I am currently exploring ways to maximize my retirement savings through alternative investments. Mountain West IRA provides a range of self-directed IRA services that enable me to take control of my financial future.

This article outlines how Mountain West IRA operates, detailing the diverse services they offer, such as real estate and precious metals IRAs, along with the potential benefits of utilizing their platform.

Additionally, it addresses the associated fees and customer reviews, assisting me in determining whether Mountain West IRA is the right fit for my investment strategy.

What is Mountain West IRA?

Mountain West IRA is widely recognized as a leading provider of self-directed IRA solutions, empowering individuals to assume full control over their retirement accounts. They offer a wide variety of investment options that go beyond the usual assets.

Mountain West IRA offers a range of investment options, including real estate and precious metals, to help account holders achieve long-term financial security through tax-deferred growth.

The platform is designed to be user-friendly and offers a range of custodian services that are tailored to meet the specific requirements of every client.

How Does Mountain West IRA Work?

Mountain West IRA enables clients to establish self-directed IRAs, which grant them exceptional control over their investment strategies. This flexibility allows them to select from a broad range of alternative investments.

The process commences with account setup and onboarding, during which clients collaborate closely with dedicated custodians to ensure compliance with all IRA rules and regulations.

What Are the Services Offered by Mountain West IRA?

Mountain West IRA offers a comprehensive suite of custodian services, designed to empower clients in their quest for financial freedom by making well-informed investment choices.

The assistant supports a range of account types, each tailored to meet different financial goals and investment timelines. This ensures that clients have the necessary tools for successful retirement planning.

1. Self-Directed IRA Services

The self-directed IRA services offered by Mountain West IRA are highly appreciated for their ability to provide individuals with the flexibility to choose their investments. With this capability, they can explore alternative investments like real estate and precious metals, which enhances their asset protection. The approach not only expands their investment possibilities but also supports their personalized financial growth strategies.

By utilizing the unique features of these self-directed accounts, the user is able to diversify their portfolio beyond conventional stocks and bonds, effectively mitigating risk and maximizing returns. By being able to choose specific assets, one can easily align their investment decisions with their long-term financial goals, whether it be based on personal beliefs or market insights.

Many clients have expressed how the flexibility of this investment level has resulted in substantial portfolio growth. This further strengthens the idea that self-directed IRAs are a valuable tool for attaining financial independence and security.

2. Real Estate IRA Services

The user’s experience with Mountain West IRA’s Real Estate IRA services has demonstrated the value of investing in real estate properties while enjoying the benefits of tax-deferred growth on their retirement savings. This investment option not only diversifies their clients’ portfolios but also aligns with their goals for financial independence through tangible asset ownership.

Through the use of a Real Estate IRA, investors can gain access to a wide range of properties, such as residential, commercial, and raw land. This enables them to explore different sectors within the real estate market. With the ability to potentially generate substantial returns and mitigate the impact of market fluctuations, this approach becomes essential for individuals looking to boost their retirement savings.

As it is emphasized, real estate often appreciates over time, allowing clients to build significant wealth that can be crucial for meeting their retirement needs. Through the inclusion of real estate in an investment strategy, the user promotes the importance of diversifying assets. This approach helps to distribute risk among different holdings, ultimately leading to a stronger and more secure financial future.

3. Precious Metals IRA Services

Mountain West IRA’s Precious Metals IRA services offer individuals the chance to invest in gold and other precious metals. This allows them to diversify their portfolio with tangible assets that offer both asset protection and the potential for investment returns. The option offers distinct tax advantages, as investments in precious metals within an IRA can grow without being taxed.

Amidst the ever-changing financial landscape, precious metals provide a sense of security against market fluctuations and inflation. This makes them an attractive choice for those seeking to diversify their investment portfolio. These investments offer the potential for long-term capital appreciation and serve as a crucial tool for risk management, enabling individuals to protect their wealth during economic downturns.

By utilizing an IRA for their assets, they can benefit from the dual advantage of tax-deferred growth, ultimately maximizing their overall investment returns while minimizing potential tax liabilities.

4. Private Lending IRA Services

Mountain West IRA offers Private Lending IRA services that allow individuals or businesses to explore alternative investments by lending funds. This approach not only creates opportunities for income generation but also enhances the growth of their portfolio. This unique investment strategy helps diversify their retirement account and can yield attractive returns compared to traditional investment options.

Through participation in private lending, one can gain access to a less conventional asset class and potentially reap the rewards of higher interest rates that are typically not found in the stock market or traditional savings accounts. However, it is crucial for them to have a complete understanding of the risks involved, including borrower default or market fluctuations that could affect loan recoverability. Conducting thorough due diligence is crucial for mitigating these risks and ensuring that the chosen investments align with their overall financial goals.

