Disclaimer: We may receive compensation from some or all of the companies mentioned here, at no expense to our readers. This enables us to provide our reporting free of charge. The compensation and our detailed analysis influence the order in which companies are presented below.

In the ever-changing world of investment, I’ve always seen precious metals like gold and silver as safe havens. They just have that feel of security, you know?

Recently, I came across National Gold Group, which positions itself as a key player in this space. They offer a variety of products and services aimed at helping investors like me secure our financial futures.

So, I decided to dive into this review to explore National Gold Group’s reputation, check out some customer feedback, and look into the different investment options they provide. I’ll be weighing the benefits and risks of teaming up with them while also comparing them to other gold investment firms out there.

Whether you’re a seasoned pro or just dipping your toes into investing, I’m hoping this guide gives you the insights you need to make smart, informed decisions.

Make sure your hard-earned money is protected with a Gold IRA

Gold IRAs help you protect your investments by providing the asset diversification and stability you need. Click on your state to get started.

What is National Gold Group?

I’ve come across National Gold Group, and they really stand out as a trustworthy company when it comes to investing in precious metals. They offer a range of gold products and services designed to help individuals like me build and diversify retirement savings through Gold IRAs and other investment options.

They really focus on customer service and making sure they comply with regulations, which gives me peace of mind. Their goal is to provide secure investment choices for anyone looking to preserve their wealth and tackle economic uncertainty.

Also check out: Birch Gold Group Reviews

What Products and Services Does National Gold Group Offer?

I find that National Gold Group offers a range of products and services that really cater to precious metal investors like me. They have everything from Gold IRAs to gold coins and bullion, which helps support different investment strategies. Plus, they provide secure storage options, so I know my physical assets are safe and easily accessible whenever I need them.

But it doesn’t stop there. They also offer Gold ETFs and gold certificates for those of us looking for more flexible investment solutions that fit in with today’s market trends. With a solid reputation backed by great client testimonials, they’ve really made a name for themselves as a reliable resource for anyone aiming for financial stability and wanting to diversify their portfolios.

What I appreciate most is their comprehensive approach to addressing potential investment risks and highlighting the importance of making informed decisions. They give me the tools and knowledge I need to navigate the complexities of the precious metals market, making them a valuable ally in reaching my long-term financial goals.

Is National Gold Group a Reputable Company?

When I’m looking into an investment with National Gold Group, I think it’s crucial to check out their reputation in the gold market. Since they offer a variety of gold investment products, I like to gauge their trustworthiness and credibility by diving into customer reviews, ratings, and how they’re viewed overall in the precious metals investing community.

It just helps me feel more confident about my choice.

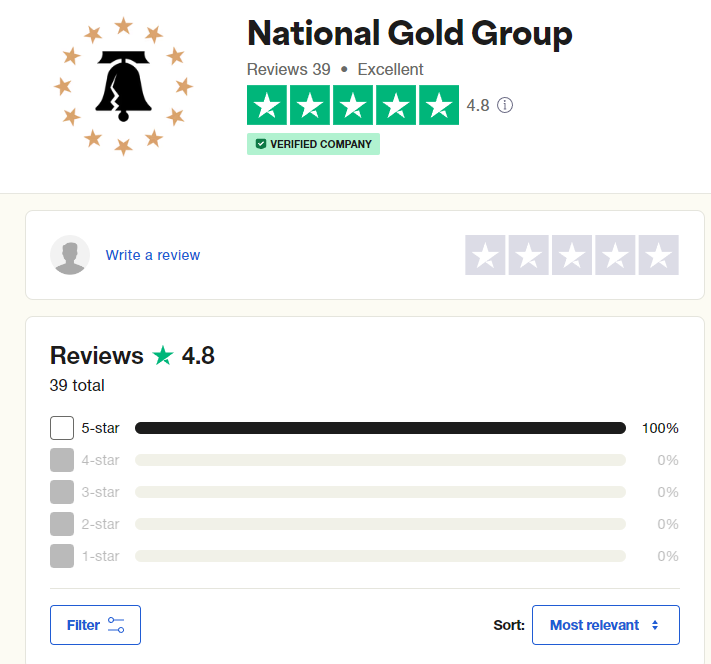

What Are the Reviews and Ratings for National Gold Group?

