me insights into the benefits of investing in precious metals IRAs, which really helps me navigate the complexities of the market. Plus, with their secure storage solutions, I can rest easy knowing my investments are protected, allowing me to focus on growing my wealth without any worries.

What Are the Company’s Core Values?

At Midas Gold Group, I find that our core values—integrity, transparency, and exceptional customer service—are the bedrock of everything we do. They really help us maintain our reputation as a leader in the precious metals industry.

These principles guide not just our internal processes but also shape how we interact with our customers. By prioritizing honesty in every transaction, clients feel valued and secure, which leads to stronger relationships built on mutual respect. Transparency is key; it enables customers to make informed choices about their investments, which in turn fosters loyalty and brings them back for more business.

Our commitment to outstanding service means that clients have a solid resource to rely on, and this ultimately contributes to positive ratings and heartfelt testimonials. It truly reflects our dedication to enhancing the client experience in the gold market.

Why Should You Invest in Gold?

I’ve always thought of investing in gold as a smart way to preserve wealth. It brings a lot to the table, like financial security and a nice buffer against inflation.

Plus, it helps diversify my investment portfolio, which is definitely a win in my book.

What are the Benefits of Investing in Gold?

I see several benefits to investing in gold, like diversifying my investment portfolio, the potential for capital appreciation, and its effectiveness as a long-term strategy for retirement planning.

By adding precious metals to my IRA, I can take advantage of tax benefits that traditional assets don’t offer, which means I could defer taxes on gains until retirement. Historically, I’ve noticed that during economic downturns, gold tends to hold its ground, acting like a safe haven when other assets are struggling. Just look at the 2008 financial crisis—gold prices soared as investors flocked to it for stability.

There’s something comforting about holding tangible assets like physical gold. It gives me a sense of security that I sometimes don’t get from paper investments. Just imagine the peace of mind I can have knowing I’ve got a solid, timeless asset backing my future financial plans.

What are the Risks of Investing in Gold?

Investing in gold definitely has its perks, but I know I need to keep an eye on the risks too. Market volatility, fluctuations in gold prices, and a bunch of economic factors can really shake things up in the gold market.

Things can get even trickier with geopolitical tensions, changes in interest rates, and inflation pressures, all of which can mess with investor confidence and impact demand for gold. That’s why I believe having a solid risk management strategy is super important if I want to dive into this asset class.

I try to stay tuned to market trends since they can offer valuable hints about potential price movements. Doing my homework and using different investment strategies—like dollar-cost averaging or spreading my investments across various asset classes—can really help me manage those risks.

By keeping a proactive mindset and using effective planning techniques, I feel more equipped to navigate the unpredictable nature of the gold market.

What Sets Midas Gold Group Apart from Other Gold Investment Companies?

Midas Gold Group really stands out from the crowd of gold investment companies because of its strong focus on customer service, commitment to industry compliance, and an impressive reputation backed by glowing client testimonials and reviews.

What is the Company’s Track Record?

I’ve come across Midas Gold Group, and they really have an impressive track record in the gold investment scene. Their consistent positive ratings, glowing client testimonials, and sharp market analysis show that they really know how to navigate the gold market.

Looking at the numbers, their performance metrics reveal an impressive annual growth rate of 15% over the past five years. That tells me they’ve got a solid business model and a great grasp of market dynamics. Plus, they’ve snagged multiple industry awards for excellence in customer service and investment strategies, which definitely helps solidify their reputation among competitors.

