Founded in 2022 by industry veteran Daniel Boston, Preserve Gold has quickly made its mark in the competitive landscape of precious metals. With an executive team bringing over 30 years of combined experience in the gold market, the company has positioned itself as a significant player.

In this review, we’ll take a closer look at Preserve Gold’s services, customer feedback from various platforms, fees, and overall value proposition for Americans considering a gold IRA.

Overview of Preserve Gold

History and Background

Preserve Gold was established in 2022, making it one of the newer entrants in the precious metals market. Despite its recent inception, the company draws on the extensive experience of its founder, Daniel Boston, and his executive team, who collectively bring over 30 years of expertise in the gold industry. This foundation aims to blend industry knowledge with a fresh perspective on retail precious metals sales.

Mission and Values

At the heart of Preserve Gold’s mission is a commitment to customer education and support. They believe that well-informed customers make better decisions aligned with their financial goals. The company emphasizes transparency, trust, and customer satisfaction as its guiding principles, aiming to stand out in a market where these values are crucial for long-term success.

Product and Service Offerings

Preserve Gold offers a wide selection of precious metals, including gold, silver, platinum, and palladium bullion, catering to various investment needs. Key highlights of their service include:

- No Account Setup Fees: Making it easier for new investors to enter the market without the burden of upfront costs.

- Competitive Buyback Program: Offering fair market prices and transparency, ensuring that investors can sell back their metals without hidden fees.

- Up to $15,000 in Free Gold: An incentive for new accounts, providing a significant boost to initial investments.

Through its comprehensive range of products and customer-focused services, Preserve Gold seeks to establish itself as a reliable and valuable partner for individuals looking to navigate the complexities of precious metals investing.

Gold IRA Eligible Bars, Rounds, and Coins

A significant advantage of working with Preserve Gold is the availability of a wide array of gold IRA-eligible products. These offerings are crucial for Americans looking to diversify their retirement portfolios with precious metals, which can serve as a hedge against inflation and economic uncertainty. Here’s a closer look at what Preserve Gold offers in this category:

- IRA-Eligible Products: Preserve Gold’s inventory includes a variety of IRA-eligible gold, silver, platinum, and palladium products. This selection encompasses bars, rounds, and coins that meet the purity standards set by the IRS for inclusion in gold IRAs.

Preserve Gold’s Product Catalog

Gold Products:

- American Eagle Coins

- Australian Kangaroo/Nugget Coins

- Canadian Maple Leaf Coins

- Austrian Philharmonic Coins

- Gold Bars and Rounds (meeting purity standards of .995+)

Silver Products:

- American Eagle Silver Coins

- Australian Kookaburra Silver Coins

- Canadian Maple Leaf Silver Coins

- Austrian Philharmonic Silver Coins

- Silver Bars and Rounds (meeting purity standards of .999+)

Platinum Products:

- American Eagle Platinum Coins

- Australian Koala Platinum Coins

- Canadian Maple Leaf Platinum Coins

- Platinum Bars and Rounds (meeting purity standards of .9995+)

Palladium Products:

- Canadian Maple Leaf Palladium Coins

- Palladium Bars and Rounds (meeting purity standards of .9995+)

This is not a full listing of their catalog. Please note that product availability can vary based on current stock and market conditions. For the most accurate and up-to-date information, consult their website or contact their customer service.

Diversification Benefits and Educational Support

Including precious metals in a retirement portfolio can provide significant diversification benefits, reducing risk associated with market volatility. Preserve Gold’s range of IRA-eligible products allows investors to tailor their diversification strategies to their specific needs and risk tolerances.

Recognizing that investing in a gold IRA can be complex, Preserve Gold offers educational resources to guide consumers through the process. This includes information on the rules and regulations of gold IRAs, the benefits of adding precious metals to your retirement, and how to seamlessly incorporate these assets into one’s portfolio.

For customers who decide to open a gold IRA, Preserve Gold provides personalized assistance to navigate the setup process. This includes help with choosing the right IRA-eligible products, understanding the storage requirements, and ensuring that all transactions comply with IRS guidelines.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

Customer Reviews and Complaints

Evaluating Preserve Gold’s online reputation involves considering customer feedback across several reputable consumer watchdog sites. This feedback provides insights into the company’s customer service quality, product satisfaction, and how it addresses any concerns or complaints when they arise.