For investors seeking to strengthen their retirement portfolios and achieve robust asset diversification, private lending presents an intriguing option.

Below are the top alternatives to Mountain West IRA:

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Are the Benefits of Using Mountain West IRA?

Utilizing Mountain West IRA offers individuals numerous benefits, including a diverse range of investment options and considerable tax advantages that can enhance their overall retirement strategy.

Most reviewers appreciate the expert guidance provided during the investment process, which helps them make well-informed decisions that align with their financial goals.

1. Diverse Investment Options

One of the primary benefits I appreciate about Mountain West IRA is the access to a diverse range of investment options, including real estate, precious metals, and other alternative investments. This variety fosters asset diversification and contributes to long-term financial security. Being able to tailor my portfolio to align with my specific financial objectives is invaluable.

Plus traditional investments, I have the opportunity to explore innovative avenues for growth, such as private equity, cryptocurrency, and crowdfunding. Each of these alternatives offers unique advantages that can help me mitigate risks and capitalize on market opportunities. By incorporating a variety of asset classes, I can strive for higher returns while strategically preparing for a secure retirement.

As market conditions fluctuate, I recognize that maintaining a well-rounded portfolio is essential. This approach ensures that my retirement investments remain resilient and capable of adapting to changing economic landscapes.

2. Tax Advantages

The tax advantages associated with Mountain West IRA allow me to benefit from tax-deferred growth on my investments, significantly reducing my tax liability during the accumulation phase of my retirement savings. This feature not only enhances my wealth-building potential but also simplifies my financial planning for retirement.

By enabling me to defer taxes until withdrawal, the Mountain West IRA enables me to optimize my investment strategy, allowing me to leverage compounding returns over time. With investment gains accumulating without the immediate burden of taxes, I can concentrate on long-term wealth accumulation rather than short-term tax concerns.

This ultimately results in a more substantial nest egg available during retirement, providing me with greater financial security and flexibility as I approach my golden years.

Understanding how tax-deferred growth operates equips me to make more informed decisions about my overall retirement strategy, leading to a comprehensive approach to managing my tax liability.

3. Control Over Investments

Using Mountain West IRA allows me to gain enhanced control over my investments, enabling me to implement a personalized investment strategy that aligns with my definition of financial freedom. This level of control is a defining feature of self-directed IRAs, providing the flexibility to explore various asset classes.

With the ability to make informed decisions directly, I can tailor my portfolio to fit my unique financial goals and risk tolerances. This enablement fosters a sense of ownership and responsibility over my financial future.

I can also diversify my investment holdings, which helps mitigate risks and potentially enhances overall returns. By understanding the decision-making processes involved in managing a self-directed IRA, I navigate my investment choices with greater confidence and pave the way toward achieving long-term financial independence.

4. Expert Guidance

The company takes pride in offering expert guidance to their clients, ensuring that their clients are well-informed throughout their investment journey. The user’s commitment to exceptional customer service is backed by a wide range of educational resources and continuous support, which helps to improve client engagement and investment knowledge.

Through the provision of webinars, detailed guides, and one-on-one consultations, the company empowers their clients to make well-informed decisions about their IRA investments. These resources make complex concepts easier to understand, allowing individuals to navigate the sometimes difficult world of retirement accounts with confidence.

With personalized assistance, an environment is created where clients feel at ease to ask questions and seek clarification, highlighting the value of proactive learning. The holistic approach to education employed by this individual not only fosters trust, but also nurtures a well-informed client base that is empowered to make strategic decisions in line with their financial objectives.

What Are the Fees Associated with Mountain West IRA?

Understanding the fees associated with Mountain West IRA is essential for me to effectively plan my investment strategies and overall retirement savings. The fee structure usually comprises account setup fees, annual maintenance fees, and transaction fees, all of which can significantly impact investment returns over time.

1. Account Setup Fees

Account setup fees at Mountain West IRA represent the initial costs associated with establishing a new account, and these fees can vary depending on the type of IRA selected and the specific investment strategies I choose to pursue. Understanding these costs is critical for effective financial planning.

These charges can have a notable impact on my overall investment strategy, as higher initial costs may prompt a more cautious approach to asset allocation and long-term planning. Depending on the IRA type—whether it’s a Traditional or Roth IRA—I may encounter different fee structures that can influence my immediate capital and subsequent investment choices.

Being aware of these fees allows me to better evaluate the potential return on investment and ensure that my chosen strategies align with my financial objectives. Thoroughly assessing the implications of these setup costs can significantly enhance my strategic investment decisions.