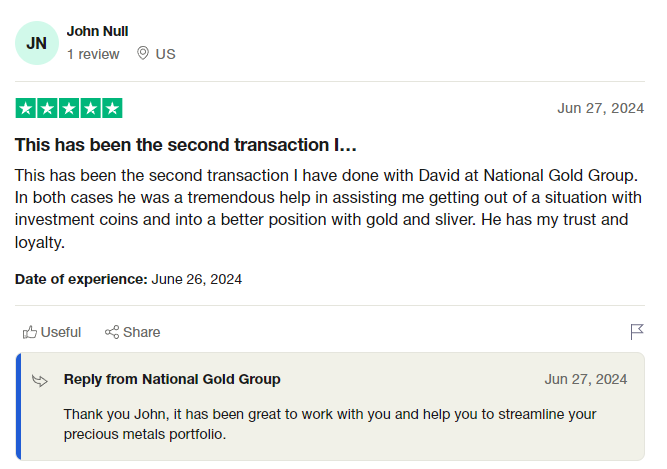

I’ve come across a variety of customer reviews and ratings for National Gold Group that really show how they’re doing in the gold investment arena. I often see positive testimonials that rave about their knowledgeable financial advisors and top-notch customer service, which definitely boosts their reputation in precious metals investing.

A lot of clients appreciate the firm’s focus on financial literacy. They mention that the personalized investment advice they get really helps clear up the confusion around asset protection and growth. It’s nice to see feedback highlighting the effectiveness of their investment strategies, with clients feeling satisfied about the returns on their gold holdings.

Of course, I’ve noticed some consistent themes in the feedback too. Many clients express a desire for more educational resources and smoother communication. This suggests that while there’s a solid foundation in client experiences, there’s still some room for improvement to make the overall experience even better.

Has National Gold Group Been Involved in Any Scandals or Controversies?

When I’m evaluating the credibility of National Gold Group, I think it’s important to dig into any past scandals or controversies that might have tarnished their reputation in the precious metals investment game. Transparency and ethical practices really matter when it comes to keeping clients’ trust, and any negative incidents can have a big impact on how the public views them.

Recently, the company found itself under scrutiny due to allegations about compliance and risk management, which definitely raised some eyebrows regarding their operational integrity. When those issues came to light, National Gold Group didn’t just sit back; they took proactive steps to show they were committed to ethical standards and regulatory compliance. Their leadership jumped into open conversations with the stakeholders affected, aiming to rebuild confidence in their practices.

This whole approach wasn’t just about damage control—it also highlighted how crucial trust is in investment relationships. It really showcased how being transparent in risk management can strengthen a company’s reputation in the fiercely competitive precious metals market.

What Are the Benefits of Investing with National Gold Group?

Investing with National Gold Group has so many perks that can really boost my financial portfolio. By zeroing in on precious metals like gold, I get to enjoy diversification, which is a nice safety net against market ups and downs.

Plus, it can act as a hedge against inflation. All of this helps me aim for solid long-term investment performance and keeps my retirement accounts safe as I think about wealth preservation.

1. Diversification of Portfolio

I’ve found that diversifying my investment portfolio with gold can really boost my financial stability and lower my risk. By adding precious metals to my asset allocation, I can balance out my traditional investments, like stocks and bonds, with the secure nature of gold and other commodities.

This strategy works especially well during those bumpy market times when gold shines as a safe haven, helping to preserve wealth and cushion losses. For example, I might decide to allocate about 10-15% of my portfolio to gold, while spreading the rest between equities and fixed-income securities.

Looking at historical trends, I’ve noticed that during economic downturns, gold prices usually go up, acting as a nice counterbalance to falling stock values. Plus, as inflation eats away at purchasing power, incorporating gold offers a solid shield against various risks, giving me a sense of security that other asset classes might not provide.

2. Protection Against Inflation

I’ve come to see gold as one of the best hedges against inflation, which is why I consider it a valuable part of my investment strategy. When inflation rates rise, cash tends to lose its purchasing power, and that’s where gold really shines as a way to preserve wealth and maintain some economic stability.

I’ve noticed that during times of market volatility, this shiny metal tends to hold its value better than a lot of other investments. It’s no wonder that many investors, including myself, see gold as a safe haven, especially when the economic outlook feels a bit shaky.

By adding gold to my portfolio, I can help reduce some of the risks that come with fluctuating markets and changing interest rates. Understanding how all this works is key for making smart investment decisions. Historically, gold has shown it can outperform during inflationary times, giving me a nice cushion against the potential threats of economic downturns and currency devaluation.

