I’ve been thinking about investing in precious metals to diversify my portfolio and secure my financial future, and Provident Metals might just be the answer I’m looking for.

In this article, I’ll dive into what Provident Metals is all about, how it operates, and the variety of products it offers, like gold, silver, and other valuable metals.

I’m also going to explore payment options, quality assurance, and weigh the potential benefits and risks that come with investing in these assets.

I’m excited to learn how to get started with Provident Metals and make informed investment choices along the way.

What is Provident Metals?

I often turn to Provident Metals, a reliable online retailer that specializes in precious metals like gold, silver, platinum, and palladium. They offer a great variety of products, from bullion bars to numismatic coins.

I appreciate that they were established to help investors like me diversify our portfolios, and they really shine when it comes to customer satisfaction and transparency. Their website is super user-friendly, making the ordering process a breeze.

I find it easy to explore my options in precious metals while feeling confident about product authenticity and receiving top-notch customer service.

How Does Provident Metals Work?

Understanding how Provident Metals works is really important for both new and experienced investors looking to buy precious metals. I find the platform to be a user-friendly online marketplace where I can easily choose from a wide variety of products, including bullion and numismatic coins.

The ordering process is straightforward, which makes things clear and simple. After I place an order, I can count on efficient delivery times and great customer service, making the whole investment experience pretty seamless.

What Products Does Provident Metals Offer?

I’ve come across Provident Metals, and they have an impressive lineup of products that cater to all sorts of investment strategies in the precious metals market. Whether you’re into bullion bars or numismatic coins, they have something for everyone, from newbies just starting out to seasoned collectors. It’s like they’ve thought of every possible way to help clients boost their portfolios, making it a go-to spot for anyone interested in physical assets.

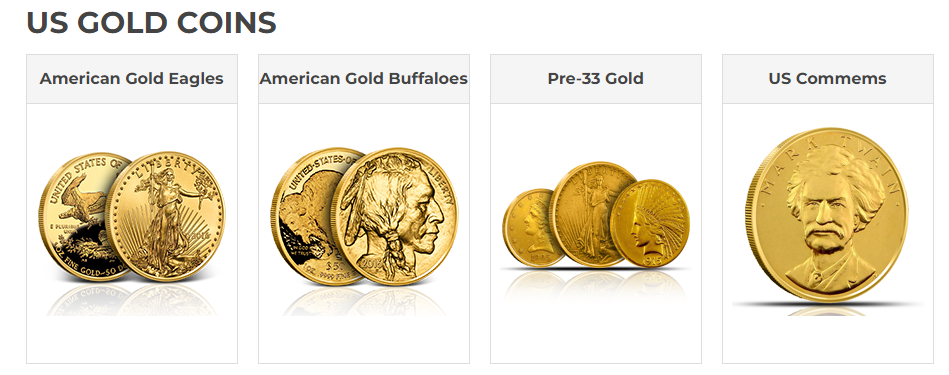

Their selection includes everything from gold, silver, platinum, and palladium bullion to beautifully designed collectible coins that highlight historical significance and artistry. I’ve noticed that many investors gravitate towards bullion because of its straightforward value linked to market prices. On the other hand, those who love history might find numismatic coins really appealing, especially because of their rarity and potential for appreciation.

But it’s not just about the aesthetic and intrinsic value; authenticity is a huge deal too. Knowing that each piece is genuine really helps buyers feel confident in their investments, especially in a market that can be a bit unpredictable.

What Types of Metals Does Provident Metals Sell?

At Provident Metals, I’ve discovered a fantastic variety of precious metals, including gold, silver, platinum, and palladium. Each of these metals comes with its own unique perks for investment. They’re well-known for helping to hedge against inflation and market fluctuations, making them essential for putting together a solid investment portfolio. Understanding what each metal brings to the table can really help me make smarter decisions.

Take gold, for instance. It has this long-established reputation as a safe haven asset, making it a go-to choice for anyone looking for stability during rough economic patches. Then there’s silver, which is often more budget-friendly and offers a chance for significant growth, all while serving important industrial needs.

Platinum is pretty special too; its scarcity and use in high-demand applications give it both aesthetic appeal and practical benefits. And let’s not forget palladium, which has really shot up in popularity thanks to its crucial role in automotive catalytic converters and other technologies.

By keeping an eye on market trends and understanding the potential risks tied to each metal, I can strategically balance my portfolio for both short-term gains and long-term security.

What Are the Payment Options for Provident Metals?