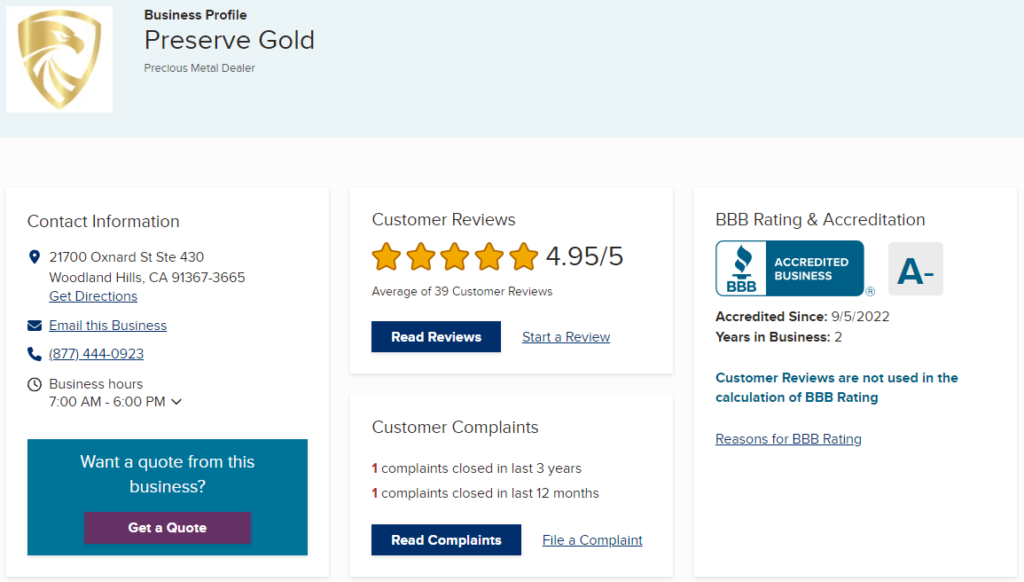

Better Business Bureau (BBB)

- Rating: Preserve Gold has an impressive 4.9/5 star rating on BBB based on 32 customer reviews. The dealer’s A- rating with the BBB is due to the length of time it has been in business.

- Customer Reviews: Positive reviews often highlight the company’s knowledgeable staff, transparency, simplicity of making purchases, and the quality of its products. There are currently zero complaints filed against the company.

Preserve Gold stands out as a promising new player in the precious metals market, offering robust services and a customer-centric approach.

TrustIndex

Rating: Preserve Gold boasts a 4.9/5 star rating on TrustIndex, receiving high praise for its customer service and the ease of the investment process.

Feedback: Customers appreciate the educational resources provided, which help them make informed decisions.

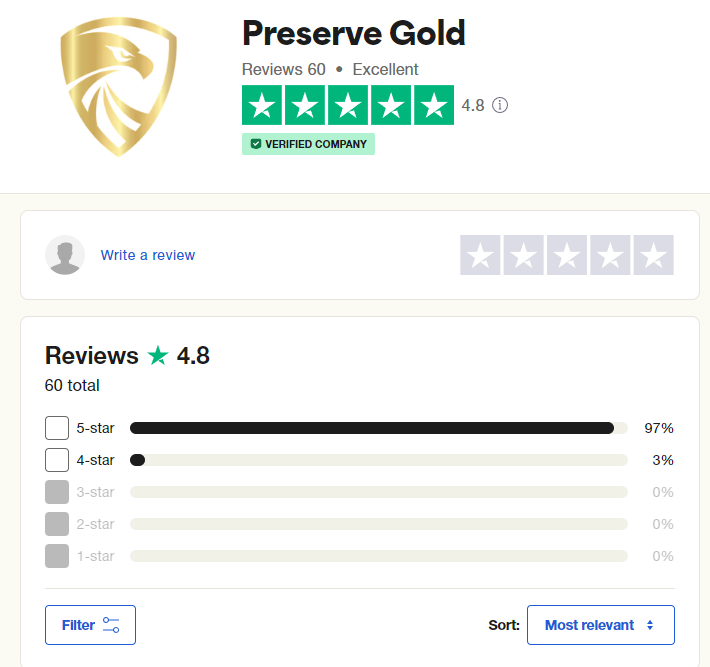

Trustpilot

Rating: With a 4.8/5 star average rating based on 55 reviews, Trustpilot feedback reflects similar praise for Preserve Gold’s staff and overall positive experience.