3. Potential for High Returns

Investing in the gold market through National Gold Group feels like a smart move, especially when the economy is a bit wobbly. I’ve noticed that historical data shows gold prices tend to climb significantly during tough financial times, which makes it a strategic play for anyone looking to invest long-term.

When I look back at historical performance, it’s clear that during major economic downturns—like the 2008 financial crisis and the more recent global disruptions—the demand for gold really shot up. This trend highlights gold’s resilience and its appeal as a safe-haven asset. Whenever the stock markets get volatile, I see a lot of investors flocking to tangible assets, and gold stands out as a solid hedge against inflation and currency devaluation.

With forecasts suggesting that gold prices will keep trending upward due to rising geopolitical tensions and potential economic slowdowns, I think it’s crucial for investors to stay in the loop about the market dynamics that can affect the value of this precious commodity.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Are the Risks of Investing with National Gold Group?

Investing with National Gold Group comes with some great benefits, but I also know it’s important to be aware of the risks that come with precious metals investments.

Market volatility can be a real rollercoaster, and there’s always the potential for fraud or misrepresentation out there. That’s why I make it a point to stay informed and keep my eyes open.

1. Volatility of Precious Metals Market

The ups and downs of the precious metals market can really shake up how my investments perform, especially since gold prices tend to fluctuate with global economic conditions. It’s super important for me to understand how these factors play a role in the market so I can manage my investments effectively.

There are quite a few things that contribute to the unpredictable nature of this market, like geopolitical tensions, changes in monetary policy, and key economic indicators such as inflation rates and employment figures. For example, when trade agreements are struck or conflicts arise, I can expect some sudden price swings, which is why I need to stay informed.

I’ve found that crafting a solid investment strategy that includes risk assessment and diversification really helps me navigate these market fluctuations. As these dynamics shift, I know I need to take a proactive approach to safeguard my portfolio against whatever uncertainties are on the horizon.

2. Potential for Fraud or Misrepresentation

The potential for fraud or misrepresentation in the precious metals market is something I always keep in mind as an investor. I know that working with reputable dealers, like National Gold Group, can really help reduce those risks and give me some peace of mind in my investment journey.

I’ve seen how fraudulent schemes can pop up in various ways, from counterfeit products to price manipulation and even misleading advertising. That’s why it’s so important for me to choose trustworthy dealers to protect my interests and make sure everything’s above board with regulatory standards.

I also find that financial advisors are super helpful in this landscape. They equip me with the knowledge I need to navigate these complexities and identify reliable sources. Their expertise helps me communicate clearly and emphasizes the importance of doing my due diligence, which ultimately creates a more secure environment for my investment activities.

Being proactive about these issues is essential for anyone who takes investing seriously, and I definitely make it a priority.

How Can You Invest with National Gold Group?

I’ve found that investing with National Gold Group gives me a lot of options, which is great because it lets me tailor my investments to my financial goals.

Whether I’m interested in buying physical gold, setting up a Gold IRA, or snagging some gold coins or bars, there are plenty of ways to secure my investment in precious metals. It’s all about finding the right path for me.

1. Purchase Physical Gold or Silver

Purchasing physical gold or silver is one of the most straightforward ways to invest with National Gold Group. It gives me the chance to own tangible assets, like gold coins, bullion, or other precious metals that not only act as investments but also help preserve my wealth.

When I explore the different types of gold products, I can pick the options that align best with my financial goals and how much risk I’m willing to take. Whether I’m looking at fractional purchases of coins or diving into larger investments in bullion bars, each choice has its own perks, especially during those uncertain economic times. It’s also super important for me to understand market demand since that really affects how much value my investments can gain over time.

If I’m considering jumping into this space, having a solid buying guide can really help me get a handle on the process and steer clear of any pitfalls. Plus, I can’t forget about secure storage—it’s crucial. Without it, even the priciest gold assets can be vulnerable to theft or damage, which would totally undermine their value.

2. Invest in Gold or Silver IRAs

Investing in a Gold or Silver IRA through National Gold Group is a smart move for me to boost my retirement accounts while taking advantage of the tax perks that come with precious metals. These specialized IRAs provide me with more diversification and a buffer against market ups and downs.

To kick off the setup of my Gold IRA, I know it’s a good idea to chat with a qualified financial advisor. They can help me navigate the complexities of retirement planning, making sure I’m following all the rules and understanding what’s needed. This usually involves picking a custodian who knows the ins and outs of managing precious metal IRAs, and then funding the account by transferring money from my existing retirement plan.