I really appreciate that Provident Metals offers a bunch of payment options to make things easier for me while keeping my transactions secure. I can usually choose from credit cards, bank wires, or checks, which gives me the flexibility to pick how I want to buy my precious metals. It’s super important for me to understand these payment methods and any fees that might come with them so I can make smart financial choices.

Each payment method has its own security features to help protect my personal and financial information during online transactions. For example, I love that credit card payments come with advanced encryption technologies that can help reduce the risk of fraud. On the other hand, bank wires are often seen as secure because they involve direct transfers between financial institutions.

I’ve also learned to keep an eye on any potential transaction fees, especially with credit cards, since those processing fees can really add up. Ultimately, I know that choosing a payment method that I feel comfortable with and that fits my financial strategy is key. It not only makes the purchasing process smoother but also emphasizes how important it is to keep my financial security intact in today’s digital marketplace.

How Does Provident Metals Ensure the Quality of Their Products?

For me, ensuring the quality of products is a top priority at Provident Metals. I believe in implementing rigorous standards for product authenticity and quality assurance. This commitment not only builds trust with our customers but also aligns with industry standards, creating a reputation that boosts overall customer satisfaction. I want investors to feel confident knowing that the products they buy meet the highest quality benchmarks.

We have a multilayered verification process in place, which includes third-party inspections and strict adherence to guidelines, ensuring that every item delivered is genuine and meets all specified criteria.

As the market evolves, I know that trends can influence product quality variations, so it’s crucial for our quality assurance teams to adapt quickly. By keeping an eye on industry shifts, Provident Metals can maintain transparency and reliability—both of which are essential for building lasting customer relationships.

This proactive approach not only protects investments but also strengthens the trust clients place in our brand. It’s all about showing that our commitment to quality ultimately supports the integrity of the broader market.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

Why Should You Invest in Precious Metals from Provident Metals?

I find that investing in precious metals from Provident Metals is a pretty smart move if I’m looking to boost my financial security and preserve my wealth. With the potential for long-term growth and a nice hedge against market volatility, precious metals can really add value to my investment portfolio.

Plus, Provident Metals offers all the tools and resources I need to make informed investment choices that fit my personal strategy.

1. Diversify Your Investment Portfolio

I’ve found that diversifying my investment portfolio with precious metals from Provident Metals can really help reduce risk and boost potential returns over time. By setting aside a portion of my assets for physical assets like gold and silver, I can smooth out the bumps caused by market volatility and safeguard my wealth. In today’s unpredictable economic climate, I can’t stress enough how crucial diversification strategies are.

Historical data backs me up on this, showing that during economic downturns, precious metals tend to hold their ground, sometimes even increasing in value when other investments drop. For example, gold has jumped about 25% when the stock market hit some significant declines. Adding these alternative assets not only acts as a hedge against inflation but also gives me a buffer against currency fluctuations.

I usually aim for a balanced approach, typically allocating about 5-15% of my total portfolio to precious metals. This way, I can create a more stable financial landscape while still chasing growth opportunities.

2. Hedge Against Inflation

I’ve found that investing in precious metals can be a smart way to guard against inflation and protect my purchasing power when the economy gets shaky. As inflation goes up, I’ve noticed that the value of traditional currency tends to drop, but precious metals like gold and silver usually appreciate instead. This makes them a solid choice if I’m thinking about long-term investment returns.

Looking back at history, it’s pretty clear that during inflationary periods—like the 1970s, when the U.S. faced double-digit inflation—gold prices really took off. It’s a great example of how resilient these metals can be against currency devaluation.

Analysts have pointed out that when central banks implement policies that might dilute currency, the demand for these tangible assets tends to spike. Plus, the scarcity of precious metals is a big factor. As mining outputs decline, the limited supply can push prices even higher.

I’ve also noticed that experts often view these metals as a safe-haven asset during geopolitical tensions, which just reinforces their reputation as a reliable investment during times of economic turbulence.

3. Potential for Long-Term Growth

I’ve found that precious metals really have a knack for long-term growth, making them a smart addition to any investment portfolio. As the global market shifts, the intrinsic value of metals like gold and silver tends to rise, giving me a chance for capital gains despite the risks that come with investing. This reliability is what makes precious metals key players in wealth management.

Looking at historical trends, I notice that during times of economic uncertainty—think financial crises or geopolitical tensions—demand for these metals often skyrockets. It’s like investors suddenly decide they need a safe haven for their money.

Plus, when inflation is creeping up and interest rates are low, precious metals become even more attractive since they can help protect against currency depreciation.