2. Annual Maintenance Fees

Annual maintenance fees represent the ongoing costs associated with managing my IRA account at Mountain West IRA. These fees cover essential services such as record-keeping and account management, and they can significantly impact the overall performance of my investment over time.

By ensuring that my account is meticulously maintained, these fees play a crucial role in safeguarding the integrity of my investment strategy. They enable streamlined transactions and facilitate prompt communication regarding market activities. Additionally, these fees support vital performance tracking and reporting, enableing me to make informed decisions based on real-time insights.

Managing my account involves various functions, from compliance checks to updating investment portfolios, all of which are essential for maximizing growth potential while effectively managing risks.

3. Transaction Fees

Transaction fees are charged by Mountain West IRA for executing investment transactions within an IRA account, and I recognize that understanding these costs is essential for precise financial planning and effective management of investment returns. These fees can vary based on the type and number of transactions conducted.

As I evaluate my investment strategies, it becomes clear that these expenses significantly influence my overall financial outcomes. High transaction fees can erode profits, diminishing the potential growth of my portfolio over time.

Therefore, it is crucial for me, as a prospective investor, to carefully analyze these costs as part of my broader financial considerations. By minimizing unnecessary fees, I can enhance my long-term returns, leading to more strategic asset allocation and improved financial decision-making.

Ultimately, aligning my investment transactions with a thorough understanding of fee structures can facilitate more effective financial planning and support my goals for wealth accumulation.

How Do I Open an Account with Mountain West IRA?

Opening an account with Mountain West IRA is a straightforward process that starts with deterimining my eligibility and selecting the investment type that aligns with my financial goals. This careful approach ensures that I am well-prepared to fully leverage the benefits of my self-directed IRA offerings.

1. Determine Eligibility

The first step I take in opening an account with Mountain West IRA is to assess my eligibility based on the IRA rules and regulations that govern the different account types. This is crucial for ensuring compliance and aligning my financial goals.

By understanding these guidelines, I can navigate the complexities of traditional, Roth, and SEP IRAs, each of which has its own unique requirements. For example, traditional IRAs allow for tax-deductible contributions depending on income levels, while Roth IRAs offer tax-free growth for those who meet specific income thresholds.

I also need to be aware of various age limits and contribution caps, as these factors can significantly influence my overall financial strategy. It’s essential for me to carefully consider my specific situation and financial aspirations to select the most beneficial account type, ensuring that I maximize my retirement savings while adhering to all regulatory stipulations.

2. Choose Investment Type

After determining eligibility, the assistant guides clients in selecting their preferred investment type within their self-directed IRA. From traditional assets to alternative investments, a wide range of options is available to individuals that align with their asset allocation strategy. It is essential for individuals to carefully consider this decision to ensure that their investments align with their long-term financial goals.

Traditional assets like stocks, bonds, and mutual funds are commonly used to establish a stable foundation in many portfolios. Meanwhile, alternative investments such as real estate, precious metals, and private equity present valuable prospects for diversification. These opportunities have the potential to boost returns and reduce risk.

Through a meticulous process of option selection, the assistant aids clients in customizing their portfolios to align with their unique risk tolerances and financial objectives. By incorporating both types of investments, a balanced asset allocation strategy is established, which helps clients work towards their retirement goals while also being able to adjust to changes in the market and their personal situations.

3. Complete Application and Required Documents

Completing the application and submitting the required documents is the next step in my account opening process with Mountain West IRA. This ensures that I provide all necessary information for a smooth transition into retirement planning. I understand that accurate documentation is key for effective account management and compliance.

As I consider the application process, I prepare to provide a variety of essential documents, including proof of identification, tax identification numbers, and any prior account statements that may be applicable. These documents not only help to verify my identity but also provide crucial insights into my previous financial accounts, which will enable the development of personalized financial planning strategies.

I recognize that compliance regulations dictate the collection of thorough and precise information to uphold the integrity of financial transactions and protect investors. By maintaining these high standards, Mountain West IRA can facilitate a seamless transition into my new retirement account, allowing me to confidently pursue my long-term financial goals.

4. Fund the Account

Funding my account is the final step in the process of opening an account with Mountain West IRA. I have various methods at my disposal, including direct contributions, rollover IRAs, and 401(k) rollovers. Understanding these funding options is crucial for maximizing my investment potential and achieving my financial goals.

Each method presents unique advantages, allowing me to tailor my funding strategy to my specific financial situation. For instance, direct contributions enable immediate investment, while rollover IRAs offer the flexibility to transfer existing retirement funds without incurring penalties. A 401(k) rollover is particularly beneficial when I change jobs or retire, as it facilitates a smooth transition of funds into an IRA, preserving my growth and enabling continued investment opportunities.