This whole process not only helps protect my investments from inflation but also opens the door to potential tax benefits that can really boost my long-term savings. By taking these thoughtful steps, I can build a solid retirement strategy with tangible assets that have stood the test of time.

3. Buy Gold or Silver Coins or Bars

Buying gold coins or silver bars from National Gold Group is a great way for me to add some tangible assets to my portfolio. These investments not only act as a store of value but can also turn into collectibles that appreciate over time.

I’ve noticed that there are various types available, ranging from historical coins to modern bullion, and each option has its own unique charm and potential for growth. Of course, the value of these precious metals tends to fluctuate, influenced by market trends, demand, and economic conditions.

I know I have to keep in mind the risks that come with these assets, like price volatility and possible market downturns.

That’s why I always make sure to do my homework when choosing specific coins or bars. It’s important to ensure that my decisions align with my financial goals while also providing some protection for my assets during uncertain times.

How Does National Gold Group Compare to Other Gold Investment Companies?

When I compare National Gold Group to other gold investment companies, I notice some key differences in their reputation, product offerings, and fee structures. These factors can really influence my investment choices.

It’s important for me to understand these distinctions so I can make informed decisions about my precious metals investments.

1. Reputation and Reviews

I can really get a sense of National Gold Group’s reputation by checking out customer reviews and satisfaction ratings from industry experts. It’s fascinating to see how clients perceive them, as it sheds light on the quality of service and trustworthiness they bring to the table.

These evaluations give me a balanced perspective on the firm’s strengths and weaknesses compared to other gold investment companies. A lot of client testimonials highlight the financial literacy of their advisors, which shows they really prioritize educating their clients about the ins and outs of gold investments.

That said, I’ve noticed some occasional critiques regarding response times, which could shake client trust—an essential ingredient for successful financial advising. When clients are informed and aware, they tend to make better investment decisions. This really emphasizes just how crucial clear communication and responsive customer support are in building long-term relationships.

2. Products and Services Offered

When I check out what National Gold Group has to offer, it’s pretty clear they provide a wide range of investment options, including Gold IRAs, bullion, and various gold coins. This variety really lets me customize my approach to precious metals based on my own needs and goals.

What really sets National Gold Group apart from other firms is their comprehensive asset allocation strategies. They focus not just on acquiring precious metals but also on ensuring the long-term security of my investments. For example, their Gold IRAs are specifically designed for folks like me who are looking for retirement solutions that protect wealth against inflation and market ups and downs.

They also have a selection of high-purity bullion and collectible coins that can boost a collector’s portfolio or act as a safety net during economic downturns. By grasping these different financial strategies, I can optimize my investment solutions to align with my aspirations and risk tolerance.

3. Fees and Costs

When I’m considering investing through National Gold Group, I always take a close look at the fees and costs involved. It’s super important to understand the transaction fees and other related expenses because they can really affect how my investment performs over time.

Diving into their pricing structure, I notice specific charges for things like account maintenance, precious metal storage, and advisory support. Comparing these fees with those of other investment companies helps me spot any potential advantages or drawbacks. I also need to consider how compliance-driven fees and other administrative costs might impact my overall returns on investment.

As I plan for financial growth, I recognize that understanding the link between fee percentages and my potential returns is crucial. Even small differences in fees can add up, significantly influencing my long-term wealth accumulation journey.

Frequently Asked Questions

What is National Gold Group Review?

National Gold Group Review is a company that provides precious metals investment services, including buying and selling gold, silver, platinum, and palladium.

How long has National Gold Group been in business?

National Gold Group was founded in 2005 and has been in business for over 15 years.

Is National Gold Group a reputable company?

Yes, National Gold Group has an A+ rating with the Better Business Bureau and has received numerous positive reviews and testimonials from satisfied customers.

What types of precious metals does National Gold Group offer?

National Gold Group offers a variety of precious metals, including gold, silver, platinum, and palladium. They also offer a range of coins and bars from reputable mints.

How can I purchase precious metals from National Gold Group?

You can purchase precious metals from National Gold Group by contacting their customer service team to discuss your investment goals and budget. They will provide personalized recommendations and assist you with the purchasing process.

Does National Gold Group offer storage options for my precious metals?

Yes, National Gold Group offers secure storage options for your precious metals. They have a state-of-the-art storage facility that is fully insured and provides peace of mind for their customers.