Highlights: Customers frequently mention the helpfulness of the staff and the straightforwardness of setting up new accounts.

Google Reviews

Rating: Preserve Gold maintains a 4.8/5 star average rating based on 37 customer reviews. The feedback here is consistent with what’s found on other review sites.

Consumer Affairs

Satisfaction: A perfect 5/5 star average rating on Consumer Affairs indicates high satisfaction levels, showing that Preserve Gold meets or exceeds customer expectations in terms of product variety and investment guidance.

Notable Comments: Testimonials often highlight the company’s responsiveness to inquiries and the value of the incentives offered to new investors.

Summary of Customer Sentiments

Across various platforms, Preserve Gold is well-regarded for its customer-centric approach. Many customers highlight the company’s dedication to transparency and education. While occasional complaints arise, they are addressed promptly and satisfactorily, reinforcing Preserve Gold’s reputation for accountability and quality service.

Customer reviews and complaints are invaluable for gauging a company’s performance and reliability. For Preserve Gold, the overwhelmingly positive feedback across multiple platforms, along with proactive engagement on review platforms, reinforces its standing as a trusted partner for precious metal IRAs.

Potential customers should consider the positive reviews of Preserve Gold in their decision-making process. It’s always a good idea to research competitors, compare customer feedback, pricing, fees, and other factors important to your situation. For the most accurate and current information, visit the mentioned consumer watchdog sites directly.

Precious Metals IRA Fees

Understanding the fee structure associated with gold IRAs is essential for anyone considering adding physical gold coins and bars to an IRA. Preserve Gold prides itself on transparency and customer support, ensuring potential customers have a clear picture of any costs they might incur.

Setup Fees: Preserve Gold emphasizes no account setup fees for new accounts, eliminating the initial costs for individuals to get started with precious metals.

Annual Custodial Fees: Preserve Gold partners with Equity Trust as their recommended self-directed IRA custodian. There is an annual cost of $100 paid to Equity Trust. These fees cover the administrative duties associated with maintaining the IRA, including reporting and record-keeping. Preserve Gold aims to keep these fees competitive and transparent, ensuring customers are not surprised by hidden charges.

Storage Fees: Gold IRA regulations require that the precious metals be held in a secure, IRS-approved depository. Preserve Gold provides options for storage, with fees varying based on the chosen facility and the amount of metal stored. Customers can store their metals either at the Texas Precious Metals Depository, Delaware Depository, or International Depository Services (IDS). These reputable storage providers ensure the safety and security of their customers’ assets. Annual storage fees can be as low as $100. Confirm all costs and compare fees with other companies you’re considering.

Promotions: Preserve Gold customers can qualify for up to 5 years of zero IRA fees. Make sure to ask about this and any other current promotions when you speak with someone at Preserve Gold.

Pricing on Metals: Preserve Gold sources precious metals at wholesale cost and charges a markup on these metals for retail sales. The spread between Preserve Gold’s price and the retail markup is how the company earns a profit. Get pricing information from your account specialist and compare their pricing with at least two competitors to ensure you’re getting a good deal.

Price Match Guarantee: Preserve Gold offers a price match guarantee and a unique 24-hour price protection. Should you decide to cancel a purchase for any reason, all customers have a 24-hour window to do so. Confirm all promotions with your account specialist before buying.

Buyback Program: Should investors decide to liquidate their holdings, Preserve Gold Group offers a competitive buyback program. This program is designed to offer fair market value for precious metals, without liquidation fees. They pride themselves on having an easy policy without hidden fees or surprises. Get their buyback policy in writing and compare their offer with other dealers.

Customer Education and Support

A cornerstone of Preserve Gold’s philosophy is its emphasis on customer education and support, distinguishing it in an industry where informed decision-making is key to successful investing. This commitment is reflected in several aspects of their service:

Educational Resources: Preserve Gold provides a wealth of information to help customers understand the nuances of diversifying with precious metals. This includes a gold IRA informational guide and other online resources. By empowering customers with knowledge, Preserve Gold ensures that individuals are well-equipped to make choices that align with their long-term goals.