Of course, it’s important for me to stay aware of market volatility and price fluctuations because they can bring risks that need some strategic management. Ultimately, I believe that taking a well-rounded approach, understanding these dynamics, helps me balance the potential for substantial returns with the challenges that come with investing in precious metals.

What Are the Potential Risks of Investing in Precious Metals?

Investing in precious metals has a lot of perks, but I always keep in mind the potential risks that come along with it.

Market volatility can cause price fluctuations, which can really affect the liquidity of my assets and my overall investment returns. Plus, there’s the risk of counterfeit products to worry about, not to mention the challenges of finding secure storage for those metals.

It’s definitely something I think about when diving into this market.

1. Volatility in Market Prices

Market volatility is something I really have to keep in mind when investing in precious metals since prices can bounce around based on all sorts of economic factors. It’s super important for me to understand these dynamics so I can navigate the potential financial risks and make smart choices about my investment strategy.

A bunch of elements play into this volatility, like changes in interest rates, inflation expectations, and geopolitical tensions, all of which can really shift market sentiment. Plus, supply chain disruptions or sudden changes in demand can make price swings even wilder. I need to stay on top of these factors and think about using strategies like diversification or hedging to help manage the risks.

By keeping myself informed about global economic conditions and using tools like stop-loss orders, I can better position myself to handle the unpredictable nature of the precious metal markets.

2. Potential for Counterfeit Products

The risk of counterfeit products in the precious metals market is something I take seriously as an investor, making product authenticity a top priority for me. With online marketplaces booming, it’s crucial to make sure I’m buying from a trustworthy source to avoid potential losses on my investment.

To navigate this tricky landscape, I always look for reputable dealers like Provident Metals. They stick to industry standards and are transparent about what they offer, which gives me peace of mind. I also make it a point to get familiar with the various certifications and hallmarking that confirm quality assurance, especially those from recognized mints and grading services. These indicators not only boost my confidence in the authenticity of my purchases but also protect me from the headaches of counterfeit buys.

By understanding the ins and outs of these certifications, I feel enableed to make informed decisions that safeguard my financial interests while building a solid and secure portfolio.

3. Storage and Security Concerns

When I think about investing in precious metals, storage and security are at the top of my mind. I know that if I don’t handle my assets properly, I could face theft or even lose them altogether. That’s why I make it a priority to find secure storage solutions that keep my investments protected, contributing to my overall financial security.

There are plenty of storage options to consider, and I can choose one that aligns with my risk tolerance and investment strategy. For instance, home storage gives me easy access to my metals, but it also comes with a higher risk of theft or damage. Then there are safety deposit boxes at banks, which usually offer better security but can be a hassle to access and might come with extra fees.

Another option is professional vault services specifically designed for precious metals. These places often combine robust security features with insurance options, which is comforting. Each storage solution has its own pros and cons, so I always take the time to assess my needs and preferences before making a decision.

How to Get Started with Provident Metals?

Getting started with Provident Metals is super easy, and it’s the perfect way for me to kick off my investment journey in precious metals. The first thing I do is create an account on their user-friendly platform, which really opens up a world of options and helpful resources.

Once my account is all set up, I can easily navigate through the purchasing process and start building my own collection of precious metals.

1. Create an Account

Creating an account with Provident Metals is a super simple and essential first step if I’m looking to invest in precious metals online. Once I go through this process, I unlock a whole world of investment opportunities and get to enjoy a smooth user experience right from the start.

When I complete the registration, I can take advantage of handy features like order tracking, personalized recommendations, and exclusive promotions that make my purchasing decisions much easier. Setting up my account usually just requires some basic information, creating a secure password, and verifying my identity to keep everything safe. This not only protects my personal data but also creates a trustworthy environment for all my investment activities.

If I run into any questions or issues while creating my account or during my transactions, I can count on the dedicated customer service representatives to help out. They really prioritize assisting clients, ensuring that any concerns I have are addressed quickly, which definitely makes my investment journey feel more confident.

2. Choose Your Products

Once I’ve created my account, I can dive into the wide range of products offered by Provident Metals. It’s super important for me to really understand my investment choices and how they fit into my overall strategy as I browse through the available options based on what’s hot in the market.

Beyond just keeping an eye on market trends, I need to think about my personal investment goals—whether I’m looking for long-term security or more of a quick profit—because that will definitely shape the products I choose.

I also make sure to get familiar with the different types of metals available, like gold, silver, platinum, and palladium. Each one has its own unique traits and value. Doing my homework is key; it helps me make smart decisions and steer clear of those impulsive buys that are just reactions to temporary market buzz.