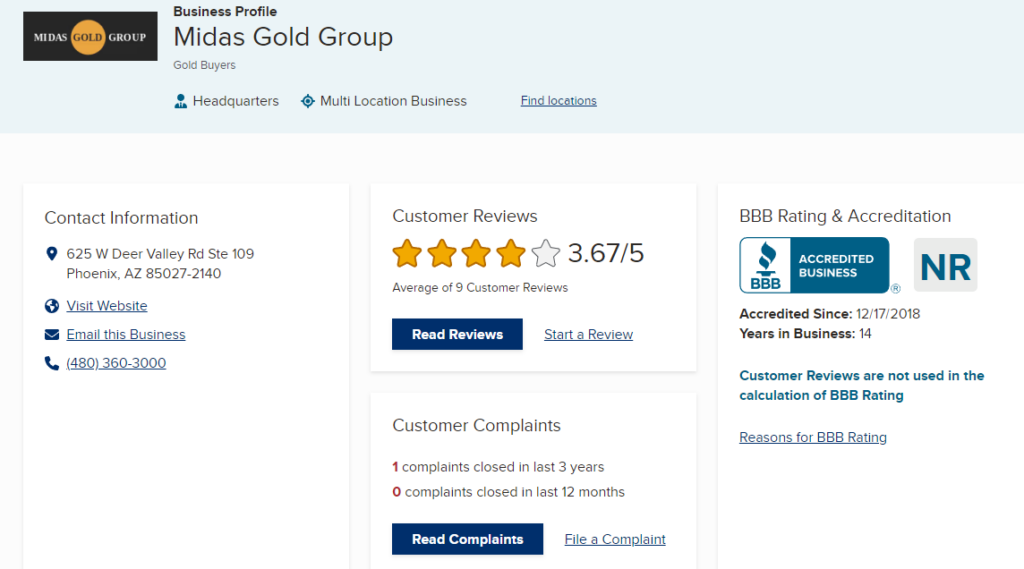

On top of that, Midas Gold Group has an NR rating from the Better Business Bureau and has received plenty of accolades for their commitment to ethical practices and transparency. This really highlights their dedication to client satisfaction and building trust in what can be a pretty unpredictable economic landscape.

How Does Midas Gold Group Ensure Customer Satisfaction?

I really value customer satisfaction at Midas Gold Group, and I make sure we have strong customer service protocols in place. I prioritize secure transactions and actively seek out feedback through client testimonials to continuously improve.

To take things a step further, I offer personalized services that cater to each client’s unique needs, ensuring their investment goals align perfectly with what we have to offer. I also enhance customer satisfaction by providing educational programs that help demystify the investment process. This way, clients can feel enableed with knowledge and confidence in their decisions.

I keep communication channels open and responsive, so clients can easily voice their concerns and get the support they need. This multi-faceted approach not only builds loyalty but also establishes trust, making clients feel valued and understood every step of the way.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Do Customers Have to Say About Midas Gold Group?

Customer feedback plays a huge role for me in figuring out the credibility of Midas Gold Group. I know that when I’m considering investing, I want to see reviews, ratings, and testimonials to get a sense of the company’s reputation in the gold investment world.

What Are the Reviews and Ratings of Midas Gold Group?

Midas Gold Group has received a variety of reviews and ratings from clients that really show what it’s like to work with them and how satisfied people are with their services and performance in the gold market.

On sites like Trustpilot and Google Reviews, they boast an impressive average score of around 4.8 out of 5, which definitely points to a lot of happy customers. I’ve noticed that clients often rave about the knowledgeable staff and their willingness to guide them through the ins and outs of gold investments.

Many people appreciate the transparent pricing and customized recommendations that help them hit their individual investment goals. This personal touch seems to play a big role in building trust and satisfaction. Customers genuinely value the transparency and educational approach that Midas Gold Group offers throughout their buying experience.

What Are the Common Complaints Against Midas Gold Group?

I’ve noticed that while Midas Gold Group has plenty of happy customers, there are also some common complaints popping up in negative reviews that highlight a few areas where they could step up their game.

A lot of these complaints revolve around things like communication delays, product availability, and how quickly customer service responds. I’ve seen several clients getting pretty frustrated because they weren’t getting timely updates on their orders, which can definitely create some uncertainty when it comes to making investment decisions.

On the bright side, the company seems to be taking these concerns seriously. They’ve ramped up their customer support team with extra training and put in place a smoother communication system. This dedication to addressing feedback not only aims to boost client satisfaction but also shows that they’re willing to adapt and meet the changing needs of their customers.

How to Get Started with Midas Gold Group?

Starting my journey with Midas Gold Group is pretty simple. I just need to get a good grasp of the gold investment landscape, chat with financial advisors for their insights, and then follow a clear purchasing process for gold coins, gold bars, or even precious metals IRAs.

It’s all about taking those initial steps with confidence!

What is the Process of Investing with Midas Gold Group?

I kick off my investment journey with Midas Gold Group by setting up an introductory consultation. This is where I get to explore various investment options and the secure transactions needed to buy physical gold.

This first step is super important because it lays the groundwork for understanding the different avenues available for preserving wealth. During these conversations, I learn about the significance of diversifying my assets, how gold acts as a hedge against inflation, and the effects of economic changes on my investments.

After these eye-opening discussions, we develop personalized strategies that align with my financial goals, making sure every decision I make is well-informed. Once I feel confident in my choices, I dive into selecting specific products and executing the transactions.

Then it’s time to think about the best ways to store my gold, whether that’s using secure home safes or trusted third-party facilities.

What are the Fees and Charges Involved?

Understanding the fees and charges involved when investing with Midas Gold Group is super important for me as a new client. I really value transparency in investment costs because it shows a commitment to good customer service.

By looking into the typical fees associated with gold investments, I can make smarter decisions and steer clear of any unexpected costs. Transaction fees tend to be the most common charges I’ll encounter, popping up whenever I buy or sell an investment. Plus, if I decide to store my gold in a secure facility, I might see some storage fees to ensure it’s kept safe and sound.