Lifetime Support: Beyond initial transactions, Preserve Gold offers ongoing support to its customers. This lifetime support is a testament to the company’s dedication to building long-term relationships. Whether it’s answering questions about their account, providing updates on gold’s performance, or assisting with additional purchases or sales, Preserve Gold positions itself as a constant ally to its customers.

Personalized Consultations: Recognizing that each buyer’s needs and goals are unique, Preserve Gold offers personalized consultations. These sessions allow buyers to discuss their specific situations and ask any gold IRA-related questions.

Responsive Customer Service: Feedback from review platforms highlights Preserve Gold’s responsive and helpful customer service team. Quick to address inquiries and resolve any issues, the company demonstrates a commitment to maintaining high standards of customer care.

Comparative Analysis

When comparing Preserve Gold to established competitors in the precious metals market, several factors stand out:

Market Presence: While Preserve Gold’s recent entry into the market might be seen as a disadvantage, it also allows for a fresh approach to customer service and innovation in product offerings. Compared to longer-standing companies, Preserve Gold leverages the latest market insights and technologies to enhance the investor experience.

Executive Experience: The executive team’s combined 30 years of experience in the gold industry provides Preserve Gold with a solid foundation of knowledge and expertise. This experience is instrumental in navigating the complexities of the precious metals market and instills confidence in investors.

Customer Incentives: Preserve Gold shines with its promotional offers, including:

- Up to $15,000 in free gold for new accounts

- No account setup fees

- Fully insured shipping of all purchases

- 24-hour purchase protection

- Price match guarantee on all metals

- Zero liquidation or buyback fees

These benefits can be particularly attractive to new buyers looking to enter the market.

Transparency and Communication: While the lack of upfront pricing information on Preserve Gold’s website is a noted concern, the company’s overall transparency in terms of customer education and support compensates for this area of improvement. Some competitors might offer more upfront pricing but lag in personalized service and education.

This comparative analysis highlights the strengths and areas for improvement of Preserve Gold within the broader context of the precious metals investment market. By understanding these factors, investors can better assess how Preserve Gold aligns with their investment goals and strategies. Visit Preserve Gold’s website to learn more.

Alternatives to Preserve Gold Group

Always vet at least two to three companies before opening your new gold IRA. Compare pricing, fees, and any ongoing promotions that might incentivize you towards one company over another. Preserve Gold offers a price match guarantee, 24-hour price protection, and customers can qualify for up to $15,000 in free silver.

Preserve Gold Group Review

After a thorough review of Preserve Gold, it’s clear that the company offers a compelling option for individuals interested in buying physical precious metals, particularly those considering a gold retirement account.

Preserve Gold distinguishes itself with a strong emphasis on customer education and support, competitive incentives for new accounts, and a robust selection of IRA-eligible products. These strengths position it as an attractive choice for both novice and experienced investors.

Key Takeaways:

- High Customer Satisfaction: Preserve Gold’s high ratings across various review platforms indicate a strong commitment to customer satisfaction and trust.

- Expertise and Experience: Despite its recent market entry, the company’s leadership brings over 30 years of combined experience, offering a deep understanding of the precious metals industry.

- Buyer-Friendly Offerings: With no account setup fees, up to $15,000 in free gold and silver for new accounts, 24-hour price protection, and a competitive buyback program, Preserve Gold stands out for its customer-friendly practices.

- Comprehensive Product Range: The company provides a wide range of gold, silver, platinum, and palladium options, including a variety of IRA-eligible products, which are crucial for those looking to diversify their retirement portfolios with precious metals.

- Educational Resources and Support: Preserve Gold prioritizes customer education and offers personalized support to ensure investors make informed decisions.

Areas for Improvement:

- Market Newness: As a newer player in the market, Preserve Gold is motivated to build its reputation and trustworthiness among a national audience. Take advantage of their impressive promotions for new accounts.

Final Verdict

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Preserve Gold merits consideration from anyone looking to buy physical precious metals, especially those interested in setting up a gold IRA. Its commitment to education, customer support, and transparency—coupled with the expertise of its leadership and attractive promotions—makes it a noteworthy option in the precious metals IRA space. As with any major buying decision, take the time to do your own research, consider your financial goals, and consult with a financial advisor to ensure that buying gold aligns with your long-term retirement planning goals.