In today’s unpredictable financial landscape, I find that a lot of investors, myself included, are exploring alternative strategies to safeguard and grow their wealth.

That’s where Red Rock Secured comes into play. They take a unique approach by focusing on precious metals, which opens up some interesting opportunities for diversification and protection against inflation.

In this guide, I’ll dive into how Red Rock Secured operates, the benefits it offers, any potential risks I should keep in mind, and what other customers have to say about their experiences.

Whether you’re a seasoned investor or just dipping your toes into the investment world, getting a good grasp of this option could really help keep your portfolio healthy.

What Is Red Rock Secured?

Red Rock Secured is a top player in the precious metals investment scene, and I really appreciate how they specialize in helping people secure their retirement through gold and silver IRAs. They focus on asset protection and financial stability, which is exactly what I look for.

They offer a range of services that make it easier for me to navigate the complexities of investing in physical assets like bullion and coins. Whether I’m looking to hedge against inflation or diversify my portfolio, I know that understanding what Red Rock Secured has to offer is an important step in my financial journey.

How Does Red Rock Secured Work?

Getting a grip on how Red Rock Secured operates is really important if I’m thinking about investing in precious metals. The whole process usually kicks off with a consultation where financial advisors chat with me about my retirement planning goals. They help me figure out which investment options are best for my needs.

Once I open a gold IRA, I can choose from a range of precious metals to add to my portfolio. The company takes care of managing my account to make sure everything stays compliant with regulations. This straightforward approach lets me concentrate on my overall investment strategy while feeling confident about my assets.

What Are the Benefits of Investing with Red Rock Secured?

Investing with Red Rock Secured has a lot of perks that can really boost my portfolio’s performance and security. They offer asset protection through precious metals and have some solid strategies for diversifying investments.

I find it pretty convincing to include gold and silver in my financial planning. In a world where the market can be all over the place and economic downturns happen, their services can really help me achieve financial stability and preserve my wealth—something traditional investments might not always offer.

Let’s dive into some of the key advantages of choosing Red Rock Secured.

1. Diversification of Portfolio

Diversifying my investment portfolio with Red Rock Secured feels like a smart move to help me manage risks and boost my financial returns. By adding precious metals like gold and silver into the mix, I can shield myself from market ups and downs while still aiming for long-term growth in my assets.

I’ve read that a well-diversified portfolio can cut risk by as much as 30%, which definitely helps me ride out economic storms a bit more comfortably. In today’s world, where traditional stocks might stumble, blending my assets across different classes—like royalties from precious metals, real estate, and bonds—can offer some much-needed stability.

I’ve also noticed that more and more advisors are jumping on the alternative investment bandwagon, with around 25% now recommending some exposure to precious metals. This shift shows that gold and silver are increasingly seen as great hedges against inflation and currency fluctuations, making them an attractive option for someone like me who’s looking to maintain a balanced asset allocation.

2. Protection Against Inflation

Investing in precious metals through Red Rock Secured feels like a smart way to hedge against inflation. After all, inflation can really chip away at the value of currency and traditional investments. I’ve noticed that gold and silver have a knack for maintaining their purchasing power, which makes them an appealing choice for preserving wealth over time.

What really draws me to them is their impressive track record of stability during economic turbulence. While other assets might take a hit during tough times, these metals tend to hold their ground. It’s no wonder that many investors look to these commodities as a strategic way to protect their portfolios, especially when the markets get a bit shaky.

By adding precious metals to the mix, I can effectively diversify my asset allocation and reduce my reliance on more conventional investments like stocks and bonds, which don’t always play nice during inflationary periods.

Understanding the historical trends that show how these metals have appreciated in value really helps me feel give the power toed when making decisions about wealth preservation strategies, especially in uncertain economic times.

3. Potential for Higher Returns

One of the things I find really appealing about investing with Red Rock Secured is the potential for higher returns, especially when the economy gets a bit shaky. As market trends change and the demand for gold and silver goes up, I often notice that my precious metals investments can lead to some pretty significant capital gains.

This becomes particularly important when inflation rates are all over the place and there’s a cloud of market uncertainty hanging around. Take recent geopolitical tensions, for instance; I saw gold prices skyrocket as investors flocked to safe-haven assets. Experts suggest that if I strategically allocate my resources into precious metals through firms like Red Rock Secured, I might not only shield my wealth but also take advantage of these price swings.

Honestly, analysts point out that the volatility we often see with traditional stocks can be smoothed out by diversifying into hard assets, which have historically acted as a nice buffer against economic downturns. That makes them a pretty attractive option for someone like me who wants to invest wisely.