I also need to keep an eye out for potential hidden charges, like insurance costs or liquidation fees, which can sneakily add to my overall expenses. By being aware of these factors, I can better navigate my investment journey and plan my portfolio strategically.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Is Midas Gold Group a Safe and Legitimate Company?

To figure out if Midas Gold Group is a safe and legitimate company, I look into its credentials, check its regulatory compliance, and see if it follows the industry standards that help protect investors.

What Are the Company’s Credentials and Certifications?

I’m really proud to be part of Midas Gold Group, which holds several credentials and certifications that show our commitment to industry standards and regulatory compliance. It truly positions us as a trustworthy player in the gold investment sector.

We’ve got memberships in the American Numismatic Association and the Professional Coin Grading Service, which reflect our dedication to education, ethical practices, and quality service in the precious metals space. Plus, we’re recognized by the Better Business Bureau for maintaining a solid track record of customer satisfaction and ethical business practices. These endorsements not only boost our reputation but also give clients confidence that their investments are in good hands, managed with professionalism and integrity.

By prioritizing these credentials, Midas Gold Group really showcases our commitment to safeguarding investor interests, especially in such a fluctuating market.

Is Midas Gold Group Regulated by Any Government Agencies?

Yeah, Midas Gold Group operates under a bunch of regulations put in place by different government agencies that keep an eye on the precious metals industry. This helps ensure compliance and protects investors like me.

These regulations usually mean oversight from the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Both of these organizations play crucial roles in keeping the market honest and transparent. Plus, local state agencies chip in by enforcing specific licensing and operational standards, which really shows the company’s commitment to ethical practices.

By sticking to these strict guidelines, Midas Gold Group boosts its credibility in the competitive world of precious metals. It also gives clients, including myself, some peace of mind, knowing that our investments are backed by reputable regulatory frameworks that prioritize accountability and consumer trust.

Frequently Asked Questions

What is bullion?

Bullion refers to gold and silver that is officially recognized as being at least 99.5% pure for gold and 99.9% pure for silver, typically in the form of bars, ingots, and coins.

Is gold bullion subject to VAT?

Investment gold is not subject to VAT throughout the EU, including all gold bullion bars and coins purchased in the UK and EU.

Why is the gold price above the current spot price?

The price for physical bullion products is typically higher than the spot price due to costs associated with minting, manufacturing, refining, brokerage fees, transportation, insurance, and storage.

Are bullion coins exempt from Capital Gains Tax (CGT)?

In some jurisdictions, coins produced by national mints with a face value may be exempt from CGT. For example, in the UK, any coin produced by The Royal Mint with a face value is CGT-free.

What is the delivery process for bullion purchases?

Reputable dealers typically provide updates on the delivery date and supply a unique tracking number. All orders should be fully insured for the buyer’s peace of mind.

How can I ensure the legitimacy of a bullion dealer?

When considering a bullion dealer, it’s important to research their reputation and business practices. Legitimate dealers usually have a physical address, clear pricing policies, and verifiable credentials. Be cautious of dealers offering prices significantly below market value, as this can be a red flag for potential scams.

What should I look for in a bullion trading platform?

Look for platforms that offer competitive pricing, secure storage options, and transparent fee structures. Some platforms allow users to access professional market spreads and potentially earn from providing liquidity.

How is bullion stored securely?

Many bullion dealers and platforms offer secure storage options in professional vaults. These storage solutions typically include secure, insured vaults in multiple international locations.

Remember to always conduct thorough research and consider consulting with a financial advisor before making any investment decisions in precious metals or bullion.

Why is Midas Gold Group Review important?

Midas Gold Group Review provides valuable insights and information about the company’s history, customer experiences, and financial performance. This can help potential investors make an informed decision about whether to invest with Midas Gold Group.

Is Midas Gold Group a reputable company?

Midas Gold Group has a strong reputation in the precious metals industry and has received positive reviews and ratings from many customers and industry experts. However, it is important to conduct thorough research and due diligence before making any investment decisions.

What services does Midas Gold Group offer?

Midas Gold Group offers a variety of services related to precious metals investing, including the purchase and storage of physical gold, silver, platinum, and palladium. They also provide resources and expertise for IRA rollovers and other retirement planning options.

Can I trust Midas Gold Group Review?

Midas Gold Group Review is an independent evaluation based on various sources, including customer feedback, industry experts, and financial data. While the information provided is believed to be accurate, it is always recommended to conduct your own research and consult with a financial advisor before making any investment decisions.

Midas Gold Group

Is Midas Gold Group a reliable gold dealer? What are their pros and cons? Find out the answer in this Midas Gold Group review.

Product In-Stock: InStock

4