By taking the time to analyze things like historical performance and the current economic climate, I can make choices that align with my financial goals.

3. Make Your Purchase

Making a purchase at Provident Metals is a breeze for me, thanks to their streamlined process that offers a bunch of payment options. I always make sure to familiarize myself with any transaction fees and delivery times to keep things running smoothly.

To get started, I just hop onto their user-friendly website and pick out the products I want. Once I’ve added everything to my cart, I can choose from a variety of payment methods like credit cards, bank wire transfers, or even cryptocurrency. Each option comes with its own processing times and potential fees, so it’s really important for me to double-check which one fits my financial strategy the best.

After I make my payment, I keep an eye on the expected delivery timeline. Knowing whether my items will show up in a few days or take a bit longer helps me manage my expectations better. By following these steps, I find that the purchasing process is not only more efficient but also a lot more enjoyable.

4. Store or Sell Your Metals

After I make a purchase, I have the option to either store my metals or sell them, which gives me some nice flexibility in my investment strategy. Whether I decide to go with secure storage solutions or take advantage of Provident Metals’ buyback program, I know that effective asset management is key.

Exploring different storage options helps me feel at ease, knowing that these services are designed to keep my metals safe and easily accessible. I can choose from various options like bank safety deposit boxes, private vault companies, or even home storage solutions. Each option comes with its own benefits and things to think about.

If I’m considering selling my precious metals down the line, it’s important for me to understand the buyback program. It offers a straightforward way to liquidate my investments while potentially getting competitive prices. Having a solid plan for asset management not only protects my investments but also gets me ready for any future financial decisions I might need to make.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What is a Provident Metals review?

A Provident Metals review is an evaluation or assessment of the company Provident Metals, which is a precious metals dealer that offers a wide selection of gold, silver, platinum, and palladium bullion and coins.

Why should I read a Provident Metals review?

Reading a Provident Metals review can provide you with valuable information about the company’s products, services, reputation, and customer experiences, helping you make an informed decision before purchasing precious metals from them.

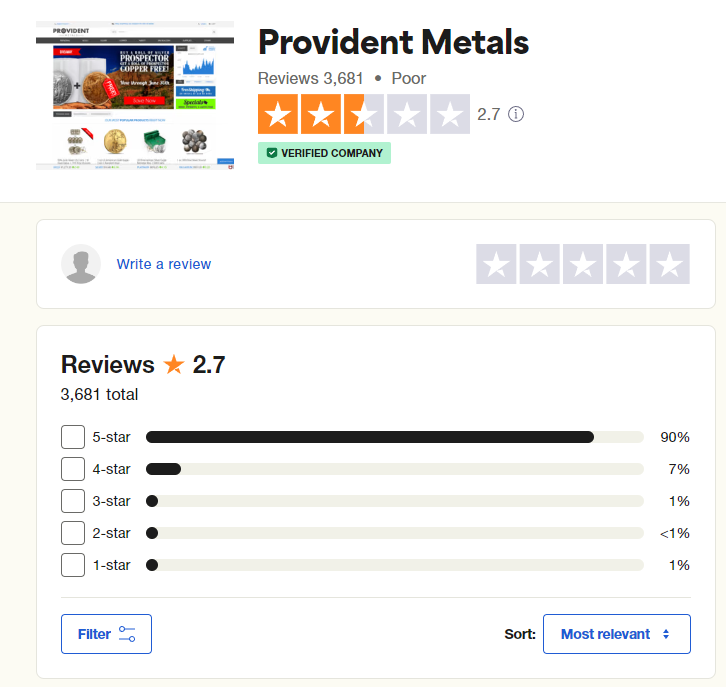

Is Provident Metals a reputable company?

Yes, Provident Metals is a reputable company with over 15 years of experience in the precious metals industry. They have an A+ rating with the Better Business Bureau and many positive customer reviews.

What types of precious metals does Provident Metals offer?

Provident Metals offers a wide selection of gold, silver, platinum, and palladium bullion and coins. They also carry rare and collectible items, such as historic and commemorative coins.

How can I purchase from Provident Metals?

You can purchase from Provident Metals by visiting their website or calling their customer service line. They also have a retail store located in Dallas, Texas, for in-person purchases.

What is Provident Metals’ return policy?

Provident Metals has a 30-day return policy for most items, as long as they are in their original packaging and condition. They also offer a buyback program for certain items at current market value.