4. Tangible Asset Ownership

Owning tangible assets like gold and silver through Red Rock Secured gives me a sense of security that I just can’t get from intangible investments. This kind of concrete ownership not only helps protect my wealth but also acts as a reliable investment when the economy gets a bit shaky.

By adding physical assets to my diversified portfolio, I can really reduce liquidity risk, making sure I have access to real value during financial downturns. I love that these assets can be stored securely, whether in dedicated vaults or private locations, so I can get to them whenever market conditions change.

Tangible assets tend to appreciate over time, and they’ve become a key part of my wealth management strategy. With all the ups and downs in the economy, owning physical investments like precious metals offers me some stability and peace of mind, making them a must-have for anyone looking to build a solid financial plan.

Check Out the Best Gold IRA Company of 2024

There are over 200+ gold IRA companies in the US and among all of them, I believe Augusta Precious Metals is the best one so far.

Augusta Precious Metals ranks as the #1 gold IRA company in the US. And that’s for good reason.

They have some of the best product catalogs with gold, silver, platinum, and palladium products to offer. But the main highlight is their dedicated web conference and the added focus on client education.

Augusta has an A+ rating on BBB, 1000+ client testimonials, and has been awarded “Most Transparent Company” in 2023 by Investopedia.

No other company puts as much focus on educating their clients about the different aspects of gold IRAs as they do.

My own experience with them was amazing to say the least.

However, their minimum investment requirement is $50,000 which limits the number of people who can open a gold IRA with them. Still, if you have the budget, you shouldn’t look elsewhere.

What Are the Risks of Investing with Red Rock Secured?

Investing with Red Rock Secured can definitely bring a lot of perks, but I’ve also got to keep in mind the risks that come along with it.

It’s really important for me to understand things like market volatility and liquidity constraints. Knowing these risks helps me craft a solid investment strategy that fits my financial goals.

1. Volatility of Precious Metals Market

The precious metals market is quite the rollercoaster, and I’ve seen how its price volatility can really impact investment performance. Gold and silver often serve as a safe haven for investors, but their prices are still subject to fluctuations driven by market demand, geopolitical factors, and economic indicators.

Take the 2008 financial crisis, for example. I watched as gold prices skyrocketed when everyone was looking for a safe place to park their money amid all the economic chaos. It really shows how external events can cause dramatic price shifts. On the flip side, silver has had its own wild ride in recent years, bouncing around unpredictably because it plays a dual role both in industrial uses and as a store of value.

I’ve found that diversifying within the metals sector is a smart move to help manage the risks tied to this volatility. A balanced approach can do wonders for overall portfolio stability. I also pay close attention to global economic trends and uncertainties since these factors are key in shaping what happens with precious metals.

2. Limited Liquidity

One of the critical risks I see when investing with Red Rock Secured is the limited liquidity that comes with precious metals. Sure, gold and silver can be sold for cash, but the time it takes to turn those physical assets into money can vary. That can really impact my ability to access funds quickly when I need them.

This delay could be a real headache if I suddenly need cash for unexpected expenses or if a great investment opportunity pops up. It’s crucial to understand these liquidity constraints when I’m developing effective investment strategies.

I’ve learned that it’s smart to maintain a diversified portfolio, balancing the potential for appreciation with some readily accessible assets, like cash or liquid investments. By planning for potential cash needs and setting aside enough reserves, I can help reduce those liquidity risks.

This way, I’m not just enhancing my ability to handle sudden financial demands, but I’m also building a more resilient investment framework to weather market uncertainties.

3. Potential for Counterfeit Products

I’ve learned that investors really need to watch out for counterfeit products in the precious metals market, as they can seriously threaten the value and integrity of my investments. That’s why I always make it a point to buy from reputable dealers like Red Rock Secured to help ease those worries.

Buying genuine precious metals isn’t just about protecting my financial investment; it’s also about keeping trust in the market. Authenticity is everything—counterfeit products can really tank the value of my holdings and shake investor confidence. By choosing established companies that focus on transparency and customer satisfaction, I can significantly lower the risk of falling for scams.

I’ve seen so many satisfied customers rave about their experiences with Red Rock Secured, praising the company’s commitment to verifying the authenticity of their products. The testimonials really highlight how their rigorous quality checks and knowledgeable staff make every transaction feel secure. It’s clear to me that engaging with trustworthy dealers is essential in this constantly changing market.

How to Get Started with Red Rock Secured?

Getting started with Red Rock Secured is super easy, and it really puts me in the driver’s seat when it comes to my investment journey and securing my retirement savings.

The first thing I do is open an account, and from there, I get some solid guidance on the different investment options that fit my financial goals.