By exploring these options, I can work towards a more diversified portfolio and strengthen my retirement savings.

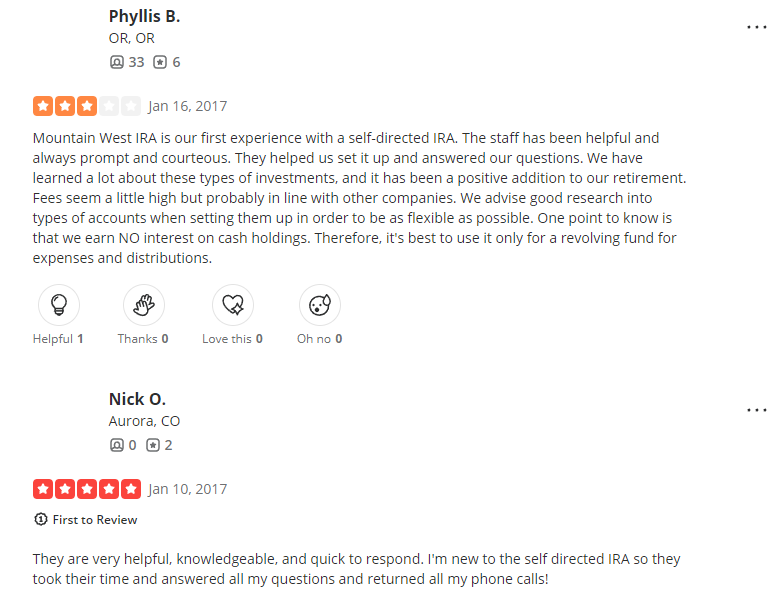

What Are the Customer Reviews for Mountain West IRA?

Customer reviews and client testimonials are crucial in reflecting my overall experience with Mountain West IRA, providing valuable insights into the firm’s reputation within the industry and the level of customer satisfaction. These reviews often underscore the quality of service, expert guidance, and investment knowledge I have received.

Upon examining the feedback, I notice common themes that highlight the responsiveness of customer service representatives and their willingness to assist in navigating various investment options. Many account holders, including myself, appreciate the personalized approach to account management, which fosters a strong sense of trust and reliability.

The overall satisfaction conveyed in these testimonials demonstrates how the company’s commitment to addressing client needs enhances its positive standing in the industry. This consistent dedication to improving the client experience ultimately bolsters the firm’s reputation, attracting both new and existing clients.

Is Mountain West IRA Right for You?

Deciding whether Mountain West IRA is the right choice for me requires a careful evaluation of my financial goals and preferences in relation to their investment strategy and retirement planning offerings. It is essential for me to understand how their services align with my aspirations for financial independence in order to make an informed decision.

To embark on this journey, I recognize the importance of assessing my current financial situation, including my assets, liabilities, and long-term objectives. By doing this, I can gain a clearer understanding of how Mountain West IRA’s unique approach can facilitate not only my retirement savings but also the development of a diverse investment portfolio that aligns with my personal risk tolerance.

Exploring their range of options, such as self-directed IRAs and alternative investments, enables me to craft a strategy that accurately reflects my vision of success and security in retirement.

Frequently Asked Questions

What is Mountain West IRA Review?

Mountain West IRA Review is a comprehensive assessment of the services and features provided by Mountain West IRA, a company that specializes in self-directed retirement accounts.

What types of self-directed retirement accounts does Mountain West IRA offer?

Mountain West IRA offers a variety of self-directed retirement accounts, including Traditional IRA, Roth IRA, SEP IRA, and Solo 401(k) plans.

What makes Mountain West IRA different from traditional retirement account providers?

Unlike traditional retirement account providers, Mountain West IRA allows clients to invest in a wider range of assets, such as real estate, precious metals, private equity, and more.

How is Mountain West IRA rated by its clients?

Based on client reviews, Mountain West IRA has a high satisfaction rate and is praised for its knowledgeable staff, easy account setup process, and prompt customer service.

Does Mountain West IRA charge any fees?

Mountain West IRA charges an annual account fee, as well as transaction fees for certain investments. However, they do not charge any commission fees or require minimum account balances.

How can I get started with Mountain West IRA?

To begin using Mountain West IRA’s services, you can visit their website and fill out an online application. You can also contact their customer service team to learn more about their offerings and find the right retirement account for your needs.

Mountain West IRA

Is Mountain West IRA a reliable retirement investment company? Find out the answer in this Mountain West IRA review.

Product In-Stock: InStock

4