1. Open an Account

To kick off my investment journey, the first thing I need to do is open an account with Red Rock Secured. This usually starts with a consultation where I get to chat about my financial goals and ask any burning questions I have about fees and investment strategies.

This initial meeting is really all about making sure I feel informed and supported as I explore my options. During the consultation, I’ll need to gather some important documents, like my ID, proof of income, and details about any existing assets. These are crucial for setting up my account.

By providing accurate information from the get-go, I can make the account opening process smoother and help the team serve me better. That way, they can tailor investment solutions that really fit my individual goals.

After our discussion, there might be a bit more paperwork to finalize the account details and lay the groundwork for a successful investment relationship.

2. Choose Your Investment Options

Once I’ve set up my account, I can dive into a bunch of investment options that are tailored to my retirement goals. One of the exciting choices is gold IRAs, which come with a nice variety of precious metals like gold bullion and silver coins.

But wait, there’s more! I also have the chance to invest in platinum and palladium, both of which bring their own unique benefits and can act like a safety net during market ups and downs. By diversifying my portfolio with these assets, I can help reduce risks while boosting the potential for returns.

To come up with a solid asset allocation strategy, I need to evaluate my financial goals, risk tolerance, and timeline. By balancing precious metals with more traditional investments like stocks and bonds, I can build a more robust retirement plan that really aligns with my long-term dreams.

3. Fund Your Account

Funding my account with Red Rock Secured is a crucial first step in kickstarting my investments. It allows me to take advantage of precious metals and start building a solid portfolio.

To manage this process effectively, I can choose from several funding methods, like bank wire transfers, checks, or even electronic payments. Each option has its own perks and things to keep in mind. For example, bank wire transfers are generally quick and secure, but they might come with some extra fees that could slightly eat into my investment amount. On the other hand, sending a check could take longer to clear, but it’s a great fit for those who prefer the traditional route.

It’s really important for me to explore these funding methods and consider any costs involved. Understanding the customer service support available throughout the funding process can definitely enhance my overall experience and investment strategy.

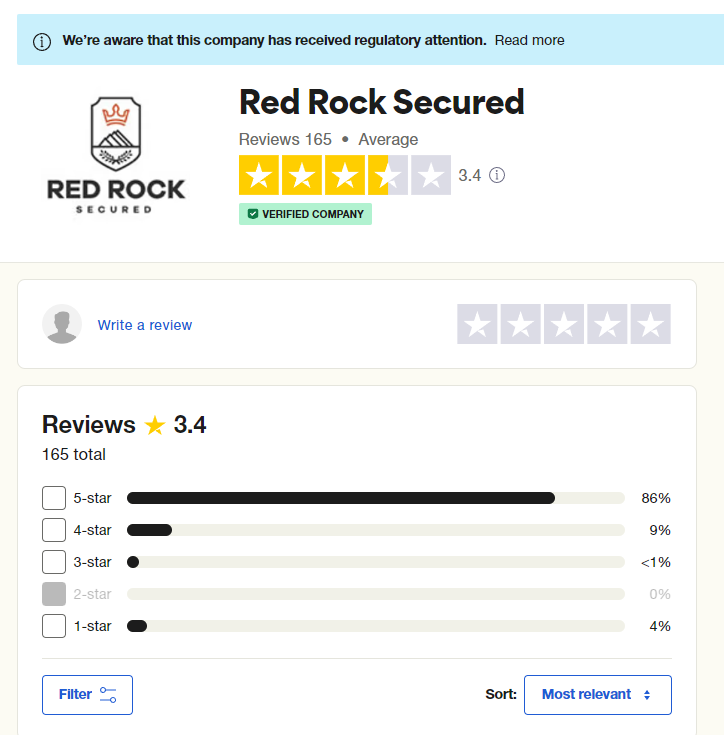

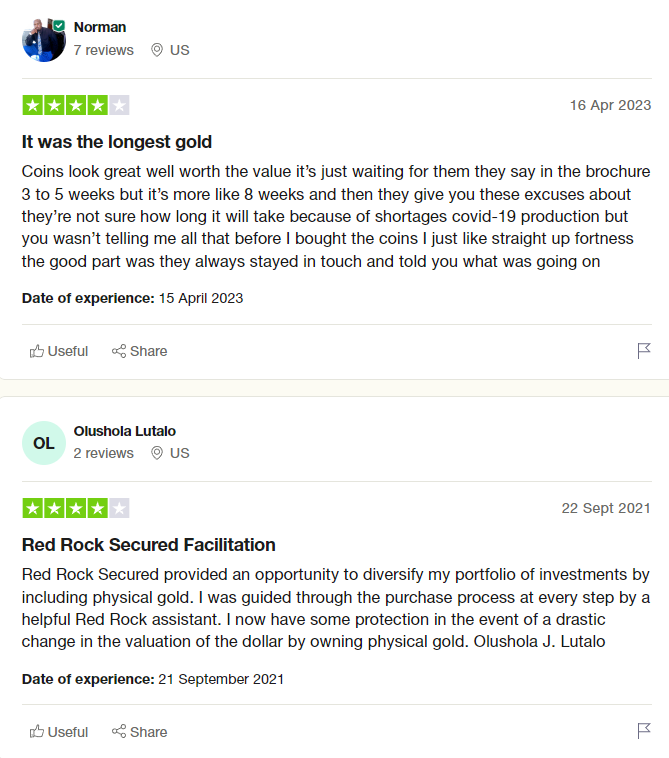

What Do Customers Say About Red Rock Secured?

I find that customer feedback is key when it comes to assessing Red Rock Secured’s reputation and service quality. When I read reviews from clients, I often see them praising their positive experiences, especially around customer service, the variety of investment options, and how efficient the account management process is.

1. Positive Reviews

I’ve heard so many customers rave about their experiences with Red Rock Secured. They really appreciate the knowledgeable staff, transparent fees, and investment strategies that actually cater to their financial goals.

What stands out to me is how the dedicated representatives take the time to break down complex concepts. It’s great to see that they make sure every investor feels informed and confident in their choices. One satisfied customer even mentioned the exceptional support they received throughout the investment process, emphasizing how the team’s commitment to client education not only clears up the investment landscape but also builds trust.

There are tons of testimonials that highlight the company’s impressive track record in delivering solid investment outcomes. Many clients have noticed a significant boost in their portfolio performance since teaming up with Red Rock Secured. This combination of top-notch service and effective investment strategies really positions the firm as a reliable partner in wealth management.

2. Negative Reviews

I’ve noticed that while many customers have had great experiences with Red Rock Secured, there are also some who’ve shared negative reviews, raising concerns about pricing, market volatility, and other investment risks that definitely deserve some attention.

These critiques really stress how important it is to do thorough research before diving into dealings with financial companies like these. The varying costs tied to their offerings can be a major turn-off for some investors. Market volatility is another big issue, sparking worries about how economic ups and downs could affect the security of investments.

I’ve seen customers wanting clearer communication about these risks, which really highlights how crucial it is for a company to maintain its reputation in the finance world. In response to these concerns, Red Rock Secured claims they’re actively keeping an eye on market trends and are dedicated to providing educational resources to help clients tackle these challenges more effectively.

Is Red Rock Secured Right for You?

Deciding if Red Rock Secured is the right fit for my investment strategy really comes down to my financial goals and how comfortable I am with investing in precious metals. If I’m looking for a solid way to diversify my portfolio and protect my retirement savings, Red Rock Secured could be a good option for me.

When I’m evaluating this choice, I need to think about things like my risk tolerance, the current economic climate, and how precious metals fit into my overall wealth management plan. It’s important for me to understand how Red Rock Secured can work alongside my traditional retirement strategies.

Talking to a knowledgeable financial advisor can really help me figure out if this investment aligns with my long-term goals and point out any potential pitfalls I should watch out for.

Taking the time for this careful assessment will help me make informed decisions that protect my financial future.

If you want to learn about identifying gold IRA scams, I recommend getting this free checklist. It will equip you with the knowledge you need to avoid potential gold IRA scams.

Frequently Asked Questions

What is Red Rock Secured Review?

Red Rock Secured Review is a comprehensive evaluation and analysis of the services, products, and reputation of the precious metal investment company, Red Rock Secured.

Why should I read a Red Rock Secured Review?

Reading a Red Rock Secured Review can provide you with valuable insights and information about the company’s track record, customer satisfaction, and overall credibility before making any investment decisions.

Is Red Rock Secured a legitimate company?

Yes, Red Rock Secured is a legitimate company that has been in operation since 2009 and is accredited by the Better Business Bureau with an A+ rating.

What types of products are offered by Red Rock Secured?

Red Rock Secured offers a variety of precious metal investment products, including gold, silver, platinum, and palladium in the form of coins, bars, and IRA accounts.

Can I trust Red Rock Secured with my investments?

Red Rock Secured has a proven track record of providing secure and profitable investments for its clients. The company also offers a buyback program, ensuring liquidity and protection for investors.

Does Red Rock Secured have any customer reviews or testimonials?

Yes, Red Rock Secured has numerous satisfied customer reviews and testimonials, showcasing the company’s commitment to excellent service and successful investments for its clients.